Pfizer is brewing the next outbreak

August 8, 2025

Source: drugdu

236

236

Three years after the COVID-19 pandemic subsided, global pharmaceutical giant Pfizer has changed direction and is betting heavily on the next generation of anti-tumor therapies. Can it return to its peak?

Q2 performance exceeded expectations, with revenue increasing by 10% year-on-year

According to Pfizer's latest financial report, its second-quarter 2025 revenue reached $14.7 billion, a 10% year-over-year increase, exceeding market expectations. Its first-half revenue reached $28.37 billion, a 1% year-over-year increase. Pfizer forecast full-year revenue of $61 billion to $64 billion and raised its 2025 full-year EPS guidance by $0.10 to a range of $2.90 to $3.10.

From the perspective of business segments, Primary Care, Specialty Care and Oncology businesses generated revenues of US$5.54 billion (12%), US$4.378 billion (+7%) and US$4.387 billion (+11%) in the second quarter, respectively.

Looking at specific products, within the Primary Care segment, the anticoagulant Eliquis (apixaban) contributed over $2 billion in Q2, a 6% year-over-year increase, supporting Pfizer's core business. However, it's worth noting that the drug's net price in the US has declined due to IRAs, and it is also facing competition in some international markets. Furthermore, its patent will expire in 2026, raising concerns about its future prospects. Growth in the Prevnar family of pneumococcal vaccines has nearly stagnated, while the RSV vaccine Abrysvo saw revenue growth of 155%, though its market share remains small.

In the Specialty Care segment, sales of the rare disease drug Vyndaqel (transthyretin amyloid cardiomyopathy drug) series reached US$1.615 billion, a year-on-year increase of 21%, becoming the most promising revenue engine at present.

The oncology sector is the most promising. Although the bestselling breast cancer drug Ibrance (palbociclib) saw an 8% revenue decline due to competition and reimbursement, the ADC drug Padcev generated $542 million in revenue, a 38% increase. Sales of the targeted lung cancer drug Lorbrena (lorlatinib) surged 48%, gaining market share in the first-line treatment of ALK-positive metastatic non-small cell lung cancer (ALK+ mNSCLC). The AR inhibitor Xtandi (enzalutamide) generated $566 million in revenue, a 14% year-on-year increase.

Among the recently launched and under-development products, Pfizer's oncology segment has many potential blockbuster products.

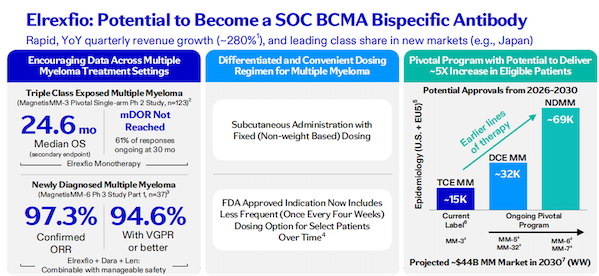

Elrexfio (elranatamab) is a CD3/BCMA dual-antibody that was approved for marketing in 2023 for the treatment of adult patients with relapsed or refractory multiple myeloma (RRMM). In the Phase 2 MagnetisMM-3 study, Elrexfio achieved a median OS of 24.6 months in patients with relapsed or refractory multiple myeloma (RRMM) who had previously received multiple lines of therapy.

The Magnetis MM-6 study in treatment-naive patients showed that the triple combination of elranatamab with daratumumab and lenalidomide was effective and manageable in the treatment of newly diagnosed multiple myeloma patients.

The drug brought in $145 million in sales revenue in the first half of this year and $85 million in Q2, a year-on-year increase of 280%. It has quickly captured market share in new markets such as Japan. Pfizer believes that Elrexfio is expected to become the standard BCMA bispecific antibody therapy.

Image source: Pfizer official website

Image source: Pfizer official website

Pfizer's $43 billion acquisition of Seagen in 2023 also yielded strong returns, with several ADC products performing well. Nectin-4 ADC drug Padcev (veentumab) generated $967 million in revenue in the first half of this year, a 32% year-over-year increase.

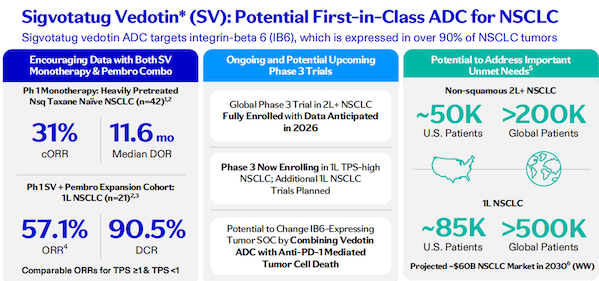

Sigvotatug Vedotin (SV) is another ADC product being promoted by Pfizer. It is a potential first-in-class integrin β6-targeted ADC. Through antibody engineering, the drug is specifically targeted to integrin β6 (IB6), preventing it from binding to other integrins and enhancing its tumor selectivity.

