Ascletis Investors surges fourfold! A quiet turnaround for Ascletis!

December 16, 2025

Source: drugdu

83

83

Recently, Ascletis Pharma released Phase II study data for its oral small molecule GLP-1 drug ASC30.

In 125 obese or overweight subjects, the 60 mg dose group experienced a weight loss of up to 7.7%, and no weight loss plateau was observed.

Following the announcement, Ascletis Pharma's stock price surged by more than 20% intraday on December 9. In fact, Ascletis Pharma's stock price has increased approximately fourfold this year, ranking among the top performers in the pharmaceutical industry.

01

The data is amazing.

small molecule GLP-1R completely biased agonist developed by Ascletis Pharma .

According to publicly available information from Ascletis Pharma, this drug possesses unique and differentiated properties, and can be taken orally once daily or subcutaneously once monthly to quarterly as a treatment or maintenance therapy for long-term weight management. Furthermore, it is not subject to dietary restrictions and can be taken at any time of day. Its patent protection expires in 2044 .

This announcement presents data from a Phase II study conducted at multiple centers in the United States, which aimed to evaluate the efficacy and safety of 20 mg, 40 mg, and 60 mg ASC30 tablets as monotherapy compared to placebo in obese subjects without diabetes (BMI ≥ 30.0 kg/m²) or overweight subjects without diabetes but with at least one weight-related comorbidity (BMI ≥ 27.0 kg/m²).

The study enrolled 125 participants. After 13 weeks of treatment, all dose groups of ASC30 tablets (20 mg, 40 mg, and 60 mg) met the primary endpoint compared to placebo, showing statistically significant and clinically meaningful weight loss (p < 0.0001). Moreover, the weight loss was dose-dependent, and no weight loss plateau was observed.

In the highest dose group (up to 60 mg), the mean weight loss, adjusted for placebo, was up to 7.7% . 80.0% of subjects receiving 60 mg of ASC30 once daily experienced a weight loss of ≥5%, compared to 4.2% in the placebo group.

Furthermore, ASC30 also met its secondary and exploratory endpoints, demonstrating improvements on multiple cardiovascular risk biomarkers . This suggests that the drug may be applicable to more indications in the future, indicating broad potential value.

In terms of safety, ASC30 demonstrated best-in-class potential. All gastrointestinal adverse events (AEs) were grade 1 (mild) and 2 (moderate), with most occurring during dose titration. No grade 3 (severe) or higher gastrointestinal adverse events occurred, no liver safety signals were observed, and there were no elevations in ALT/AST/TBL.

In each dose group, the discontinuation rate due to adverse events for ASC30 tablets was 7.3% (20 mg), 7.5% (40 mg), and 0.0% (60 mg), respectively , compared to 0.0% in the placebo group.

02

Two Aces

In recent years, weight loss drugs targeting GLP-1 have become one of the hottest and most competitive tracks in new drug development. Smegglutide and telposide have successively topped the global "drug king" throne.

In the development of next-generation GLP-1 drugs, biased agonists have attracted attention.

GLP-1 receptor-biased agonists influence efficacy and tolerability by selectively activating specific signaling pathways, such as preferentially activating the G protein pathway rather than the β-arrestin pathway.

Studies have shown that Eli Lilly's telpokines exhibit a certain bias at the GLP-1 receptor—more readily promoting cAMP production and less readily recruiting β-arrestin. Its success, to some extent, demonstrates the potential of this biased agonist mechanism.

ASC30, as a novel oral GLP-1R-biased small molecule agonist, does not recruit β-arrestin. Although it is not the fastest in terms of progress, it still shows a competitive advantage among drugs of the same class .

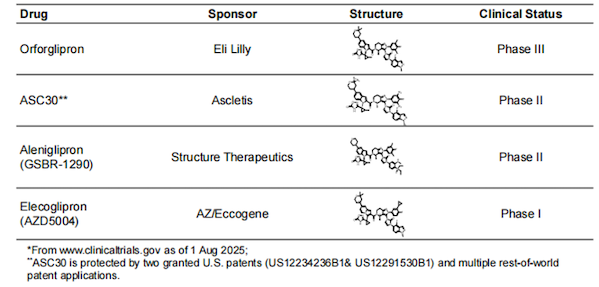

Figure 1. Comparison of similar drugs in ASC30

Figure 1. Comparison of similar drugs in ASC30

Image source: Ascletis Pharma ObesityWeek display poster

Eli Lilly's orforglipron is the world's most advanced small-molecule oral GLP-1R agonist. In the Phase 3 clinical trial ATTAIN-1 for the treatment of obesity, the 36mg dose group achieved an 11.5% weight loss after 72 weeks of treatment (adjusted for placebo).

ASC30 has a highly similar chemical structure to orforglipron and is a completely GLP-1 receptor agonist. Currently, only 13-week weight loss data for ASC30 is available, and its long-term efficacy remains to be verified.

However, Ascletis Pharma specifically highlighted the drug's advantages in terms of gastrointestinal tolerability. According to the press release, the incidence of vomiting with weekly titrations of ASC30 up to the target dose was approximately half that observed with orforglipron. The gastrointestinal tolerability of weekly titrations of ASC30 was comparable to that of orforglipron titrations every four weeks.

Among other competing drugs, Hangzhou Xianweida's ecnoglutide showed significant weight loss at 4 weeks in the SLIMMER Phase 3 clinical trial; at week 40, the highest dose (2.4 mg) group had a mean weight loss of 13.2% from baseline, while the placebo group had an increase of 0.1% (p<0.0001). By week 48, the weight loss had further increased to 15.4% (15.1% after placebo adjustment).

