China’s Import and Export Report of Surgical Instruments

September 15, 2017

Source: Ddu

4,147

4,147

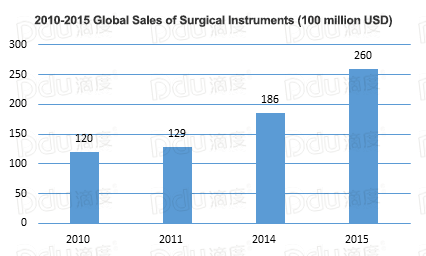

According to a global statistics report on medical devices, the global surgical instruments market has witnessed a drastic growth spurt in the past 8 years. In 2010, global sales of surgical instruments reached 12 billion USD, 12.9 billion USD in 2011 and 18.6 billion USD in 2014.

Since the advent of more and more new surgical instruments, global sales have rocked 26 million USD dollars by the year 2015.

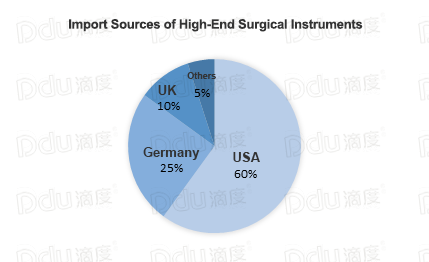

Developed counties have taken a prominent position in the surgical instruments market with the USA coming out on top, taking up 60% of global shares. They were followed by Europe accounting for 25%. However, China, India, Russia, and South Africa together merely took up 10% while other counties and regions accounted for the remaining 5%.

Today, Ddu, the leading global pharmaceutical & medical device B2B online platform, brings you the all the market details with our comprehensive import and export report on surgical instruments.

1. Competition is fierce in the industry with anincreasing number of domestic surgical instrument companies.

In recent years, domestic surgical instrument companies have improved the quality of their products extensively and gradually began to produce medium and high-end products rather than the low quality product which was produced in the past. In addition to meeting domestic needs for basic surgical instruments, they also developed a variety of specialized surgical instruments for microsurgery, neurosurgery, cardiothoracic surgery and so forth.

According to statistics from the China Association for Medical Devices Industry (CAMDI), there are over 100 companies engaged in the production of surgical operating instruments.

These companies include: Shanghai Surgical Instrument Factory, a company with a long and rich history, SHINVA Medical Instrument, a foreign joint-venture with AESCULAP, Suzhou 6 6 Vision who specializes in microsurgical instrument and Huibo Surgical Instrument, located in Changzhou, China.

Some of these companies focus on a specialized field but in general, most of them are still trying to expand their markets, taking advantage of low production costs.

2. High-end products are mainly imported.

At present, most surgical instruments in China are imported from the USA, Germany and the UK.

The main import brands are:

BOSS (USA),

Scanlan International (USA),

Geister (Germany),

LANDANGER (France),

PRIMA (Germany),

TUMED (Germany)

AESCULAP (Germany)

All of them are well-known in domestic market for their high quality, excellent design and exquisite craftsmanship which justifies they high price.

The main imported products are:

Ophthalmic surgical instrument,

Obstetrics and gynecology equipment,

Oral surgery equipment,

Rhinitis equipment,

Urinary tract equipment

Cardiovascular surgery equipment

3. With a steady increase in exports, some companies gained international recognition.

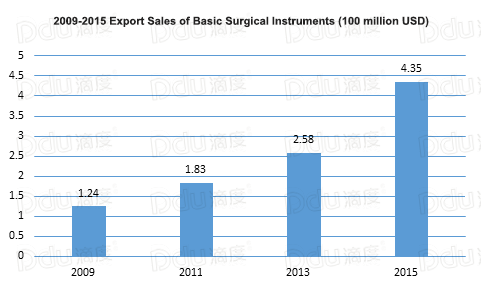

There is no doubt that basic surgical instrument are in great demand. In the past decade, export sales of basic surgical instrument manufactured in China have been on steadily on the rise due to their low prices, mainly being exported to Europe, Asia and North America.

According to the statistics of China customs, export sales for basic surgical instruments manufactured in China, totaled 124 million USD in 2009, 183 million USD in 2011 ,258 million USD in 2013 and 435 million USD in 2015.

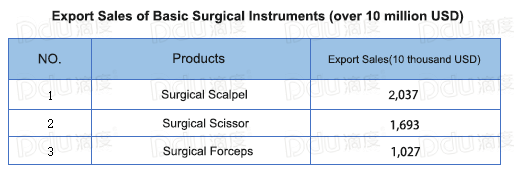

Basic surgical instrument with over 10 thousand USD in export sales are surgical scalpels, surgical scissors and surgical forceps.

There are various domestic companies in this field who attach great importance to scientific research and their products have gained a international recognition as a result. SHINVA, for example, with their joint venture with AESCULAP, have become well-known for their specialized equipment, making their mark and gaining clients in flieds such neurosurgery and cardiothoracic surgery.

4. Thailand and Vietnam are expected to become China's hot market.

In recent years, with the development of Southeast Asian economies, the governments of both Thailand and Vietnam have prepared sufficient funds to invest in medical and health care services, which is a promising aspect for the local medical device market. The local medical device industry is still underdeveloped though, giving foreign traders ample opportunity to improve the situation.

The market sales for Vietnam currently stand at 400 million USD (similar to Singapore) of which import sales took up 60% to 65%. Japan, the USA and EU countries accounted for about 40% of Thailand's medical device imports while China accounted for 10% to 12%. Thailand mainly imports medium and low-end medical devices and China just can meet its demand with obvious advantages on production capacity and product price.

According to foreign media reports, Vietnam's total imports of medical equipment was only 80 million USD in 2015, of which the United States accounted for 45% of the share and Japan and Germany, accounted for 15% and 8% respectively. China however accounted for less than 10%. In fact, statistic Vietnam prefers to import medical devices from USA, Japan and Germany to China because the the adoption of governments’ gifts and installment payment of developed countries encourages Vietnam to import products from them and as a result, taking more share than China does.

After careful consideration and analysis, Ddu’s recommendation is to keep these countries in mind, look for opportunities as these they

continue to increase the intensity of expanding markets.

This article is from DduNews, only for non-commercial use and reproduction. Please indicate the source when distributed.

By Ddu

Read more on

- China’s Import and Export Market Report of Vitamins August 26, 2021

- China’s Import and Export Market Report of Rheumatoid Arthritis Drugs August 26, 2021

- How to Select Basic Surgical Instruments | Drugdu.com August 7, 2018

- What’s Driving the Global Surgical Robotics Market February 26, 2018

- Ddu College–China’s Import and Export Market Report of Antiallergic Drugs December 1, 2017

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.