Eli Lilly claims that Tilpotide is more effective than Smeaglutide

December 7, 2024

Source: drugdu

780

780

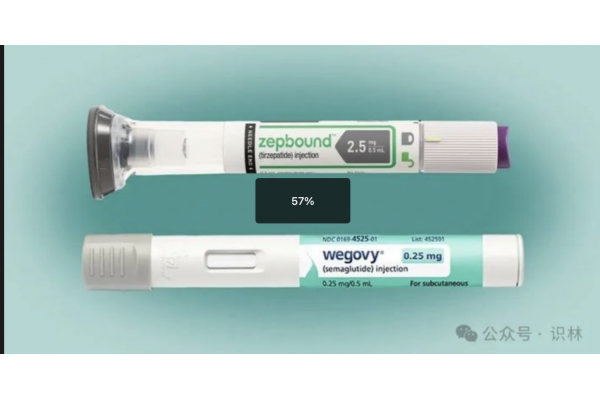

Lilly stated in a press release on December 4th that in a head to head randomized controlled trial, its weight loss drug Zepbound was more effective in weight loss than its competitor Novo Nordisk's Wegovy.

This result is not surprising for scientists and doctors who are closely monitoring the rise of glucagon like peptide-1 (GLP-1) weight loss drugs. This randomized controlled trial also reflects the results of diabetes drugs from the two companies. These drugs use the same active ingredients and are sold under the brands of Mounjaro and Ozempic respectively. Similar results have been observed in observational studies and previous clinical trials comparing drugs with placebos separately.

However, recording the differences between Zepbound and Wegovy in a rigorous manner is still an important step, especially as such a comparison may allow Lilly to claim in marketing that Zepbound has better therapeutic effects. This can help Lilly win market share in competition with Novo Nordisk.

The study recruited 751 volunteers in the United States who were either obese or overweight and may have complications caused by overweight, including a history of diabetes, depression or pancreatitis. They were randomly selected to receive either the highest tolerated dose of Zepbound (10 mg or 15 mg) or Wegovy (1.7 mg or 2.4 mg).

At the end of 72 weeks, volunteers receiving Zepbound treatment lost an average of 20.2% weight, while volunteers receiving Wegovy treatment lost an average of 13.7% weight. This means that participants using Zebound lost an average of 22.8 kilograms, while those using Wegovy lost an average of 15.0 kilograms.

Leonard C. Glass, Senior Vice President of Eli Lilly, said in a statement, "Given the increasing interest in weight loss drugs, we conducted this study to help doctors and patients make informed decisions about treatment options.

Both tilboptin and semaglutide act by binding to GLP-1 receptors, but tilboptin also triggers receptors targeted by gastric inhibitory peptide (GIP), which may explain its additional therapeutic effects.

Lilly did not disclose the latest details about the side effects of these drugs, but both of them can cause some side effects, including nausea, diarrhea, constipation, and vomiting, which can sometimes be controlled by slowly increasing the drug dosage.

A key question facing doctors is whether both groups in this randomized study adjusted their doses at the same pace; The slower the dose change, the fewer side effects, but the faster the increase, the better the therapeutic effect may be.

However, the results were generally in line with expectations. The comparison between Zepbound and the placebo included in the drug instructions shows that at the highest dose, the drug can reduce body weight by 12% to 18% after 72 weeks. A study on Wegovy showed that compared to placebo, the drug can reduce body weight by 11%. A recent observational study also showed that patients taking tilboptide lost more weight.

A key issue facing Lilly is how regulatory agencies will handle this data. In the field of diabetes, Lilly's Mounjaro's packaging manual does contain data on head to head research with Ozempic. If these data are included in a similar way in Zepbound tags, it will allow Lilly to use this information in marketing to doctors and patients, becoming an advantage of Zepbound. Ozempic was approved in 2017, five years earlier than Zepbound, and Zepbound can take advantage of this when the Ozempic brand name has become ubiquitous.

In the third quarter of 2024, Zepbound generated $1.3 billion in revenue, in addition to Mounjaro's sales of $3.1 billion. In the same quarter, Wegovy generated $2.4 billion in revenue, while Ozempic generated approximately $4.2 billion in revenue.

The enduring interest of people in these drugs has made their producers one of the most valuable companies in the world, with Eli Lilly's market value of $772 billion and Novo Nordisk's market value of $375 billion.

Source: https://pharm.jgvogel.cn/c1468341.shtml

By editor

Read more on

- Shanghai Pharmaceuticals’ Rivaroxaban Tablets Receive Singapore Drug Registration Certificate February 27, 2026

- Boehringer Ingelheim’s “Zonartinib” Receives FDA Approval for Treatment-naïve NSCLC February 27, 2026

- Marketing application for recombinant anti-IL-4Rα humanized monoclonal antibody injection accepted February 27, 2026

- Genrix Bio’s marketing application for talicibazine injection for the treatment of adult seasonal allergic rhinitis has been accepted. February 27, 2026

- 13.8 billion! Leading domestic imaging equipment manufacturer sees significant revenue growth. February 27, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.