Domestic new drugs are popular, and some people are falling behind

January 22, 2025

Source: drugdu

279

279

In the second half of 2024, domestic TCE bispecific antibody transactions are popular all over the world, and autoimmune-related transactions account for 5 of all 7 domestic TCE bispecific antibody transactions, which can be called the "hottest" type of domestic innovative drugs.

In the second half of 2024, domestic TCE bispecific antibody transactions are popular all over the world, and autoimmune-related transactions account for 5 of all 7 domestic TCE bispecific antibody transactions, which can be called the "hottest" type of domestic innovative drugs.

It is in this wave of global pharmaceutical companies scrambling for autoimmune TCE bispecific antibody rights that some developers have begun to fall behind, and the most advanced overseas biotech company IGM Biosciences.

On January 9, IGM Biosciences announced that the company will lay off 73% of its employees and stop developing two autoimmune candidate drugs, Imvotamab (CD3/CD20 bispecific antibody) and IGM-2644 (CD3/CD38 bispecific antibody). IGM made such a decision because its CEO Mary Beth Harler said that the interim data of the Phase Ib study of Imvotamab in the treatment of rheumatoid arthritis and systemic lupus erythematosus showed that the depth and consistency of B cell depletion did not meet the company's expectations.

After abandoning Imvotamab and IGM-2644, IGM Biosciences currently has only one IgM antibody in its pipeline in cooperation with Sanofi, and has completely withdrawn from the competition in the autoimmune TCE track.

This may have poured cold water on the Biotech and MNC buyers who are enthusiastically developing autoimmune TCE bispecific antibodies.

01

IGM Biosciences's Another Arm Cut

This is not the first time that IGM has laid off employees for strategic adjustments. Its last layoff can be traced back to the end of 2023, when the company laid off 22% of its employees and stopped all hematological tumor projects and the clinical development of its targeted cytokine candidate products.

In September 2024, IGM deprioritized its tumor-related priorities and placed all its bets on autoimmune-related exploration. For example, the company's core pipeline Imvotamab was initially targeted at indolent NHL, DLBCL and other cancer indications, but the subsequent data generated in NHL were not satisfactory.

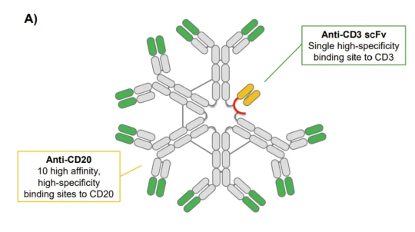

The core technical feature of IGM is the development of antibody drugs with IgM as the skeleton. Compared with the most common IgG antibodies (two binding sites), IgM antibodies exist in the form of pentamers and have multivalence (theoretically 12 binding sites), which gives them stronger binding force and target aggregation effect.

Structurally, Imvotamab has up to 10 binding sites targeting CD20 and 1 binding site for CD3. Its mechanism of action is to kill B cells through T cell-dependent cytotoxicity (TDCC) and complement-dependent cytotoxicity (CDC). The high probability that so many CD20 binding sites bring about the maximum affinity of the target, even if it is an escaped cancer cell with extremely low CD20 expression, Imvotamab can bind and kill it.

Preclinical mouse model data show that Imvotamab is more effective in clearing B cells with low CD20 expression than existing CD20 monoclonal antibodies, and its EC50 index is 50 times and 1000 times lower than that of otuzumab and rituximab, respectively.

IGM has not yet announced the specific data that Imvotamab is not as good as expected in autoimmune indications, but the market speculates that it has a lot to do with the route of the IgM skeleton (there is currently no IgM molecule drug in the world). The half-life of natural IgM antibodies in the human body is 5.1 days. In previous clinical trials, the half-life of IgM antibodies generally does not exceed two days, while the half-life of Imvotamab in previous phase I clinical trials is even lower, only 1.5 days. The advantage of this short half-life, high-affinity TCE drug is that it can bring relatively good treatment safety, but the disadvantage is that frequent injections reduce patient compliance.

Past data on nearly 100 non-Hodgkin's lymphoma (NHL) patients with Imvotamab showed that it showed good safety (the incidence of cytokine release syndrome in all dose groups was 15%, and 9% in the 100mg maintenance dose group), and showed superior efficacy in binding and killing low CD20 expressing cells.

Another point that the market speculated that the efficacy was not as good as expected may be that there were certain problems in the design of the CD3 part. The efficacy and safety of TCE bispecific antibodies are often affected by factors such as steric hindrance. In addition, the balance of high or low affinity with CD3 also needs to be controlled by developers (high affinity may not bring enhanced tumor killing power, and low affinity may have safety risks caused by off-target).

IGM's failure in Imvotamab fully demonstrates that the field of TCE bispecific antibodies in autoimmunity is not as popular as the "mass BD blowout", especially with the competition of monoclonal antibodies in front and CAR-T in the back, TCE bispecific antibodies need to avoid potential safety risks while outstanding efficacy, which is not easy.

02

Is the autoimmune TCE pipeline transformed from tumor under great pressure?

After IGM, the pressure is on the remaining "TCE bispecific antibodies from tumor to autoimmunity" leaders.

Currently, Cullinan Therapeutics is the fastest-progressing company in the world besides IGM. Similarly, the company was called Cullinan Oncology before April 2024. It is obviously a company focusing on tumor drug development. Because some pipelines expand autoimmune indications, it is renamed.

Cullinan's core asset in expanding the autoimmune field is CLN-978, a CD3/CD19 bispecific antibody, and also the first CD19 T cell adapter therapy approved by the FDA for autoimmune indication IND.