Phase IIb clinical data from SodiBio's aleniglipron (GSBR-1290) showed that, after placebo adjustment, weight loss after 36 weeks of treatment with 45, 90, and 120 mg was 8.2%, 9.8%, and 11.3%, respectively, comparable to the efficacy of Eli Lilly's orforglipron. 65% of patients experienced nausea, 32% experienced vomiting, and 11% discontinued treatment due to adverse events.

Moreover, ASC30's dual administration method (oral/injection) also brings a differentiated advantage to the field of obesity treatment.

The subcutaneous injection formulation of ASC30 allows for long-acting dosing once a month or less. A Phase IIa study in the US has been initiated for once-monthly or less-frequency subcutaneous injection of ASC30 in obese patients, and the first subjects have been dosed. Topline data are expected in Q1 2026.

Ascletis Pharma has also targeted the "weight loss without muscle loss" market by developing ASC47. This is a fat-targeting, once-monthly subcutaneous injection of a selective small molecule THRβ agonist.

Its phase Ib single subcutaneous injection study in healthy subjects with high LDL-C and obese patients showed half-lives of up to 26 days and 40 days , respectively , supporting monthly to bi-monthly dosing.

ASC47 demonstrated signs of weight loss following a single subcutaneous injection (90 mg) in obese patients. The mean weight loss, adjusted for placebo, was 0.2% (day 29), 1.0% (day 43), and 1.7% (day 50, peak), and the treatment was well-tolerated with no adverse events (SAEs) or withdrawals due to AEs.

Meanwhile, ASC47 demonstrated potential for combination therapy. Its combination with the GLP-1R/GIPR dual-target agonist peptide ASC31 resulted in a 44.8% weight loss, while ASC31 monotherapy resulted in a 19.1% weight loss, representing a 134% relative improvement in weight loss efficacy compared to monotherapy. The combination of ASC47 and telpotetide resulted in a 38.1% weight loss, while telpotetide monotherapy resulted in a 20.4% weight loss, representing an 87% relative improvement in weight loss efficacy compared to telpotetide monotherapy.

In addition to its two trump cards, ASC30 and ASC47, Ascletis Pharma is also continuously expanding its weight loss drug pipeline.

Ascletis Pharma recently announced that its monthly next-generation amylin receptor agonist ASC36 and monthly next-generation GLP-1R/GIPR dual-target agonist ASC35 combination formulation have entered clinical development, with an Investigational New Drug (IND) submission expected to be submitted to the FDA in Q2 2026. Simultaneously, its first-ever oral GLP-1R/GIPR/GCGR tri-target agonist peptide, ASC37, has been selected as a clinical development candidate, with an IND submission expected to be submitted to the FDA in Q2 2026 for the treatment of obesity.

03

Strategic turnaround

In 2018, Ascletis Pharma became the first company to be listed under the Hong Kong Stock Exchange’s Rule 18A (which allows unprofitable biotechnology companies to list).

At the time of its listing, Ascletis Pharma was known as the "top domestic hepatitis C drug in China ," with its main products being the hepatitis C treatment drug Ganovo (danoprevir sodium) and the long-acting interferon "Pegasys" distributed by Roche, and it was close to profitability.

However, with the failure of negotiations for Ganovo's inclusion in the national health insurance program, Roche's revocation of the Pegasys distribution rights, the need for updates to hepatitis C treatments, and the underperformance of the hepatitis B pipeline, Ascletis Pharma's core business of viral diseases has become increasingly difficult, forcing the company to adjust its strategic direction .

Compared to the R&D pipeline announced by the company in recent years, Ascletis Pharma has almost completely abandoned the viral disease, MASH, and oncology product pipelines that it once heavily invested in. This includes the MASH pipeline ASC41—a THRβ agonist in Phase 3 clinical trials—which the company had high hopes for, and has decided not to pursue further development.

After a series of restructuring efforts, Ascletis shifted its focus in 2024 to its weight loss and metabolism drug pipeline, making it a "key gamble" for the company's future direction.

Despite facing dire circumstances, Ascletis Pharma appears to have refocused its strategic direction, with a series of weight-loss pipelines progressing rapidly, and its stock price has surged this year.

However, it must be noted that the weight loss track has become one of the most "chaotic" tracks in new drug development, and Ascletis Pharma will face considerable competitive pressure and commercialization challenges in the future.

Globally, Novo Nordisk and Eli Lilly have already dominated the GLP-1 market. In the domestic market, companies with extensive commercial experience, such as Innovent Biologics and Hengrui Medicine, have already entered late-stage clinical trials for their weight loss products, making the market far more competitive than it was in the hepatitis C market years ago. Furthermore, with the expiration of the patent for semaglutide in 2026, numerous generic drugs are poised to enter the market, further intensifying competition.

https://news.yaozh.com/archive/46488.html

By editorRead more on

- a full look at 15 blockbuster drugs. February 28, 2026

- EMA CHMP Recommends EU Approval of Henlius’ Pertuzumab Biosimilar HLX11 February 28, 2026

- Akeso Biopharma’s autoimmune pipeline reaches another milestone! Mandocizumab submits application for market approval, targeting a market worth tens of billions. February 28, 2026

- $2.1 billion! Novo Nordisk reaches new cooperation agreement February 28, 2026

- After Eli Lilly and Novo Nordisk, who most resembles the “Third Brother of Weight Loss”? February 28, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.