Johnson & Johnson aims to become the “number one” company

November 13, 2025

Source: drugdu

202

202

Johnson & Johnson recently announced that the U.S. FDA has approved CAPLYTA (Lumateperone) as an adjunctive therapy in combination with an antidepressant for the treatment of major depressive disorder (MDD) in adults. This is the first new drug approved under Johnson & Johnson's leadership since its acquisition of Intra-Cellular.

01. Major products acquired through acquisition

CAPLYTA (Lumateperone) is a first-in-class small molecule drug developed by Intra-Cellular, but its origins can be traced back to Bristol-Myers Squibb (BMS). Intra-Cellular acquired the original patent for the compound from BMS in 2005 and continued to advance its research and development based on that. In January 2025, Johnson & Johnson acquired Intra-Cellular for a staggering $14.6 billion, strengthening its pipeline in the field of central nervous system (CNS) diseases.

Lumateperone is a once-daily oral atypical antipsychotic. Its exact mechanism of action is not fully understood, but studies show that at therapeutic doses, it antagonizes central serotonin 2A (5-HT2A) receptors and modulates dopamine D2 receptors, thereby exerting its therapeutic effect. Lumateperone was first approved in the United States in December 2019 for the treatment of schizophrenia in adults; subsequently, in December 2021, it received expanded approval to be used as monotherapy or in combination with lithium/valproate for the treatment of depressive episodes associated with type I or type II bipolar disorder.

Major depressive disorder is one of the most common mental illnesses in the United States, affecting approximately 22 million adults. While existing oral antidepressants can provide relief for some patients, about two-thirds of patients experience residual symptoms after treatment, significantly impacting their quality of life. Furthermore, major depressive disorder not only damages patients' health but also imposes a heavy economic burden and has become the leading cause of disability in the United States.

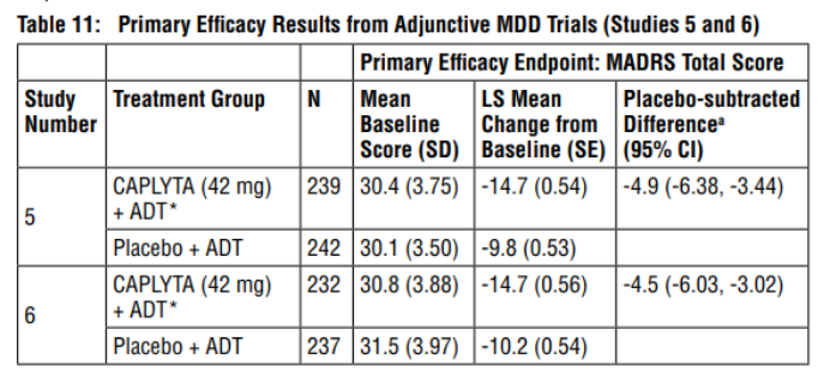

This approval for adjunctive treatment of major depressive disorder is primarily based on positive results from two global, multicenter, double-blind, placebo-controlled phase III clinical trials, 501 and 502. Both studies met their primary and key secondary endpoints: compared to "antidepressant + placebo," "antidepressant + lumateperone" demonstrated statistically and clinically significant improvements in both the Montgomery-Asperger's Depression Rating Scale (MADRS) total score and the Clinical Global Impression Scale-Severity (CGI-S) total score.

In terms of specific data, at 6 weeks of treatment, the total MADRS score in the Lumateperone group was reduced by 4.9 points (effect size 0.61) compared to the placebo group in study 501, and by 4.5 points (effect size 0.56) in study 502. Study 501 showed inter-group differences as early as week 1 of treatment, while study 502 showed differences as early as week 2.

Image source: Johnson & Johnson official website

Image source: Johnson & Johnson official website

Regarding the key secondary endpoints, both studies showed a significant decrease in the total CGI-S score from baseline at 6 weeks: study 501 showed a decrease of 0.7 points (effect size 0.67), and study 502 showed a decrease of 0.5 points (effect size 0.51).

In terms of safety, Lumateperone performed consistently with data from previous studies in schizophrenia and bipolar disorder, with no new safety concerns identified. Common side effects include drowsiness, dizziness, nausea, dry mouth, fatigue, and diarrhea.

Johnson & Johnson continues to explore the potential of Lumateperone. In July 2025, Johnson & Johnson submitted a supplemental New Drug Application (sNDA) to the U.S. FDA for Lumateperone for the prevention of relapse in schizophrenia. Currently, the drug is also undergoing multiple clinical studies for other neuropsychiatric and neurological disorders.

