750 million license in, Chinese pharmaceutical companies make money overseas and spend overseas

November 23, 2024

Source: drugdu

324

324

On November 20, Junshi Bio released an announcement and signed a License Agreement with an undisclosed licensor to obtain the exclusive license right and sub license right of the licensor to develop, manufacture, use, import, export, sell and commercialize the two dual target fusion proteins in Greater China (including Chinese Mainland, Hong Kong Special Administrative Region, Macao Special Administrative Region and Taiwan).

The subject of this transaction is two dual target fusion proteins, mainly used for the treatment of malignant tumors. Currently, licensed product 1 is in the overseas Phase I clinical trial stage. Junshi Biotechnology has submitted its Phase I clinical trial application to the National Medical Products Administration in China, and Junshi Biotechnology has the right of first refusal for licensed product 1 outside of Greater China.

Licensed product 2 is in the preclinical research stage. In addition to the exclusive license and sub license rights to develop, manufacture, use, import, export, sell, and commercialize in any other way within the Greater China region, Junshi Biotechnology will also share all rights and interests in developing, manufacturing, using, importing, exporting, selling, and commercializing the licensed product 2 globally with the licensor in a 50-50 equity ratio.

After the signing of the license agreement, Junshi Biotechnology will make a down payment of 1.5 million US dollars to the licensor. In the future, based on the progress of licensed product research and development and sales, Junshi Biotechnology will pay a cumulative milestone payment of no more than 740 million RMB, as well as a possible sales commission based on the percentage of annual net sales of licensed products in Greater China. (Note: The total transaction amount is approximately RMB 750 million)

1. Make money overseas and spend it overseas

The launch of the first domestically produced PD-1 trastuzumab injection successfully going global has led to continuous growth in Junshi Biotechnology's overseas market layout in recent years. In 2021, it was approved by NMPA for the treatment of advanced nasopharyngeal carcinoma, becoming the world's first immune checkpoint inhibitor approved for nasopharyngeal carcinoma treatment. In the past three years, Terizumab has gradually been approved as the first nasopharyngeal carcinoma drug in the United States, Europe, India, Jordan, Hong Kong, and the United Kingdom. In the UK, trastuzumab is also approved as the only first-line treatment for advanced or metastatic esophageal squamous cell carcinoma with no restriction on PD-L1 expression.

Annual Report of Junshi Biotechnology in 2023

Unit: Yuan Current: RMB

Main business classified by industry

By industry Operating revenue Operating costs Gross profit (%) Increase or decrease in operating revenue compared to the previous year (%) Increase or decrease in operating costs compared to the previous year (%) Increase or decrease in gross profit compared to the previous year (%)

Pharmaceutical manufacturing industry 1,474,150,813.81 520,000,971.32 64.73 19.92 51.04 Reduce 7.26%

Main business classified by product

By product Operating revenue Operating costs Gross profit (%) Increase or decrease in operating revenue compared to the previous year (%) Increase or decrease in operating costs compared to the previous year (%) Increase or decrease in gross profit compared to the previous year (%)

Antineoplastic 919,485,869.85 235,971,305.90 74.34 24.93 -7.12 Increase 8.86%

Revenue from technology licensing and franchise usage 283,724,802.97 - 100.00 -40.45 -100.00 Increase 14.50%

Main business classified by area

By area Operating revenue Operating costs Gross profit (%) Increase or decrease in operating revenue compared to the previous year (%) Increase or decrease in operating costs compared to the previous year (%) Increase or decrease in gross profit compared to the previous year (%)

Domestic 1,162,154,912.58 514,375,148.36 55.74 54.39 86.92 Decrease 7.70%

Overseas 311,995,901.23 5,625,822.96 98.20 -34.52 -91.86 Increase 12.70%

In terms of performance, Junshi Biotechnology is expected to achieve a revenue of approximately 1.474 billion yuan in 2023, an increase of 19.92% compared to the previous year; Among them, the domestic income is about 1.162 billion yuan, and the overseas income is about 312 million yuan. Junshi Biotechnology explained that the increase in drug sales revenue in this period is mainly due to the improvement of the company's commercialization ability during the reporting period, and the sales situation in the domestic market has gradually entered a positive cycle.

As of the end of the reporting period, Junshi Biological has three commercial drugs, namely PD-1 teriprizumab injection (trade name: Tuoyi), adalimumab injection (trade name: Junmaikang) and COVID-19 small molecule drug Remidvir deuterium hydrobromide tablets (trade name: Mindiver).

Domestically, Terizumab has been approved for 7 indications and 6 indications have been included in the national medical insurance catalog. The indications of Mindwell for adult patients with mild to moderate novel coronavirus infection were included in the official national medical insurance list for the first time. The 8 approved indications for Junmaikang will continue to be included in the national medical insurance catalog.

