Global Hemodialysis Consumables Market Analysis

June 24, 2017

Source: Ddu

847

847

As the most potential market in china, Hemodialysis market appears a large revenue space. With the opening of private hemodialysis services, private economy in the hemodialysis industry is about to take a ”Golden era”.

So, what is the current status of hemodialysis consumables market in China? How is the import and export situation? Now Ddu will introduct the potential hemodialysis consumables market to you.

Domestic status - domestic brands gradually replace foreign brands

Hemodialysis is one type of renal replacement therapy for people who have acute or chronic kidney disease. Hemodialysis consumables include dialyzer, blood tube, puncture needle, dialysate, catheter, etc.

In China, the number of patients with end stage renal disease is nearly 2 million. It costs 70,000 RMB annually for one patient, which shows the market size of 100 billion RMB. However, only 300,000 patients are receiving dialysis treatment. The treatment rates is lower than 15%. There are many opportunities in hemodialysis consumables market.

Meanwhile, China's hemodialysis consumables market is facing the transformation from foreign brands to domestic brands. With the improvement of domestic technology, China's hemodialysis consumables market is expected to gradually reduce dependency on foreign countries.

Import market: Europe and Japan are the main sources of imports

In 2014, China's imports of hemodialysis consumables amount to $191 million. Due to the factors of national preferential policies, import substitutions and so on, China's imports of hemodialysis consumables decreased by 8.39%.

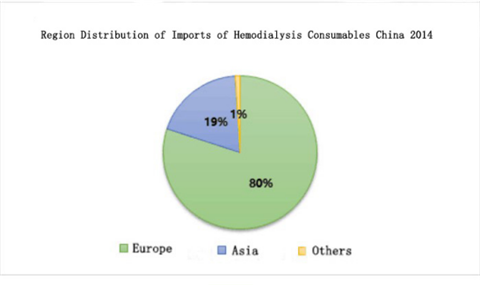

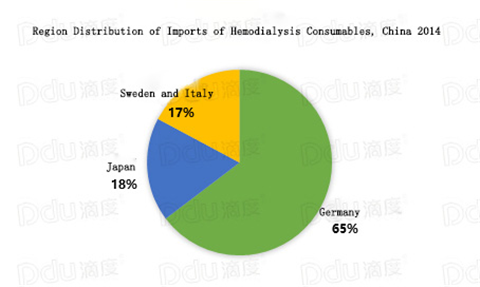

Geographically, China mainly imports hemodialysis consumables from Europe and Japan, accounting for 99%. As for source of imports, the 4 main countries are Germany, Japan, Sweden and Italy.

As of trade model, the main forms of import are general trade and bonded warehouse entrepot trade. General trade import volume has fallen 3.01% to 103 million dollars, accounting for 53.74%. The import volume of bonded warehouse entrepot trade has fallen 14.50% to 87.12 million dollars, accounting for 45.57%.

In 2014, There are 31 enterprises importing hemodialysis consumables. The top five are Fresenius Medical Care (Shanghai) Co., Ltd., B.Braun Avitum (Shanghai) Trading Co.,Ltd., Gambro Medical Products (Shanghai) Co., Ltd., Weigao Nikkiso(weihai)dialysis equipment co.,ltd, Shanghai Machinery Complete Equipment(Group) Corp.,Ltd.

Export market: Hongkong and Taiwan are the largest export destinations

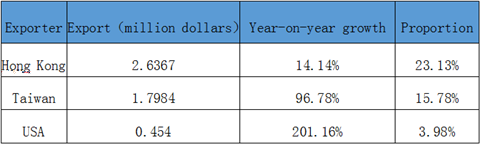

In 2014, China’s export of hemodialysis consumables has reached, 11.4 million dollars representing an increase of 63.31% comparing to 2013. From the export destination, due to new market and the influence of producers immigration from Taiwan to Mainland China, Hongkong and Taiwan became the China's largest hemodialysis consumables export destination. Details are as follows:

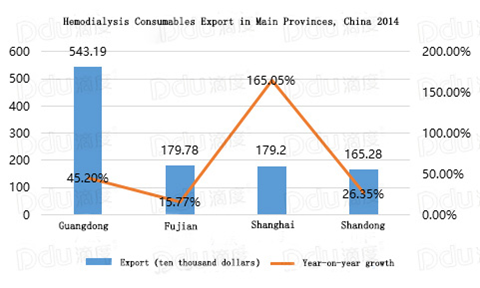

As for the domestic export area, there are 11 provinces and municipalities exporting hemodialysis consumables while the main areas are Guangdong, Fujian, Shanghai and Shandong. The specific export situation is as follows:

Because of the great potential of Chinese hemodialysis market, many listed companies have involved in the field of dialysis. Peritoneal dialysis product of Huaren Pharmaceutical Co., Ltd have already come in the market since the the third quarter of 2012. Biolight plans to get into hemodialysis market through the acquisition of Tianjin Zhixin Hongda Medical Instrument Development Co.,Ltd. Biolight has also got the registration certificate of dialysis machine medical device through the acquisition of Chongqing Duotai medical Equipment Co. Ltd; Kelun got into hemodialysis market through additional capital into Qingshan LiKang.

Future prospects: the Asian, African and Latin American market have great potential

For a long time, China's dialysis equipment and consumable markets are mainly and monopoly dominated by Europe, USA and Japan. However, the competitiveness of domestic enterprises is relatively weak, mainly due to the late start, the weak power of science and technology , lack of core competitiveness of products. In high value equipment, there is still a gap in stability, effectiveness and safety when comparing with international brands on the.

Fortunately, there is a compound increase rate in China’s hemodialysis products export market, amounting to 24%, with a particularly rapid uptake in the past 5 years. Some domestic products is equal to those from abroad (Dialysis pipeline, dialysis powder, dialysis water treatment system). Although seldom products could replace imported ones, there is a clear trend for the replacement of imported products in dialysis equipment.

Asian, Africa and Latin America are the high-prevalence areas of the end-stage renal disease. But hemodialysis treatment rate is far lower than the United States, Japan and other developed countries. With the wide application of hemodialysis technology in clinic, third world countries will become the new direction for Chinese hemodialysis consumables enterprises to explore the international market.

By editor

Read more on

- China’s Import and Export Market Report of Vitamins August 26, 2021

- China’s Import and Export Market Report of Rheumatoid Arthritis Drugs August 26, 2021

- What’s Driving the Global Surgical Robotics Market February 26, 2018

- Ddu College–China’s Import and Export Market Report of Antiallergic Drugs December 1, 2017

- Brief Report on Exports of Chinese Vaccines in the First Three Quarters of 2017 November 27, 2017

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.