The new king of the multi-billion myeloma market is here

September 2, 2025

Source: drugdu

217

217

In the multi-billion dollar global myeloma market, BCMA/CD3 bispecific antibodies are becoming a powerful weapon reshaping the treatment landscape. Currently, the market is dominated by Johnson & Johnson, Pfizer, and Regeneron, with competition escalating.

Digging for Gold in the Billion-Dollar Myeloma Market

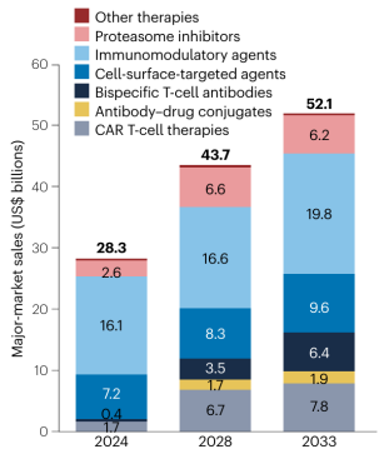

Multiple myeloma, a common hematologic malignancy, is experiencing an expanding global market for treatment. The market reached $28.3 billion in 2024 and is projected to continue growing at an average annual rate of 6.6%. Industry forecasts predict the market will exceed $52.1 billion by 2032. The global multiple myeloma market is currently characterized by a competitive landscape characterized by the simultaneous advancement of traditional drugs, biologics, and cell therapies.

Forecast sales of key multiple myeloma therapeutics in major markets from 2024 to 2033

Forecast sales of key multiple myeloma therapeutics in major markets from 2024 to 2033

Image source: Nature reviews. Drug discovery, 24(4), 244–245.

Among core therapeutic drugs, immunomodulators (IMiDs) still hold a significant position. Lenalidomide, a second-generation drug, continues to dominate the market due to its low neurotoxicity and convenient oral administration, particularly in China, where it holds approximately three-quarters of the IMiDs market share. Pomalidomide, a third-generation drug, has also seen rapid growth since its launch in 2020, demonstrating significant clinical alternative potential. Although this class of drugs faces challenges brought on by patent expirations, its fundamental role across multiple lines of treatment will continue to support its approximately 38% market share by 2033.

Meanwhile, monoclonal antibodies targeting CD38 have performed particularly well. Since its approval in 2015, Johnson & Johnson's daratumumab has expanded its indications to encompass a wide range of treatment scenarios, from back-line to front-line. Global sales are expected to reach $9.7 billion in 2023 and exceed $10 billion in 2024, reaching $11.6 billion. This makes it the first drug in this field to reach the "tens of billions" mark, significantly boosting overall market growth expectations.

Meanwhile, the protease inhibitor market is experiencing structural differentiation. Bortezomib, a longtime first-line option, has been impacted by national centralized procurement policies, leading to a significant decline in sales. Carfilzomib, due to concerns about cardiotoxicity and renal toxicity, has seen continued sluggish market performance. While the oral formulation ixazomib improves convenience, its limited combination regimens limit its further development. Traditional chemotherapy drugs, due to their numerous adverse reactions, are being rapidly replaced by more precisely targeted therapies.

At the innovative treatment level, CAR-T cell therapy targeting BCMA is making rapid progress. Currently, eight BCMA-targeted drugs for the treatment of multiple myeloma are marketed worldwide. Four CAR-T products alone have been approved for marketing. Among them, Cedars-Sinai has performed particularly well, with sales rapidly climbing since its launch in 2022, reaching nearly $1 billion in 2024, demonstrating strong market competitiveness. Domestically, approved drugs include Ikiorensa from Reindeer Biopharmaceuticals and Zewokiorensa from Coherus Biosciences/Huadong Medicine. As CAR-T therapy advances in clinical trials, its potential for early-stage treatment is being continuously explored.

Competition in the BCMA/CD3 bispecific antibody market is intensifying

In recent years, fierce competition has emerged in the BCMA/CD3 bispecific antibody market, making it a hot topic for global pharmaceutical companies. Currently, there are over 10 BCMA/CD3 bispecific antibodies under development worldwide. With Regeneron Pharmaceuticals' Lynozyfic receiving accelerated approval from the FDA in July 2025, the market has become a three-way battleground between Johnson & Johnson, Pfizer, and Regeneron, and the competition continues to escalate.

Among them, Johnson & Johnson's teclizumab was the first to receive approval overseas, receiving NMPA approval in June 2024 for the treatment of adult patients with RRMM who have received at least three prior lines of therapy. This approval was based on data from the pivotal Phase I/II MajesTEC-1 study, which demonstrated an objective response rate (ORR) of 63% and demonstrated durable efficacy, with 57% of patients still in remission at 18 months. Based on its significant clinical value, Johnson & Johnson projected peak global sales of over $5 billion, fully demonstrating the market potential of this target.

