Telpotide will surpass semaglutide in all aspects, and it will be around next year

August 28, 2025

Source: drugdu

253

253

If the GLP-1 drug battle between Novo Nordisk and Eli Lilly were a football match, then 2021-2025 would be the first half, with Novo Nordisk's earlier launches giving Eli Lilly's product a head start. However, the situation seems poised to reverse in the second half, which begins in 2026.

In 2026, we will achieve comprehensive transcendence

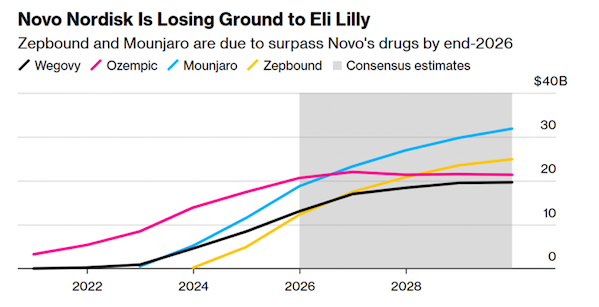

According to Bloomberg's forecast, Mounjaro and Zepbound will surpass Ozempic and Wegovy in 2026, and the gap will widen significantly in the next three years (Figure 1).

Figure 1 Historical sales and future sales forecast trends of Wegovy, Ozempic, Mounjaro, and Zepbound

Figure 1 Historical sales and future sales forecast trends of Wegovy, Ozempic, Mounjaro, and Zepbound

Image source: Bloomberg

In 2025, Novo's semaglutide combination (Ozempic + Wegovy) will have a total revenue of US$33.6 billion, still higher than Lilly's tirzepatide combination (Mounjaro + Zepbound) of US$31.1 billion; by 2026, the positions will be reversed, with Eli Lilly's tirzepatide products totaling US$40.8 billion, ahead of Novo Nordisk's semaglutide of US$39 billion.

The advantage then widens every year: the gap is US$7.9 billion in 2027, increasing to US$12.3 billion in 2028, and further expanding to US$15.8 billion in 2029, forming a stable lead of US$56.8 billion over US$41 billion (Table 1).

Focusing on the individual product comparisons, the paths of the two rivals intersect in 2026. The diabetes drug Mounjaro still trails Ozempic in 2025 ($18.8 billion vs. $20.6 billion), but surpasses it for the first time a year later ($23.3 billion vs. $22 billion). The gap widens annually thereafter, reaching a significant advantage of $31.9 billion vs. $21.4 billion in 2029, a $10.5 billion difference per product.

The weight loss drug Zepbound is also projected to surpass Wegovy by 2026 ($17.5 billion versus $17 billion), reaching $24.9 billion versus $19.6 billion by 2029, a $5.3 billion difference per product. Based on a cross-sectional calculation in 2029, Mounjaro will be approximately 1.49 times the size of Ozempic, and Zepbound will be approximately 1.27 times the size of Wegovy.

The pace of growth and incremental growth further demonstrates divergence. Based on a compound annual growth rate (CAGR) from 2025 to 2029, Mounjaro will see approximately +14.1% growth, Zepbound approximately +19.3%, maintaining strong expansion from a high base. Ozempic will see approximately +1.0%, remaining almost flat. Wegovy will see approximately +10.8%, but its growth momentum is declining year by year. In terms of annual net growth, Mounjaro's annual growth will gradually decline from $4.5 billion (2026) to $2.1 billion (2029), while Zepbound's will fall from $5.2 billion to $1.4 billion, reflecting continued expansion from a high base. Ozempic's revenue may decline slightly by $600 million in 2027 before remaining essentially flat thereafter. Wegovy's annual growth will decline from $4 billion to $100 million. A four-year cumulative growth comparison is most instructive: Eli Lilly's total growth is $25.7 billion, while Novo Nordisk's is only $7.4 billion, representing a net increase of approximately 3.47 times that of Novo Nordisk.

Internal structures are also changing. By 2025, both companies will be primarily structured around "old players leading new players." By 2029, Eli Lilly's "dual core" of Mounjaro ($31.9 billion) and Zepbound ($24.9 billion) will be in a dominant position, holding a weight of approximately 56% and 44% respectively, with the total value driven by both ends. Novo is gradually shifting from a dominant position with Ozempic to a roughly balanced position with Wegovy. However, due to Ozempic's clear platform nature, even continued growth in Wegovy's sales will struggle to reverse its overall lagging trend.

Comparing the two companies combined at the two endpoints, Novo Nordisk leads by $2.5 billion in 2025, but by 2029, Eli Lilly leads by $15.8 billion, resulting in a net swing of $18.3 billion over four years. In other words, not only will the position shift completely in 2026, but the gap will also be gradually tightened over the next three years, resulting in Eli Lilly holding a 38.5% lead over Novo Nordisk in total by 2029.

