2025 Biopharmaceutical CEO Star

December 29, 2025

Source: drugdu

87

87

In the biopharmaceutical industry in 2025, the names of several key figures were frequently mentioned. The choices they made during merger and acquisition negotiations, pipeline advancement, commercialization, or company turning points directly influenced the company's trajectory that year.

01

CEOs who drive up the value of M&A deals

In the unpredictable biopharmaceutical M&A landscape of 2025, one of the most memorable cases is the "value maximization" case involving Metsera .

The obesity market was already hot due to GLP-1 competition, but Metera wasn't a giant company. Its value stemmed more from the potential assessment of its early assets and its judgment of the future market landscape. The co-founders, Whit Bernard and Clive Meanwell , seized the opportunities presented by the times. Amidst a dazzling array of offers, they skillfully used their business negotiation techniques, controlling the pace, information disclosure, and bidding mechanisms to ultimately push Pfizer's seemingly settled $7 billion acquisition price to a final $10 billion deal.

This is not a coincidence brought about by "Novo Nordisk's assistance," but a capital game ability that only a very few CEOs possess: knowing when to act, when to remain silent, and when to send signals, thereby maximizing the company's final valuation.

Sharon Mates , founder and CEO of Intra-Cellular Therapies, led the company to complete a $14.6 billion deal with Johnson & Johnson at the beginning of the year, creating one of the largest biotech mergers and acquisitions of the year. For the past few years, Sharon Mates has been committed to a differentiated strategy in the field of central nervous system diseases. This is almost like a long and arduous medical road, but Sharon Mates ultimately led Intra-Cellular Therapies to success.

Intra-Cellular's core asset is the small-molecule oral psychotropic drug Caplyta (lumateperone). Caplyta was initially approved by the FDA in 2019 for the treatment of schizophrenia in adults, and its indication was expanded to bipolar disorder in 2021. Johnson & Johnson's acquisition of it in the agreement further advances its global operations in the psychotropic field.

Furthermore, in 2025, the FDA accepted Caplyta's supplemental New Drug Application and approved it in November for the treatment of major depressive disorder (MDD) in adults as adjunctive therapy to antidepressants. This new approval, driven by Johnson & Johnson after the acquisition, signifies a further expansion of Caplyta's indications and market potential.

Avidity is also a highly representative case in this year's M&A wave. In 2025, Novartis acquired Avidity in an all-cash deal worth approximately $12 billion, completing a large-scale company transaction rarely seen in the RNA field. This transaction attracted industry attention because Avidity's core value is not a single asset, but rather the fact that its AOC (antibody-oligonucleotide conjugate) platform was clinically validated for the first time in 2024–2025. Its flagship project, AOC-1001, observed functional improvement signals in patients with myotonic dystrophy, resolving a long-standing core question about whether RNA-targeted delivery could truly be effective in humans, and enabling this platform to move from a conceptual technology to an industrial-scale evaluation stage.

At this critical juncture, Avidity CEO Sarah Boyce made the correct judgment that the company had passed the most critical risk point of technology validation, while simultaneously avoiding entering the lengthy and extremely costly next phase of expansion development. During this window of upward valuation, she pushed forward with data disclosure, capital communications, and discussions with potential acquirers, enabling the company to complete the transaction at the intersection of reduced risk and increased value. For Novartis, this represents a strategic move to acquire a next-generation RNA targeted delivery technology platform. For Avidity, it signifies the market's recognition of years of investment in key clinical milestones.

Verona is another high-profile case in this year's M&A wave. In 2025, Merck acquired Verona in an all-cash deal worth approximately $10 billion, a rare large-scale whole-company transaction in the respiratory disease field. Verona's value lies primarily in its core product, ensimentrine, which achieved stable and commercially viable clinical results in a Phase III COPD study. This drug, with its combined bronchodilator and anti-inflammatory mechanisms, provides sustained benefits on key endpoints such as improved lung function and reduced acute exacerbations, resolving the long-standing industry question of whether the efficacy and safety of dual-mechanism drugs could be simultaneously achieved in COPD treatment. This makes it a clearly near-market asset with immediate commercial potential.

Verona's CEO, David Zaccardelli, maintained a very clear dual-pathway between clinical and commercial development throughout the process . He avoided prematurely betting on potential outcomes, instead prioritizing the maturation and disclosure of complete Phase III data—the most crucial evidence—as the core of the company's strategic communication. This allowed investors and potential partners to form judgments based on stable and comparable data. Building on this foundation, he led the team to expedite pre-review technical interactions, define clinical application scenarios, and prepare for pre-market production and channel development. This ensured that ensimentrine achieved high commercial viability while simultaneously undergoing regulatory review. This pace placed Verona at a point where a large pharmaceutical company could most easily intervene: the technological risks had passed, but the massive promotional resources required after market launch had not yet become a burden. It was at this juncture that Merck chose to include Verona in its respiratory disease strategy.