02 Seize the Track

Johnson & Johnson’s innovative pharmaceutical business focuses on areas such as oncology, autoimmune diseases, neuroscience, infections, pulmonary hypertension, cardiovascular diseases, and metabolism.

Looking back at the 2024 financial report, Johnson & Johnson's innovative pharmaceutical business generated total revenue of $56.964 billion, of which neuroscience revenue was $7.115 billion, accounting for only 12.5%, far lower than the oncology business (36.48%) and the immunology business (31.30%).

In early 2025, Johnson & Johnson acquired Intra-Cellular for $14.6 billion, bringing its mature commercial product Lumateperone into its portfolio. This not only strengthened Johnson & Johnson's neuroscience business segment but also further boosted its performance in this area.

According to its Q3 2025 financial report, Johnson & Johnson's innovative pharmaceutical business achieved sales of $15.563 billion, a year-on-year increase of 5.3%, with the neuroscience segment performing particularly well, generating revenue of $2.024 billion, a year-on-year increase of 14.6%. Neuroscience and oncology were the main drivers of the growth in Johnson & Johnson's innovative pharmaceutical business.

Besides Lumateperone, we must mention another major product Johnson & Johnson has developed in the field of depression – Spravato (esketamine).

While traditional antidepressants such as SSRIs and SNRIs are currently recommended as first-line treatment options, their limitations are also significant: they typically take 2 to 4 weeks to become effective, and patients need to continue taking them for more than six months. Furthermore, common adverse reactions include gastrointestinal discomfort, headache, sedation, insomnia, and sexual dysfunction, severely impacting patient adherence.

Unlike traditional neurotransmitter reuptake inhibition mechanisms, esketamine is a novel mechanism antidepressant. It primarily works by antagonizing NMDA receptors, inhibiting GABAergic interneurons, and activating glutamatergic signaling pathways, thereby promoting synaptic plasticity and releasing brain-derived neurotrophic factors, achieving a rapid and long-lasting antidepressant effect.

In March 2019, Spravato nasal spray was first approved by the FDA for use in combination with oral antidepressants to treat TRD; in January 2025, its supplemental new drug application was approved, making it the first and only monotherapy available for adult patients with MDD who have not responded to at least two oral antidepressants.

Spravato's global sales grew to $1.077 billion in 2024 and reached $1.193 billion in the first three quarters of 2025, representing a year-on-year increase of 52.9%. Johnson & Johnson's CEO stated at the 2024 JPM conference that Spravato's peak sales are expected to exceed analysts' expectations, potentially reaching as high as $5 billion.

In addition, Johnson & Johnson is advancing another antidepressant candidate, seltorexant. This is a selective orexin-2 receptor antagonist designed to improve both depression and sleep disorders. Although its Phase III study in patients with depression and insomnia did not meet its primary endpoint, the data still showed a positive trend. Johnson & Johnson executives emphasized, "We will continue to advance seltorexant because its excellent safety profile effectively addresses unmet patient needs." Despite this setback, it has not shaken Johnson & Johnson's overall confidence in its neuroscience strategy.

03 The Eve of the CNS Explosion

For a long time, the CNS field has been regarded as a "research black hole" due to the natural barrier of the blood-brain barrier, the complexity of disease mechanisms, and the high failure rate of research and development. In the past few decades, many multinational pharmaceutical companies have reduced or even abandoned their CNS pipelines due to repeated failures in clinical trials.

However, in recent years, multiple factors have jointly driven a turning point in the CNS field. The global population is aging rapidly, and the number of patients with neurodegenerative diseases such as Alzheimer's and Parkinson's continues to grow. In addition, the increased awareness of diseases among the public has led to a rise in the rate of medical visits, resulting in a continuous surge in market demand for the CNS field.

According to data from the World Health Organization in March 2023, approximately 280 million people worldwide suffer from depression, with a prevalence rate of about 5% among adults. It is projected that by 2030, depression will become the leading cause of global disease burden.

Evaluate Pharma predicts that the neuroscience market will grow from $22.6 billion in 2022 to $54.6 billion in 2030, representing a CAGR of 11.7%. The depression segment, in particular, is expected to grow from $4.8 billion to $9 billion, showing significant potential.

In addition to the rigid growth in market demand, the long-cycle and high-return characteristics of CNS products have also attracted the attention of more and more giants. For example, in 2024, Roche's Ocrevus sales exceeded $7.6 billion, becoming the best-selling drug in the CNS field; Novartis' Kesimpta sales also exceeded $3.2 billion, and continued to climb at a growth rate of 49%.