The reason why telpotide came from behind and gained an advantage

First, efficacy and labeling. In comparable comparisons, tirzepatide (Zepbound/Mounjaro), leveraging its dual receptor mechanism (GLP-1/GIP), surpasses semaglutide (Wegovy/Ozempic) in average weight loss depth. Furthermore, Eli Lilly secured an indication for moderate-to-severe obstructive sleep apnea (OSA) in adults with obesity in December 2024, broadening both its medical value and reimbursement options, pushing the clinical reach of "weight loss drugs" toward a stronger medical necessity. This label expansion significantly improves prescriber acceptance and payer acceptance, providing a more stable anchor for subsequent volume expansion. Although semaglutide recently received approval for MASH (metabolic steatohepatitis), facing strong competition from Madrigal's Rezdiffra, it remains to be seen how much additional revenue Novo Nordisk will generate.

Secondly, there are the non-technical variables of commercial implementation. Starting in July 2025, CVS Caremark made Wegovy the preferred option on several standard formularies, downgrading or removing Zepbound. This move could have slowed Eli Lilly's growth. However, even with restrictions on unfavorable formularies, Eli Lilly offset the impact with its stronger efficacy and broader labeling in other PBM/employer plans, maintaining overall growth in the US. Channels don't always tilt in one direction, but during this period, Eli Lilly's combination of "decentralized channels and higher single-product effectiveness" proved more stable.

The third issue is delivery and supply. Novo's oral product portfolio (including oral semaglutide) faces the engineering challenge of increasing API dosage by dozens of times, further tightening the supply chain. Eli Lilly, while simultaneously preparing for the launch of its small molecule orforglipron, is responding to the dual demands of diabetes and obesity with substantial finished product inventory and expanded production capacity, thus strengthening its ability to deliver. Delivery isn't a marketing issue, but an industrialization one: whoever can strike the right balance between production capacity, yield, cost, and stable supply faster will be able to transform its "clinical advantage" into a sustainable "cash flow advantage."

Fourth, over the past year, the gray/illegal market for compounded semaglutide in the United States has persisted, directly diluting branded prescription revenue and market share. By August 5, 2025, Novo Nordisk disclosed that it had filed over 130 lawsuits in 40 states and obtained over 40 permanent injunctions. However, company management has repeatedly emphasized that civil litigation alone is insufficient to eradicate the problem and requires supplemental enforcement and API port blockades to reverse the situation. This poses an asymmetric risk in the "semaglutide vs. tirzepatide" battle: tirzepatide has yet to face a comparable compounded alternative, further favoring it beyond the financial statements. In early August, Novo Nordisk confirmed downward revisions to its 2025 sales growth rate to 8%–14% and operating profit to 10%–16%. It also announced a leadership change and a significant pipeline cleanup (including next-generation GLP-1/GIP projects). Fundamentals, cadence, and organizational stability are under combined pressure.

Taking all of these factors into account, we can see that tirzepatide is no longer simply a "latecomer" but is gradually transforming its leading edge into a stable industry landscape through its efficacy, label expansion, channel adaptability, and delivery resilience. 2026 will be a key inflection point. Over the next three to four years, Eli Lilly's incremental growth will not only be reflected in its numerical lead, but also in its systematic advantages in clinical value, commercialization, and industry support. While Novo Nordisk has not lost its competitiveness, its growth focus is more on new indications, new formulations, and internal efficiency improvements, and these adjustments often require a longer incubation period.

It's foreseeable that in the second half of the GLP-1 drug market, the competitive landscape will be more like a protracted battle. Eli Lilly's short-term lead has been largely established, while Novo Nordisk's counterattack will depend on whether it can find new breakthroughs in its innovative pipeline and supply chain. In other words, the battle has shifted from "who gets to the table first" to "who can hold on to the end." The real competition in this pharmaceutical industry showdown of the century has just begun.

https://news.yaozh.com/archive/45959.html

By editorRead more on

- a full look at 15 blockbuster drugs. February 28, 2026

- EMA CHMP Recommends EU Approval of Henlius’ Pertuzumab Biosimilar HLX11 February 28, 2026

- Akeso Biopharma’s autoimmune pipeline reaches another milestone! Mandocizumab submits application for market approval, targeting a market worth tens of billions. February 28, 2026

- $2.1 billion! Novo Nordisk reaches new cooperation agreement February 28, 2026

- After Eli Lilly and Novo Nordisk, who most resembles the “Third Brother of Weight Loss”? February 28, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.