-

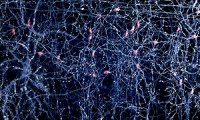

Researchers develop new probes to record neural activity in brain

- Source: medicaldevice-network

- 485

- November 15, 2017

-

Pear Therapeutics Wins FDA Nod for the First-Ever Medical App for Treating Drug Addiction

- Source: Biospace

- 632

- September 18, 2017

-

As the industry is going down, more and more pharmaceutical companies are seeking to “exit”?

- Source: drugdu

- 31

- November 22, 2024

-

Is Jingtai Technology once again breaking through the “first AI pharmaceutical stock” halo and shedding?

- Source: drugdu

- 38

- November 21, 2024

-

WuXi AppTec’s Couvet Site Receives EcoVadis 2024 Silver Medal Rating

- Source: drugdu

- 40

- November 19, 2024

-

Breaking news! CEO of global orthopedic giant may be dismissed

- Source: drugdu

- 38

- November 18, 2024

-

Breaking news! The CEO of a global orthopedic giant may be dismissed

- Source: drugdu

- 48

- November 16, 2024

-

Global orthopedic giant CEO may be dismissed

- Source: drugdu

- 51

- November 15, 2024

-

Imaging giant, newly established production base

- Source: drugdu

- 52

- November 13, 2024

-

The “trust crack” of the first brother of early cancer screening

- Source: drugdu

- 46

- November 12, 2024

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.