-

The View from Investors

- Source: drugdu

- 133

- May 20, 2024

-

Companies prepare for ADC trial readouts at ASCO 2024

- Source: drugdu

- 115

- May 17, 2024

-

Understanding Payer Perceptions

- Source: drugdu

- 79

- May 15, 2024

-

FTC Seeks More Information on the $16.5B Novo-Catalent Deal, Leading to Another Delay

- Source: drugdu

- 135

- May 8, 2024

-

Amgen reports a 22% increase in Q1 2024 net revenues

- Source: drugdu

- 115

- May 6, 2024

-

Novartis Set to Acquire Mariana Oncology to Enhance Radioligand Therapy Pipeline

- Source: drugdu

- 119

- May 6, 2024

-

Ono Pharmaceutical acquires cancer-focused biopharma Deciphera for $2.4bn

- Source: drugdu

- 107

- May 3, 2024

-

Gilead writes $2.4B off Trodelvy as CEO underscores ‘time of focused execution’

- Source: drugdu

- 128

- April 30, 2024

-

23andMe CEO plans to take company private

- Source: drugdu

- 84

- April 22, 2024

-

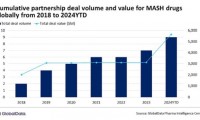

GlobalData

- Source: drugdu

- 132

- April 20, 2024

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.