For Merck, this acquisition fills a structural gap in its chronic respiratory disease segment and provides it with an asset in the long-term chronic disease management market that has a dual mechanism of action and a clear value proposition prior to its market launch. For Verona, this transaction represents a natural convergence of the drug's potential value and the company's strategic investment after years of steady progress, at a stage with ample evidence and a clear market positioning.

02

Eli Lilly CEO who stands out from the crowd

Among biopharmaceutical CEOs in 2025, Dave Ricks is undoubtedly the best in terms of performance and benchmark role. This Eli Lilly leader led the company to become the world's first pharmaceutical company to surpass a trillion-dollar market capitalization this year . The significance of this milestone goes far beyond the number itself; it stems from the company's continuous progress in supply chain, production capacity, pipeline, regulatory interactions, and global commercialization over several years. The stable operation of this combination largely depends on the long-term strategic planning of top management.

If GLP-1 was the main engine propelling Eli Lilly past its trillion-dollar market capitalization, then what truly keeps this engine running is Ricks' systematic approach, balancing foresight with steadfast execution. In the field of metabolic diseases, he has advanced a multi-node, multi-timeline structured decision-making system. Instead of simply betting on a single blockbuster drug, he places tirzepatide, retatrutide, early-stage assets, and the oral pipeline on the same timeline, ensuring that assets at different stages can contribute to growth in a relay fashion. More importantly, even with the industry supply chain still unstable due to the aftershocks of the pandemic, he made decisions more than a year in advance to expand production capacity, strengthen the raw material supply chain, and enhance the global production network. This ensured that the tirzepatide product line maintained supply continuity when global demand surged, rather than having its growth momentum hampered by production capacity bottlenecks.

These actions are crucial because market competition for GLP-1 hinges on who can simultaneously drive approval, negotiation, health insurance coverage, and supply chain implementation across dozens of countries; who can prioritize next-generation multi-target pipelines; and who can manage commercialization, payment negotiations, capacity allocation, and regulatory communication as a systematic project. Ricks maintained a high level of commitment across all these areas. He pushed for faster approval processes in multiple markets, accelerated capacity deployment outside the US, and continuously strengthened communication with the FDA, enabling Eli Lilly to steadily advance multiple indication expansions from a regulatory perspective and maintain the dynamic growth of its GLP-1 pipeline.

With the GLP-1 competition intensifying, misjudgment at any stage could lead to market capitalization fluctuations of billions of dollars. Ricks' influence lies precisely in the stability of this multi-faceted scenario: Eli Lilly not only expanded its tirzepatide product line to multiple indications, but also placed its metabolic disease pipeline planning for the next five to ten years within a traceable and quantifiable framework, allowing the capital market to see that growth was structurally supported for many consecutive years. This is why, even in a year of constant market volatility, Eli Lilly was still able to surpass a level of market capitalization that no global technology and pharmaceutical company had ever reached before.

03

CEOs with miraculous healing skills

In the ephemeral world of biomedicine, cases of defying fate are not commonplace. However, this year, several companies, led by their CEOs, have reached a point where they can "sit back and watch the clouds rise after reaching the end of the road."

Abivax 's turnaround is a prime example. For the past few years, the company has faced repeated skepticism and volatility surrounding its oral small-molecule drug obefazimod for ulcerative colitis (UC), resulting in a prolonged period of low stock prices and market concerns that Phase III trials might not yield convincing results. In 2025, top-line data from the ABTECT-1 and ABTECT-2 Phase III trials were released. In 1275 UC patients, the placebo-corrected response rate in the 50 mg group reached 16.4%, a statistically significant difference compared to 19.3% and 13.4% in the two trials. This transformed obefazimod's prospects from gloomy to bright. Despite limited funding, Abivax CEO Marc de Garidel persevered, completing both large-scale, global, multicenter Phase III trials and releasing the data just as it was sufficient to change expectations , leading to a systematic upgrade in ratings and target prices.

Nektar 's situation was more extreme; it was one of the few companies in this cycle that almost faced a "death sentence" from the market. After the failure of its early immuno-oncology projects, its stock price hovered around one dollar for a long time. The turning point came in mid-2025: the company announced that its Treg-activating drug rezpegaldesleukin (rezpeg), used for moderate to severe atopic dermatitis, met all three doses of its REZOLVE-AD IIb trial, achieving the primary endpoint. On the day of the announcement, the stock price surged by more than 130%–150%, and the company subsequently completed a capital increase of approximately $115 million. Its CEO, Howard Robin , made a key decision here: with almost only one core project to pursue, he focused all remaining resources on rezpeg and avoided common pitfalls in the trial design, such as "high placebo rates," which can destroy Phase II data. When the results came out, the market saw not just a data point, but a combination of "new mechanism + replicable clinical pathway + additional capital."