Under this trend, global pharmaceutical giants have adjusted their strategies and accelerated their efforts to seize the commanding heights in the CNS field, forming a differentiated layout pattern.

In addition to its deep involvement in the field of depression, Johnson & Johnson is also actively expanding its pipeline of other psychiatric and neurodegenerative diseases. For example, its two self-developed Alzheimer's disease therapies targeting Tau protein have entered Phase II clinical trials; and through the acquisition of Intra-Cellular, it has simultaneously launched research on ITI-1284 for generalized anxiety disorder, Alzheimer's disease, and its agitation symptoms.

AbbVie positions the CNS (Chemical, Neuro, and Social Sciences) field as its second largest strategic segment after its autoimmune business. In 2024, it acquired Cerevel Therapeutics for $8.7 billion, gaining access to several pipeline assets, including Emraclidine, further strengthening its portfolio in schizophrenia and Parkinson's disease. In August 2025, it acquired Gilgamesh Pharmaceuticals for $1.2 billion, incorporating the psychedelic therapy Bretisilocin. Its antipsychotic drug Vraylar already covers multiple indications, including schizophrenia, bipolar I disorder, and major depressive disorder, achieving sales of $2.599 billion in the first three quarters of 2025, a year-on-year increase of 10.9%. Furthermore, the migraine drugs Ubrelvy and Qulipta achieved sales of $932 million and $748 million respectively in the first three quarters of 2025, driving total revenue for the neuroscience segment to $7.805 billion.

In March 2024, BMS completed its $14 billion acquisition of Karuna Therapeutics, focusing on the development of the novel antipsychotic drug KarXT. This combination oral muscarinic antipsychotic has a completely new mechanism of action, distinct from first- and second-generation antipsychotics. In September 2024, KarXT received FDA approval, becoming the first novel mechanism of action FDA-approved treatment for schizophrenia in 60 years. The Greater China rights are held by Zai Lab.

Biogen, a veteran player in the CNS field, has always regarded neuroscience as its core business, with a presence in multiple disease areas including Alzheimer's disease, epilepsy, and multiple sclerosis. Previously, Biogen decisively abandoned its Aβ monoclonal antibody Aduhelm, instead focusing on Leqembi and Tau protein antisense oligonucleotide therapy, hoping to achieve greater breakthroughs in Alzheimer's disease treatment.

However, not all companies are choosing to increase their investment in CNS (Neuroscience, Natural Sciences, and Human Sciences). During its Q1 2025 earnings call, AstraZeneca announced its formal exit from the neuroscience field, shifting its resources to core areas such as weight loss and immunology.

From a financial perspective, AstraZeneca's total revenue reached $13.588 billion in the first quarter of 2025, with oncology accounting for 42% of the core revenue at $5.643 billion. The diabetes drug Farxiga saw a 15% year-on-year increase to $2.058 billion, becoming the core engine of revenue growth. Given limited resources, to improve ROI, AstraZeneca has had to shift its focus towards the larger market areas of oncology, immunology, and metabolic diseases. As AstraZeneca's CEO stated, "We cannot fund all projects; the central nervous system disease area is more suitable for companies that specialize in this area to cultivate deeply."

AstraZeneca's withdrawal reflects the harsh reality of the CNS field: high R&D failure rates remain an unavoidable challenge. In January of this year, Boehringer Ingelheim suffered a setback in the treatment of schizophrenia; Sage, Cassava Sciences, and other companies have also failed in the Alzheimer's disease field. In the face of fierce market competition, if developed products cannot achieve a differentiated advantage, commercial returns are out of the question, posing a significant challenge to pharmaceutical companies' financial strength and R&D confidence.

04 Conclusion

Johnson & Johnson has strengthened its leading position in the treatment of depression through the acquisition of Intra-Cellular and the approval of a new indication for CAPLYTA. Given the current global surge in the number of people suffering from depression and the unmet clinical needs, drugs with innovative mechanisms of action, rapid onset of action, and good safety profiles will undoubtedly become the core competitive advantage in the future market.

https://news.yaozh.com/archive/46298.html

By editorRead more on

- a full look at 15 blockbuster drugs. February 28, 2026

- EMA CHMP Recommends EU Approval of Henlius’ Pertuzumab Biosimilar HLX11 February 28, 2026

- Akeso Biopharma’s autoimmune pipeline reaches another milestone! Mandocizumab submits application for market approval, targeting a market worth tens of billions. February 28, 2026

- $2.1 billion! Novo Nordisk reaches new cooperation agreement February 28, 2026

- After Eli Lilly and Novo Nordisk, who most resembles the “Third Brother of Weight Loss”? February 28, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.