From a regional perspective, domestic income mainly comes from drug sales revenue, while overseas income mainly comes from technology licensing and franchise revenue. This is in line with Junshi Biotechnology's globalization strategy, which is to establish commercialization and industrialization paths through authorized cooperation with overseas pharmaceutical companies. Taking the United States and Canada as examples, Junshi Biosciences had already reached a cooperation agreement with Coherus BioSciences for the development and commercialization of Terriptylimab injection before submitting its first marketing application (BLA) to the FDA.

According to the terms of the agreement, Junshi Biotechnology and Coherus will jointly develop Triprolizumab, with Coherus responsible for all commercial activities in the United States and Canada, and will receive a total down payment of up to $1.11 billion, optional project execution fees, and milestone payments. In addition, Junshi Biotechnology will grant Coherus JS006 (anti TIGIT monoclonal antibody) and JS018-1 (new generation improved IL-2 cytokine drug) the option, as well as priority negotiation rights for two early stage checkpoint inhibitor antibody drugs.

This collaboration is similar to the license in transaction announced today, but Junshi Biotechnology has shifted from a licensor to an authorized party, increasing its clinical and preclinical pipeline reserves. Furthermore, with the improved accessibility of approved products and indications included in the national medical insurance catalog, Junshi Biotechnology's continuous enhancement of commercial hematopoietic capabilities has provided more confidence for expanding its research and development layout and achieving high efficiency.

Since its establishment, Junshi Biotechnology has developed over 50 investigational drugs, with nearly 30 investigational products in clinical trials and over 20 in preclinical development. At the same time, accelerating global integration, the San Francisco laboratory in the United States is conducting preliminary high-throughput antibody screening and further humanization, selection, and optimization; The Maryland laboratory uses a membrane receptor proteome library and a eukaryotic cell-based functional assay platform for screening new targets and evaluating and selecting antibody candidates.

2. Secondary trading of fusion protein pipeline

In this transaction, Junshi Biotechnology exempts disclosure of information related to the counterparty and the subject matter of the transaction, but mentions that the license agreement shall be governed by the laws of California and the United States. It is worth noting that this license agreement includes a limitation clause on rights protection - if the licensor grants third parties the right to develop, commercialize, manufacture, use, sell, import or export licensed products outside of Greater China based on the licensor's intellectual property or the sub license rights obtained from the company, the licensor may pay the company up to 20% of the sub license revenue or 200 million US dollars (whichever is lower).

This is not the first time Junshi Biology has expanded its fusion protein pipeline through acquisition.

On June 24, 2019, Junshi Biosciences entered into a share purchase agreement with Anwita Biosciences to subscribe for 2990162 Series A preferred shares (approximately 20% of the outstanding shares) for a cash consideration of $10 million. At the same time, both parties signed a license agreement to develop and commercialize Anwita's innovative IL-21 fusion protein AWT008 in Greater China (including mainland China, Taiwan, Macau, and Hong Kong). After the technology transfer, a cash payment of 2 million US dollars and subsequent milestone payments of up to 64.5 million US dollars will be made.

In March 2021, both parties signed the "B-series Preferred Stock Subscription Agreement" again, and Junshi Biotechnology contributed approximately 6.5 million US dollars to subscribe for 423212 B-series preferred shares issued by Anwita. After the completion of this subscription, Junshi Biotechnology holds a total of 19.53% equity in Anwita.

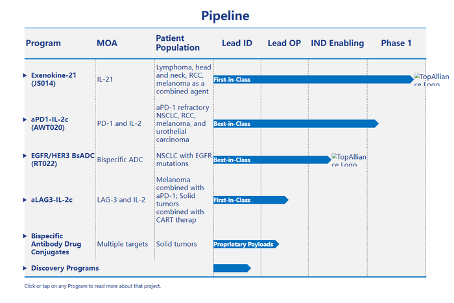

Pipelines of Anwita under development

In August 2021, Junshi Biotechnology's IL21 fusion protein JS014 (Exenokine-21) was approved for clinical use, becoming the first IL-21 fusion protein in China. According to the Zhizhiya New Drug Database, JS014 is currently undergoing Phase I clinical trials both domestically and internationally, with its original formula, Anwita, being the applicant for clinical trials abroad.

By editorRead more on

- The first subject has been dosed in the Phase I clinical trial of Yuandong Bio’s EP-0210 monoclonal antibody injection. February 10, 2026

- Clinical trial of recombinant herpes zoster ZFA01 adjuvant vaccine (CHO cells) approved February 10, 2026

- Heyu Pharmaceuticals’ FGFR4 inhibitor ipagoglottinib has received Fast Track designation from the FDA for the treatment of advanced HCC patients with FGF19 overexpression who have been treated with ICIs and mTKIs. February 10, 2026

- Sanofi’s “Rilzabrutinib” has been recognized as a Breakthrough Therapy in the United States and an Orphan Drug in Japan, and has applied for marketing approval in China. February 10, 2026

- Domestically developed blockbuster ADC approved for new indication February 10, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.