Aohua Endoscope, Enters the Medical Robot Industry

March 13, 2025

Source: drugdu

427

427

Recently, Aohua Endoscope has successfully obtained an invention patent authorization called "Endoscope Trolley and Medical Robot", with patent application number CN202210369876.8.

Recently, Aohua Endoscope has successfully obtained an invention patent authorization called "Endoscope Trolley and Medical Robot", with patent application number CN202210369876.8.

It is reported that this patent effectively reduces the physical exertion of operators through rich operating functions, which will further enhance the company's technological advantages in the field of soft endoscopes.

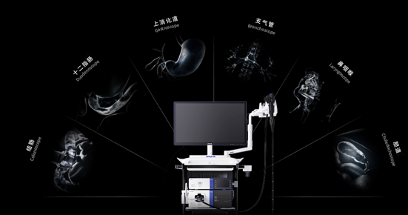

As a company with over 30 years of development history, Aohua Endoscope's product layout covers soft mirrors, hard mirrors, and diagnostic and therapeutic consumables. Its diversified layout from upstream to downstream is continuously enhancing its influence in the industry.

01. Obtained patents for endoscope trolleys and medical robots

According to the patent abstract, the present invention provides an endoscope trolley and a medical robot. The endoscope trolley comprises a trolley body, a first telescopic arm, and a second telescopic arm. The trolley body comprises a base and a worktable. The worktable is installed on the base in a lifting manner, the first telescopic arm is rotatably installed on the worktable, and the second telescopic arm is fixedly installed on the worktable. The lengths of the first telescopic arm and the second telescopic arm can be adjusted; The first telescopic arm is used for installing the endoscope driving device and the endoscope instrument switching device, and the second extension arm is used for installing the endoscope delivery device.

The endoscope trolley provided by the present invention can achieve the switching and transportation of endoscopic instruments, as well as the bending, rotation, and advancement of endoscopes, through an endoscope instrument switching device, an endoscope instrument conveying device, an endoscope driving device, and an endoscope conveying device. It has rich operating functions and can effectively reduce the physical consumption of operators.

According to public information, since the beginning of this year, Aohua Endoscopy has obtained 5 new patent authorizations, an increase of 400% compared to the same period last year. Based on the company's 2024 interim financial data, the company invested 87.3368 million yuan in research and development in the first half of 2024, a year-on-year increase of 25.48%.

In fact, in addition to focusing on core endoscopic equipment, Aohua Endoscope also has a wide range of diagnostic and therapeutic consumables, including biopsy products, stent series, foreign body products ERCP, Polyp resection and cleaning services fully meet the various needs of endoscopic diagnosis and treatment.

In addition, compared to international giant Olympus, Aohua Endoscopy is comprehensively laying out its endoscope product line, innovatively launching a variety of high-end and diversified products, accelerating the coverage and penetration of traditional departments, as well as the development of new departments. Prospective layout of flexible endoscopic surgical robots targeting clinical surgical pain points; Focusing on the development trend of AI healthcare, we have launched the "Aoxiaobao" endoscopic intelligent assisted diagnosis system.

02. In 2024, the annual revenue was 749 million yuan, but the net profit decreased

In terms of performance, Aohua Endoscopy released a performance report on the evening of February 26th, achieving a total operating revenue of 749 million yuan in 2024, a year-on-year increase of 10.39%; Net profit was 21.3218 million yuan, a year-on-year decrease of 63.15%; Basic earnings per share of 0.16 yuan. During the reporting period, operating profit decreased by 87.07% compared to the same period last year, total profit decreased by 88.12% compared to the same period last year, and net profit attributable to the owners of the parent company decreased by 63.15% compared to the same period last year.

Aohua Endoscope stated that the main change in the company's performance was the reduction in domestic terminal market procurement activities during the reporting period, which was affected by the decrease in the total amount of bidding and tendering, resulting in limited growth in the company's domestic business revenue.

At the same time, due to the expected inability to complete the company level performance assessment set for the partial assessment period of the restricted stock incentive plan in 2022 and 2023, the accumulated share based payment expenses recognized in previous years will be offset in 2024. However, the company's overseas market access and business expansion are progressing smoothly, with a certain increase in overseas business revenue compared to last year, driving overall revenue growth.