CLN-978 is composed of single-chain variable fragments of CD19 and CD3, and contains an albumin binding domain to extend half-life. The characteristics of this drug are that it has been engineered to have high binding affinity for CD19 (even for B cells with extremely low CD19 expression, and preclinical results show that it is superior to Amgen's belintoumab), has lower affinity for CD3 (reducing safety risks) and can be injected subcutaneously (convenient injection).

CLN-978 has just entered the clinical stage in the field of autoimmunity and has become the first CD19 T cell adapter approved by the FDA for autoimmune indications IND. Preclinical data showed that subcutaneous administration of CLN-978 achieved rapid, deep and sustained B cell depletion in the bone marrow, spleen and lymphoid tissue, while reducing cytokine release.

It is worth noting that the company's CLN-978's first clinical exploration indication is diffuse large B-cell lymphoma (DLBCL). The first phase small sample data showed that: 3 patients received 30mg subcutaneous injections per week. Within 96 hours after the first dose, the peripheral B cells of 2 patients with detectable baseline B cells decreased by 93% and 98%, respectively, and two patients with larger tumor volumes experienced a grade 1 CRS event after the first dose. Other adverse events were low-grade or mechanism-related events (such as lymphocytopenia).

CLN-978's first phase SLE clinical trial will obtain preliminary data in 2025Q4. This may be one of the fastest early clinical data read out by TCE dual antibodies for the treatment of autoimmune diseases overseas, which is worth looking forward to.

03

The domestic pipeline from tumor to autoimmune is yet to be verified

Of course, there is no need for us to worry too much about the risks of "TCE dual antibodies" such as tumor to autoimmune. There have been successful cases of such "turnaround" drugs in the past, such as Roche's CD20 rituximab, which has expanded from hematological tumors to autoimmune diseases such as rheumatoid arthritis (RA), and has made a great breakthrough in the commercialization ceiling.

Compared with monoclonal antibodies, TCE bispecific antibodies currently have more reasonable technical and theoretical advantages for autoimmune diseases, which urgently need to be verified; however, the difference is that compared with tumor indications, autoimmune patients have lower target cell loads and require lower drug doses than tumor patients, which will undoubtedly reduce the risk of related CRS and ICANS. At the same time, TCE bispecific antibodies need to ensure the affinity of the target to provide more lasting and thorough B cell depletion, while striving to improve drug safety (autoimmune patients are more sensitive to side effects).

A more classic example may be the CD19/CD3 bispecific CN-201 from Tongrun Biotech, which has reached a cooperation with Merck. The drug is constructed through WuxiBody platform of WuXi Biologics, with TCR replacing CH1 and CL to avoid light chain mismatch. It can be designed with 1:1 or 2:1 valence as needed; the molecule is a low-affinity CD3 antibody that can bind and dissociate quickly, while maintaining strong and deep B cell clearance ability, and the preliminary data on efficacy and safety are good.

The latest disclosed phase I data of CN-201 for the treatment of R/R B-ALL patients showed that 16 of the 51 patients received treatment with a target dose of 20 mg or more, and 12/16 (75%) patients achieved CR/CRi; 7 patients received treatment with a target dose of 40 mg or more, and 6/7 (85.7%) patients achieved CR/CRi, with the longest duration of remission being 8 months. In addition, 15 patients developed CRS in the trial, of which 2 were grade 3 events, mainly occurring after the first dose, and most of the others were low-grade, and no immune effector cell-associated neurotoxicity syndrome (ICANS) was observed. It can be seen that CN-201 maintains a strong efficacy in malignant blood tumors with poor therapeutic efficacy such as R/R B-ALL, and its safety is relatively controllable at high doses, which also makes people look forward to its efficacy and safety for autoimmune indications at low doses.

Another thing worth noting is Conoya's BCMA/CD3 bispecific antibody CM336, which went overseas in the form of Newco last year and the corresponding project company Ouro Medicines recently received a large amount of financing.

CM336 is a weakened natural Y-type antibody developed by Conoya. Preclinical data show that CM336 is significantly superior to Johnson & Johnson's BCMA/CD3 bispecific antibody Teclistamab in BCMA target affinity. At the same time, CM336 is more active than similar competitor TDCC and has a weaker cytokine release effect.

The latest clinical data of CM336 to some extent reflects the advantages shown in its preclinical data. 68 patients (4th line) with relapsed or refractory multiple myeloma participated in the Phase I/II study of CM336. The ORR of CM336 in the dose escalation and expansion phases was 67% and 76%, respectively, of which the ORR of the 80mg and 160mg dose groups was 100%; at a median follow-up time of 12.1 months in the dose escalation phase, 52% of the subjects achieved strict complete remission (sCR) or complete remission (CR). In terms of safety, the dose of CM336 was successfully increased to 160 mg, and the maximum tolerated dose has not yet been reached. Most CRS were grade 1 events, only 7% of the subjects had grade 2 CRS events, and no immune effector cell-related neurotoxicity syndrome occurred.

From the high dose ramp-up and low safety risk of CM336 in the Phase I clinical trial, we have reason to look forward to its performance in autoimmune indications.

https://mp.weixin.qq.com/

By editorRead more on

- Gan & Lee Pharmaceuticals’ new PROTAC drug GLR2037 tablets have been approved for clinical trials to enter the field of prostate cancer treatment March 3, 2026

- AideaPharmaceuticals plans to raise no more than 1.277 billion yuan through a private placement to focus on the global clinical development of innovative HIV drugs March 3, 2026

- Giant Exits! Its Star Business Acquired March 3, 2026

- Focusing on cardiovascular and cerebrovascular diseases! OpenMediLead Medical Intelligence Dual Engines Launch Internal Testing, Connecting Drug Development and Clinical Diagnosis in a Closed Loop March 3, 2026

- Innovent Biologics Announces Approval of New Indication for BTK Inhibitor “Pitubrutinib” in China March 3, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.