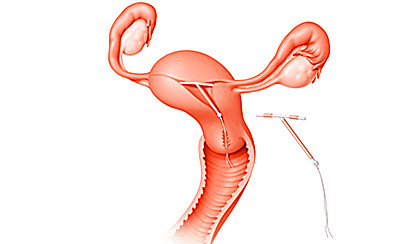

Teva Announces Sale of PARAGARD® (intrauterine copper contraceptive) to CooperSurgical

September 13, 2017

Source: finance.yahoo

868

868

Teva Pharmaceutical Industries Ltd., (NYSE and TASE: TEVA) today announced it has entered into a definitive agreement under which CooperSurgical will acquire PARAGARD® (intrauterine copper contraceptive), a product within its global Women’s Health business, in a $1.1 billion cash transaction. PARAGARD® had revenues of approximately $168 million for the trailing twelve month period ending June 30, 2017. This transaction includes Teva’s manufacturing facility in Buffalo, NY, which produces PARAGARD® exclusively.

Teva continues to actively pursue additional divestiture opportunities, including the sale of the remaining assets of its global Women's Health business, as well as its Oncology and Pain businesses in Europe. Teva continues to expect to generate at least $2 billion in total proceeds from the sale of these businesses, as well as additional asset sales to be executed by year end 2017.

“CooperSurgical’s commitment to women's health, fertility and diagnostics, will help to assure that patients in the U.S. continue to benefit from access to PARAGARD®,” stated Dr. Yitzhak Peterburg, Interim CEO. “This is an important step towards completing the divestments we have promised our stakeholders. Teva will use the proceeds from the sale to repay term loan debt under its Senior Credit Facility.”

Peterburg continued, “Today’s announcement emphasizes our commitment to divest non-core businesses to ensure that Teva is even more focused and efficient in this rapidly changing and highly-competitive environment.”

With the divestiture of PARAGARD®, and planned divestiture of other global Women’s Health products and the Oncology and Pain business in Europe, Teva is reinforcing its strategic focus on CNS and Respiratory as its core global therapeutic areas of focus within Global Specialty Medicines. In these areas Teva maintains a strong pipeline and portfolio globally, and will continue to invest in creating long term value.

Teva is committed to working closely with CooperSurgical to ensure a smooth transition of PARAGARD®. Completion of the transaction is subject to customary conditions, including antitrust clearance in the U.S. The transaction is expected to close before the end of 2017.

Until the transaction is completed, Teva will continue to manufacture and sell PARAGARD® in the U.S. in the normal course, providing full support to manage the business and meet the needs of customers and patients.

Morgan Stanley and Ernst & Young acted as advisor to Teva and Goodwin Procter as Teva’s legal counsel for this transaction.

By DduRead more on

- Disposable Medical Products that Keep Your Medical Facility Clean and Sterile March 31, 2022

- 10 Triumphant Drug Launches Of The Decade August 26, 2021

- Drugdu.com’s 4 most Popular Veterinary APIs and Veterinary medicine Suppliers September 6, 2018

- 4 Pharmaceutical Machinery Packaging and Materials Suppliers September 6, 2018

- 3 ENT Equipment and Medical Anaesthesia Equipment Suppliers September 6, 2018

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.