Following closely, Pfizer's elranatamab was approved for the same indication in China in March 2025. Data from the MagnetisMM-3 trial, which supports this, demonstrated profound and durable efficacy, with a 30-month DOR rate of 61.0%, a metastatic progression-free survival (mPFS) of 17.2 months, and a metastatic overall survival (mOS) of 24.6 months. Elranatamab demonstrated a manageable safety profile with no new risk factors. The successive launches of these two pioneering products officially launched the race for dual-antibody therapies in the multi-billion dollar myeloma market in China.

In April 2025, Regeneron's linvoseltamab received conditional approval from the European Commission (EC) for the treatment of adult patients with relapsed/refractory multiple myeloma (MM) who have progressed after at least three prior lines of therapy (including a proteasome inhibitor, an immunomodulator, and an anti-CD38 monoclonal antibody). In July 2025, Regeneron's linvoseltamab received FDA approval for the treatment of adult patients with relapsed or refractory (R/R) multiple myeloma (MM). Data from the pivotal Phase I/II LINKER-MM1 study demonstrated an ORR of 70%, with 45% of patients achieving a complete response (CR) or better, and a median duration of first remission of 0.95 months. Although Regeneron entered the market later than its competitors, it has differentiated itself through its clinical advantages and response-adapted monthly dosing regimen.

Notably, the company's next-generation technology pipeline has already begun. AbbVie spent $700 million upfront to acquire the rights to ISB 2001, a trispecific antibody developed by Ichnos Glenmark Innovation. This drug simultaneously targets CD38, BCMA, and CD3. Compared to bispecific antibodies, it may have stronger binding to tumor cells with low BCMA expression, thereby reducing the risk of drug resistance. Phase I clinical data showed that ISB 2001 achieved a 79% overall response rate in 35 patients with relapsed or refractory multiple myeloma, with nearly 30% achieving complete remission.

The rise of domestic power

As domestic innovative pharmaceutical companies continue to make efforts, China's R&D capabilities are rapidly rising in the BCMA/CD3 bispecific antibody field.

In terms of R&D progress, domestically produced BCMA/CD3 bispecific antibodies have demonstrated remarkable clinical effects.

Conoya's CM336 has shown in clinical studies that 52% of patients achieved strict complete remission and is currently in Phase II clinical trials. In June 2025, its breakthrough case for the treatment of refractory autoimmune hemolytic anemia (AIHA) was published in the New England Journal of Medicine. Two patients who had failed multiple treatments achieved rapid remission and maintained efficacy for over 6 months after CM336 rescue treatment, with a good safety profile.

Zhixiang Jintai's GR1803 precisely activates T cells to kill tumor cells by targeting the BCMA antigen with high affinity and binding to CD3 with low affinity. Data from the 2024 EHA Annual Meeting demonstrated significant objective response rates in patients with multiple myeloma who had received at least three lines of therapy, and also demonstrated significant efficacy in patients with extramedullary plasmacytomas.

In addition, Innovent Biologics' EMB-06 is currently undergoing a Phase I/II study for relapsed or refractory multiple myeloma; Zhengda Tianqing's TQB2934 has also added a new indication for the treatment of systemic light-chain amyloidosis in adults, bringing new hope to patients with rare diseases.

With excellent clinical data, China's R&D capabilities have gradually won wide recognition in the international market.

In September 2024, EpiMed Biopharmaceuticals licensed global rights to its BCMA/CD3 bispecific antibody EMB-06 to Vignette Bio for an initial payment and equity consideration of US$60 million, with potential milestone payments of up to US$575 million.

In November 2024, Weilizhibo co-founded Oblenio Bio with Aditum Bio based on its innovative CD19/BCMA/CD3 triple antibody LBL-051 and obtained financial support to accelerate clinical advancement;

During the same period, Conoya reached an agreement with Platina Medicines to grant it overseas rights to the BCMA/CD3 bispecific antibody CM336, receiving an initial payment of US$16 million and milestone payments of up to US$610 million.

In January 2025, Innovent Biologics and AbbVie reached an agreement on the GPRC5D-BCMA-CD3 trispecific antibody SIM0500, with a potential transaction value of up to US$1.055 billion, further enriching the layout of domestic bispecific antibody drugs.

In June 2025, Zhixiang Jintai authorized Cullinan to cover overseas markets for GR1803 for a total amount of US$712 million, exploring the application of GR1803 in the autoimmune field and opening up incremental markets.

Conclusion

As the BCMA/CD3 bispecific antibody market continues to heat up, Chinese pharmaceutical companies are emerging, and the treatment of multiple myeloma is about to enter a new era of greater precision and accessibility.

https://news.yaozh.com/archive/45982.html

By editorRead more on

- Lunan Pharmaceutical’s Jiali® Oxaliplatin Injection Receives US Marketing Approval January 19, 2026

- The second NDA for gumozymab, a new drug application for the treatment of ankylosing spondylitis, has been accepted January 19, 2026

- The clinical trial application for its shingles mRNA vaccine has been officially accepted January 19, 2026

- 3.1 billion! Orthopedic giant announces major acquisition. January 19, 2026

- The Small Nucleic Acid Track is Ushering in a Major Explosion January 19, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.