Pfizer has currently launched two Phase III clinical trials of this drug for non-small cell lung cancer (NSCLC), one for the second-line treatment or above of non-squamous NSCLC patients who have not been treated with paclitaxel, and the other for the first-line treatment in combination with K drug for patients with non-small cell lung cancer with high PD-L1 expression.

Image source: Pfizer official website

Image source: Pfizer official website

Betting big on next-generation cancer therapies

In addition to its existing pipeline, Pfizer is also aggressively acquiring external pipeline partners this year to strengthen its product portfolio. Tidu data shows that the company has secured numerous collaborations in the first half of the year, encompassing bispecific antibodies, ADCs, small molecules, AI, and other technologies, primarily focusing on oncology.

Among them, the cooperation between Pfizer and Sansure Pharmaceutical worth over US$6 billion is undoubtedly the focus of attention.

On May 20, Pfizer announced it had acquired global rights outside of China to 3SBio's dual-antibody PD-1/VEGF therapy SSGJ-707, with an initial payment of $1.25 billion, for a total transaction value of up to $6.05 billion. In the agreement, which took effect on July 24, Pfizer added an additional $150 million in initial payment to acquire exclusive development and commercialization rights for SSGJ-707 in China . In addition, Pfizer will subscribe for $100 million worth of 3SBio's common stock.

Pfizer believes SSGJ-707 (707, PF-08634404) is a potentially transformative MOA with broad development opportunities that aligns seamlessly with the company's strategy. SSGJ-707 is currently in Phase 3 clinical trials, and Pfizer is developing a rational development plan.

SSGJ-707, developed by 3SBio based on its patented CLF2 platform, simultaneously inhibits both PD-1 and VEGF. Preclinical data demonstrate best-in-class anti-angiogenic activity and high affinity for PD-1. Structurally, 707 is a tetravalent antibody with two PD-1 and two VEGF binding sites. Its unique "synergistic binding" property increases 707's binding affinity for PD-1 by approximately 100-fold when it binds to VEGF, which is highly expressed in the tumor microenvironment. This could theoretically enhance anti-tumor activity and target activity to tumors with elevated VEGF levels, potentially improving safety and tolerability. Furthermore, 707 utilizes an IgG4 Fc fragment, which naturally has a lower pro-inflammatory immune activation potential, helping to minimize adverse immune responses.

At this year's ASCO Annual Meeting, 3SBio announced positive interim analysis results from a Phase II clinical trial of SSGJ-707 monotherapy for the treatment of advanced NSCLC. In the first-line treatment of PD-L1-positive NSCLC, the 10 mg/kg Q3W dose group achieved an ORR of 72% (18/25) and a DCR of 100% (25/25), demonstrating best-in-class potential.

In terms of safety, 78.3% of the subjects experienced treatment-related adverse events (TRAEs), of which 24.1% experienced grade ≥ 3 TRAEs, 6% of the patients discontinued the drug due to TRAEs, and there were no treatment-related deaths. The overall safety was better than traditional chemotherapy.

In addition to non-small cell lung cancer, clinical research on SSGJ-707 for the treatment of colorectal cancer, gynecological tumors and other fields is also underway.

Currently, PD-1 dominates the oncology treatment market, with the emergence of two billion-dollar molecules, K-1 and O-1. The PD-1/VEGF dual antibody is the only one in the past decade to demonstrate superiority to PD-1 in a head-to-head Phase 3 clinical trial, presenting enormous opportunities.

Furthermore, ADCs have shown promise in combination with PD-1 in next-generation cancer therapies. Pfizer's Padcev has previously received FDA approval for combination therapy with the PD-1 monoclonal antibody K (pembrolizumab) as a first-line treatment for locally advanced or metastatic urothelial carcinoma, becoming the world's first approved "PD-1 + ADC" combination therapy.

Based on its rich ADC products, Pfizer is now introducing a late-clinical PD-1/VEGF dual antibody, which is expected to achieve a double upgrade of existing anti-tumor therapies, lead the next generation of tumor treatment, and bring about another burst of performance.

Conclusion

In the past decade, Pfizer spent more than $10 billion on transactions in five years. It once bought the drug king Lipitor and mRNA vaccine Comirnaty through transactions. It is undoubtedly the most confident buyer in the BD market.

In 2023, Pfizer made another major investment: spending $43 billion to acquire ADC pioneer Seagen. This year, it also secured 3SBio's PD-1/VEGF dual antibody for $1.4 billion down payment and $4.8 billion in milestone payments. This combination of ADC and IO dual antibodies is expected to help Pfizer become a leader in next-generation oncology treatments, reclaiming its reputation as the world's leading pharmaceutical company.

https://news.yaozh.com/archive/45875.html

By editorRead more on

- Lunan Pharmaceutical’s Jiali® Oxaliplatin Injection Receives US Marketing Approval January 19, 2026

- The second NDA for gumozymab, a new drug application for the treatment of ankylosing spondylitis, has been accepted January 19, 2026

- The clinical trial application for its shingles mRNA vaccine has been officially accepted January 19, 2026

- 3.1 billion! Orthopedic giant announces major acquisition. January 19, 2026

- The Small Nucleic Acid Track is Ushering in a Major Explosion January 19, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.