Terns ' failure to achieve its initial goals, though seemingly minor, also reflects the CEO's skillful leadership. After setbacks with its early MASH assets and the suspension of non-core projects, CEO Amy Burroughs focused resources on two small molecule projects : TERN-701 (a BCR-ABL inhibitor for chronic myeloid leukemia) and TERN-601 (an oral small molecule GLP-1 receptor agonist). This focus paid off in 2025, with TERN-601 entering Phase 2 trials and TERN-701 preparing for expanded dose cohorts in chronic myeloid leukemia patients, with cash reserves sufficient to sustain operations until 2028. Even when the company's valuation and resources were at a low point, Amy Burroughs preserved projects capable of rebuilding the company's credibility within one or two readiness points and skillfully managed to turn the tide in a stalemate.

04

CEOs who led their companies to soaring market value

In 2025, a number of mid-sized biopharmaceutical companies saw significant increases in market capitalization, primarily due to the progress made by their respective CEOs in clinical trials, indication expansion, and commercialization strategies. These decisions were not simply about increasing product volume, but rather had a substantial impact on the companies' valuation structures, enabling them to potentially evolve from mid-sized companies into platform enterprises.

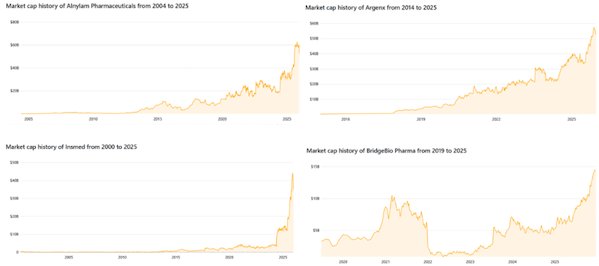

Figure 1: Market capitalization trend of Alnylam, Insmed, Argenx, and BridgeBio

Figure 1: Market capitalization trend of Alnylam, Insmed, Argenx, and BridgeBio

Image source: companiesmarketcap

At Alnylam , Yvonne Greenstreet spearheaded Amvuttra's expansion strategy, enabling this RNAi product, originally primarily targeting hATTR peripheral neuropathy, to enter the significantly larger cardiovascular field : ATTR-CM (cardiac transthyretin amyloidosis). This turning point altered the company's growth trajectory, allowing it to truly break out of the single rare disease track for the first time. Consequently, revenue expectations were significantly revised upwards in 2025, laying the foundation for continued growth in the company's market capitalization.

Insmed CEO Will Lewis is maintaining stable sales growth for the Arikayce asset in the treatment of MAC (Mycobacterium avium complex) nontuberculous mycobacterial lung diseases, while also pushing for the approval of brenscotib for noncystic fibrotic bronchiectasis. These two commercialized products with completely different indications give Insmed its first dual-growth pipeline structure in many years , allowing the company's valuation to shift from a single-asset-driven model to a more robust system.

Argenx CEO Tim Hauwermeiren continued to drive the multi-indication expansion of VYVGART in 2025 , extending it from the already approved myasthenia gravis (gMG) to a wider range of autoimmune diseases such as CIDP (chronic inflammatory demyelinating polyneuropathy) and ITP (immune thrombocytopenic purpura). Simultaneously, he accelerated commercialization in multiple countries, resulting in a steady acceleration in the company's global sales this year. This cross-therapeutic and cross-regional coverage is the core reason for Argenx's continued market capitalization growth this year.

BridgeBio CEO Neil Kumar , leveraging the positive results from acoramidis' Phase III ATTR-CM trial and the subsequent NDA application, has enabled the company to move beyond its previous focus on a single rare disease asset . Bayer's commercialization partnership in Europe further confirms the asset's scalability potential and, for the first time, gives BridgeBio's market capitalization structure support from a large market like cardiovascular disease.

What these CEOs had in common in 2025 was that, within these non-leading pharmaceutical companies, they propelled their businesses through the most challenging valuation range. Their decisions enabled their companies to achieve market capitalization leaps far exceeding the industry average for the same period.

In conclusion , the biopharmaceutical industry in 2025 presented a variety of paths, and behind each of these paths, the imprints of specific decision-makers can be seen. Whether it's finding a suitable position in a rapidly expanding field or maintaining organizational sustainability under pressure, these choices form a solid foundation for companies to move to the next stage.

https://news.yaozh.com/archive/46766.html

By editorRead more on

- a full look at 15 blockbuster drugs. February 28, 2026

- EMA CHMP Recommends EU Approval of Henlius’ Pertuzumab Biosimilar HLX11 February 28, 2026

- Akeso Biopharma’s autoimmune pipeline reaches another milestone! Mandocizumab submits application for market approval, targeting a market worth tens of billions. February 28, 2026

- $2.1 billion! Novo Nordisk reaches new cooperation agreement February 28, 2026

- After Eli Lilly and Novo Nordisk, who most resembles the “Third Brother of Weight Loss”? February 28, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.