-

Samsung Bioepis, J&J Ink Settlement and License Deal for Stelara Biosimilar

- Source: drugdu

- 130

- December 4, 2023

-

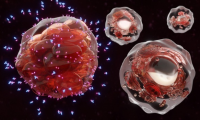

FDA to investigate risk of T-cell malignancy from CAR-T cell immunotherapies

- Source: drugdu

- 105

- December 4, 2023

-

FDA opens investigation into secondary cancer risk with CAR-T therapies

- Source: drugdu

- 98

- December 1, 2023

-

FDA Launches Probe of Malignancies Linked to CAR-T Therapies

- Source: drugdu

- 114

- November 30, 2023

-

FDA investigates ‘serious risk’ of secondary cancer following CAR-T treatment

- Source: drugdu

- 229

- November 30, 2023

-

Alkermes Spins Off Oncology Business with $275M to Focus on Neuroscience

- Source: drugdu

- 127

- November 17, 2023

-

GSK’s momelotinib recommended by CHMP to treat myelofibrosis patients with anaemia

- Source: drugdu

- 98

- November 15, 2023

-

HHS Considers Removing J&J’s Stelara from Medicare Drug Price Negotiations

- Source: drugdu

- 114

- November 9, 2023

-

Sangamo tightens the belt, cutting staff and assets to advance product pipeline

- Source: drugdu

- 183

- November 5, 2023

-

Royalty Boosts Struggling PTC with Additional $1B for Royalties on Roche’s Evrysdi

- Source: Kate Goodwin

- 120

- October 21, 2023

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.