It is worth noting that previously, Aohua Endoscopy planned to invest 396 million yuan in the construction of a medical endoscope production base project. However, according to an announcement released by Aohua Endoscopy, the original plan was to have the base available for use in July 2024, but the company has decided to postpone it to January 2026.

According to Aohua Endoscopy, the construction project of the medical endoscope production base was determined by the company based on industry development trends, business development needs, and company development strategies. It has undergone sufficient feasibility studies in the early stage. However, during the implementation process, due to the complex structural design of the project, the design scheme involves over limit structures. The design scheme has been verified, modified, and reviewed by domestic experts in relevant fields multiple times, and finally formed a summary document. The over limit review was completed in November 2023, and the main construction permit was obtained. At the same time, the surrounding residential areas of the project implementation site are relatively concentrated, which limits the construction time and leads to a delay in the overall progress of the project.

03. Domestic soft mirrors represented by Huawei Australia are in an upward trend

Medical endoscopes are one of the rapidly growing segments in the global medical device market. According to calculations by Hongta Securities, the market size of electronic endoscopes (soft endoscopes) in China was 6.29 billion yuan in 2021, a year-on-year increase of 9.77%. With the popularization of early gastrointestinal cancer screening and the development of new endoscopic techniques, the domestic soft endoscopy market will continue to maintain rapid growth in the future, with sales expected to reach 8.12 billion yuan by 2025.

In recent years, domestic soft mirrors have emerged in the medical field, achieving a significant leap from a difficult start to rapid development.

In the early days, due to the extremely high technological barriers of soft mirrors, China's soft mirror market was firmly controlled by foreign brands such as Olympus, Fuji, and Pentax for a long time. But with the steady improvement of domestic technological strength, local enterprises continue to increase their research and development investment, achieving many breakthroughs in core technologies and gradually launching a series of soft mirror products with independent intellectual property rights, breaking the monopoly of foreign brands.

According to market data, the market size of China's soft lens industry has significantly expanded. From 2015 to 2023, the market size has climbed from 2.87 billion yuan to 7.33 billion yuan, with a compound annual growth rate of 12.44%. In 2024, although Olympus still holds the top spot with a market share of 49.56% in the winning brands of digestive endoscopy and respiratory endoscopy, domestic enterprise Kaikai Medical has become a leader among domestic brands with a market share of 10.36%. In the field of digestive endoscopy, Olympus leads with a market share of 46.16%, while Fuji, Kaikai, Aohua, and Pentax hold market shares of 19.03%, 14.94%, 10.73%, and 5.17%, respectively.

On the technical level, domestic soft mirror enterprises have achieved remarkable results. In 2022, Aohua Endoscopy launched the AQ-300 4K ultra high definition endoscopic system, which has performance approaching the international advanced level. At the same time, the industry development trend is improving, and the country is vigorously promoting policies for updating medical equipment, providing special funding support. Various regions are also actively responding. This series of measures is expected to increase the localization rate of soft lenses in China from 3.6% in 2017 to 35.2% by 2030.

In addition, new technologies such as AI are accelerating their integration with the soft endoscope industry, and the "Aoxiaobao" endoscope intelligent auxiliary diagnosis system and the medical equipment+AI strategy developed by Aohua Endoscope demonstrate the power of technological innovation. In terms of market demand, the early screening rate for digestive tract cancer in China is relatively low, and the aging process is accelerating. The demand for early diagnosis and treatment of digestive tract cancer is becoming increasingly urgent. In addition, with the high incidence of diseases such as lung cancer, the application prospects of soft endoscopes in respiratory medicine are broad.

From a capital perspective, in 2024, there will be frequent investment and financing activities in the field of endoscopes. Soft endoscope companies such as Ruipai Medical, Lingmou Medical, and Hongji Medical have completed a new round of financing, injecting strong momentum into the industry.

Source: http://qixieke.com/Font/index/detailPage.html?id=3369-136

By editorRead more on

- API Is Not Just a Cost – It’s Your Ticket to Global Markets March 3, 2026

- Rovaxitinib approved for marketing, filling the demand for myelofibrosis treatment March 2, 2026

- Warrant Pharmaceuticals’ active pharmaceutical ingredient receives Brazil’s first official GMP certification March 2, 2026

- Merck’s New Story March 2, 2026

- Rongchang Biotechnology has turned a profit! March 2, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.