With a transaction volume exceeding $37.3 billion, psychotropic drugs have reached a “new level.”

January 5, 2026

Source: drugdu

84

84

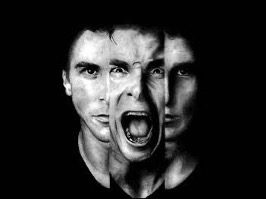

In the global pharmaceutical landscape, the development of drugs for schizophrenia presents a paradoxical scene: it is both a "valley of death" where giants stumble and a frontier where capital pours in. In recent years, with breakthroughs in drugs with novel mechanisms of action, the sector has seen transaction volumes exceed $37.3 billion , propelling schizophrenia drugs to new heights!

In the global pharmaceutical landscape, the development of drugs for schizophrenia presents a paradoxical scene: it is both a "valley of death" where giants stumble and a frontier where capital pours in. In recent years, with breakthroughs in drugs with novel mechanisms of action, the sector has seen transaction volumes exceed $37.3 billion , propelling schizophrenia drugs to new heights!

01

Development and Competitive Landscape of Psychosomatic Drugs

The schizophrenia market is a crucial component of the CNS (Chemical, Neuro, and Social Sciences) field, but its research and clinical translation face severe challenges. The success rate of new drugs in this area obtaining FDA approval is only about 6%, making it a veritable "valley of death" in pharmaceutical R&D. According to Expert Market Research, the antipsychotic drug market is projected to reach nearly $20 billion in 2024. This market size reflects the concentrated demand for medication from a long-term patient population.

Since chlorpromazine was launched in 1957, many antipsychotic drugs have been launched, and the existing antipsychotic drugs are mainly divided into three generations.

First-generation drugs, such as chlorpromazine, perphenazine, and sulpiride, belong to the dopamine D2 receptor blockers. They effectively control positive symptoms such as hallucinations and delusions by blocking the mesolimbic dopamine pathway. However, due to their non-selective blocking of dopamine receptors throughout the brain, they often cause serious side effects such as extrapyramidal reactions and tardive dyskinesia, resulting in poor patient tolerance and compliance.

Second-generation drugs, such as clozapine, olanzapine, risperidone, and ziprasidone, have mechanisms of action that extend to simultaneously antagonizing dopamine D2/D3/D4 receptors and 5-HT2A receptors. While maintaining antipsychotic efficacy, these drugs reduce some musculoskeletal side effects, but may still cause problems such as weight gain, metabolic syndrome, and hyperprolactinemia, making long-term treatment challenging.

Third-generation drugs are represented by D2/D3 receptor partial agonists, 5-HT2A receptor agonists or antagonists, and 5-HT1A receptor partial agonists, such as rumepirozol, aripiprazole, epipiprazole, and cariprazine. The therapeutic targets of third-generation antipsychotics for schizophrenia have expanded beyond D2 receptor blockade to explore the antipsychotic effects of D2 receptor partial agonists and new targets such as D3, 5-HT1A, 5-HT7, and mGlu2/3 receptors.

Compared to first-generation drugs, second- and third-generation drugs have fewer extrapyramidal side effects and are slightly effective for negative symptoms (such as emotional apathy). Nevertheless, existing drugs still cannot achieve selective action targeting only the mesolimbic pathway. Therefore, motor disorders, metabolic abnormalities, and endocrine side effects caused by interference with the substantia nigra-striatal pathway and tuberoinfundibulum pathway still exist, which constitutes the main limitation of current treatment.

Due to these unresolved side effects, psychosomatic drug management still faces serious challenges in clinical practice regarding adherence and relapse rates. Statistics show that approximately 75% of patients discontinue treatment within 18 months, and even with maintenance therapy, the annual relapse rate remains as high as 18% to 32%. On the one hand, the drugs have limited efficacy against negative symptoms and cognitive deficits; on the other hand, side effects significantly impact patients' quality of life and willingness to take medication long-term, creating a treatment gap.

02

MNCs all suffered setbacks.

Over the past decade, the development of psychosocial drugs has been fraught with difficulties. Only a few dozen new psychosocial drugs have been approved for marketing globally, while more than 150 drugs in development have failed . Even international pharmaceutical giants such as AbbVie and Roche have not escaped the common fate of research and development failures. The extremely high scientific barriers and clinical uncertainties in this field have also prompted many MNCs to reassess their strategic layout in the CNS and psychosocial fields.

In 2011, Novartis closed its neuroscience research facility in Basel, Switzerland, and has since significantly reduced its investment in this area, suggesting a substantial retreat from developing cutting-edge neuroscience research.

In 2018, after experiencing failures in drug development for Alzheimer's and Huntington's diseases, Pfizer decided to halt the early discovery and development of neuroscience drugs and cut approximately 300 related jobs. Some of its pipeline assets were spun off to form Cerevel Therapeutics, with Pfizer retaining a 25% stake.

At the end of 2019, Amgen terminated its schizophrenia and Alzheimer's disease projects and essentially withdrew from the field of neuroscience, citing that the understanding of disease mechanisms was still in its early stages and that development cycles were long and risky, and that resources would be shifted to more certain areas such as oncology and inflammation.

In 2020, Novartis acquired Cadent Therapeutics for $770 million, gaining access to its NMDAr positive allosteric modulator CAD-9303, a candidate drug for schizophrenia. However, the pipeline has been stagnant since then, with no significant clinical data disclosed.

In May 2023, Roche terminated its Phase II clinical trial of the TAAR1 agonist ralmitaront, which aimed to evaluate the efficacy of ralmitaront compared to placebo in treating patients with schizophrenia or negative symptoms of schizoaffective disorder. The trial was terminated because an interim analysis indicated that ralmitaront was unlikely to meet the primary endpoint in the study.

In late 2023, AbbVie acquired Cerevel Therapeutics for approximately $8.7 billion, gaining access to a neuroscience pipeline that includes Emraclidine, an M4 positive allosteric modulator.

However, in November 2024, Emraclidine failed to meet its primary endpoint in two Phase II studies (EMPOWER-1 and EMPOWER-2) for schizophrenia, causing AbbVie's stock price to plummet by more than 12% in a single day, wiping out approximately $40 billion in market value. The company subsequently recognized an asset impairment of approximately $3.5 billion.

In April 2024, Neumora Therapeutics ' NMRA-266 also had its Phase I clinical trial suspended by the FDA due to a preclinical rabbit seizure incident.

In 2025, setbacks continued.

In January, Boehringer Ingelheim announced that its GlyT1 inhibitor, Iclepertin, failed to meet its primary endpoint in a Phase III study for the treatment of cognitive impairment in schizophrenia, and the long-term extension trial was subsequently terminated.

In April, AstraZeneca announced its complete withdrawal from the CNS (Consumer, Reproductive, and New) field in its quarterly financial report, terminating several related pipelines. The company attributed this to the high difficulty and long development cycle of the field, which it felt inconsistent with its $80 billion revenue target focused on short-term, high-certainty growth. This move caused widespread shockwaves within the industry.

Giants can no longer sustain the high investment and high risk in this field. They are forced to allocate resources towards areas with relatively clear R&D paths, high success rates, and short return cycles, such as oncology and autoimmune diseases. In contrast, fields like psychoanalysis, which require extremely long-term and massive investment, have abnormally high failure rates, and highly uncertain market returns, are finding it increasingly difficult to gain support in internal resource competition.

03

The way to break the deadlock

Despite frequent failures in schizophrenia drug development, leading some multi-company companies (MNCs) to withdraw, the vast unmet clinical needs and promising market prospects continue to attract the industry's persistence and exploration. The successful launch of a drug with an innovative mechanism not only signifies a major breakthrough in clinical treatment but also often brings substantial market returns. This high-risk, high-reward nature has spurred numerous companies to invest, resulting in transactions in the schizophrenia sector exceeding $37.3 billion in recent years!

In late 2023, BMS acquired Karuna Therapeutics for $14 billion , gaining access to its innovative therapy KarXT (xanomeline-trospium). KarXT, an oral M1/M4 muscarinic acetylcholine receptor agonist, was approved by the FDA in September 2024 for the treatment of schizophrenia in adults, becoming the first drug of its kind approved in decades based on a novel mechanism of action. Following its market launch, it performed exceptionally well, with sales jumping to $62 million in the first half of 2025 alone. Evaluate listed it as one of the top ten potential blockbuster pipelines in 2024 and predicted its sales could reach $3.1 billion by 2030.

In early 2025, Johnson & Johnson acquired Intra-Cellular Therapies, a company focused on treating central nervous system disorders, for $14.6 billion , bringing its core product, Caplyta (lumateperone), into its portfolio. This oral atypical antipsychotic had already generated $680 million in sales in 2024. Johnson & Johnson has high hopes for its prospects, predicting that its peak sales could exceed $5 billion, potentially becoming its third major product in the schizophrenia field, after paliperidone long-acting formulations and esketamine nasal spray.

In 2023, AbbVie acquired Emraclidine , an M4 receptor modulator, from Cerevel for $8.7 billion. Although its efficacy in the Phase II clinical trial did not meet expectations, AbbVie has not given up. It plans to explore its potential by adjusting the dosage, exploring its role as an adjunct therapy, and expanding its indications to include Alzheimer's disease/Parkinson's disease-related psychosis.

Furthermore, innovative targets are injecting new vitality into the field and market of antipsychotic drugs.

Evenamide, developed by Newron Pharmaceuticals, is a novel oral medication that regulates abnormal sodium channel activity and normalizes glutamate release. Potential pivotal clinical trial results, announced in April 2024, showed it met its primary endpoint in treating patients with resistant schizophrenia. Newron believes this drug has the potential to become the first new therapy for this treatment-resistant population since clozapine.

Another company, Reviva Pharmaceuticals, developed Brilaroxazine, a novel chemical entity with high selectivity for serotonin and dopamine receptors, which also achieved positive results in its Phase III clinical trial announced in December 2024.

In addition, MapLight Therapeutics completed a $372.5 million Series D financing round in July 2025, which will primarily be used to advance its Phase II clinical trial of its oral M1/M4 agonist combination ML-007C-MA in schizophrenia and Alzheimer's disease-related psychosis. The drug is designed to optimize efficacy and reduce peripheral side effects, and early clinical data show it is well-tolerated.

In conclusion , the development of drugs for schizophrenia is a pragmatic track that directly confronts enormous clinical challenges. Traditional drugs have limitations, while breakthroughs in drugs with new mechanisms of action are bringing tangible improvements to treatment.

https://news.yaozh.com/archive/46793.html

By editorRead more on

- Qilu Pharmaceutical achieves another breakthrough in internationalization, with its blockbuster anti-tumor drug bevacizumab approved for marketing in the UK. February 26, 2026

- Etoposide Injection and Fluorouracil Injection Receive FDA Approval in the United States February 26, 2026

- Jikeqin’s marketing application accepted by the drug regulatory authority February 26, 2026

- Net profit surged by 1041%, marking a breakthrough for the self-exempt king February 26, 2026

- Kanghong Pharmaceutical’s Class 1 new drug receives clinical trial approval February 26, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.