China’s Import and Export Market of Obstetrics and Gynecology Equipment

September 20, 2017

Source: Ddu

1,578

1,578

Development of technology over the past couple of decades has led to societal and cultural development which in turn has resulted in awareness of issues such as the importance of women’s health. With vast improvements taking place in this field, obstetrics and gynecology equipment has experienced major changes.

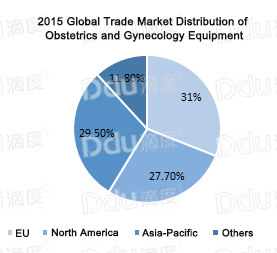

The EU remains to be the world's largest gynecological equipment market. In 2015, the market size was 44.64 billion USD, accounting for 31% of the global market scale; the North American market size was 39.89 billion USD, accounting for 27.7% of the global market scale and the Asia-Pacific market size was 42.482 billion USD, accounting for 29.5% of the global market scale.

Ddu now brings you the breakdown with our China’s Import and Export Market Report on Obstetrics and Gynecology Equipment.

Ⅰ.Great demand for domestic infrastructure and large profits for high-end equipment

Data Source: CAMDI

With the implementation of China’s two-child policy, the gynecological equipment market demand has experienced substantial growth with an annual increase rate of 10-15% in 2015 and a market size exceeding 10.8 billion USD. It’s estimated that total sales will reach 15 billion USD by 2021.

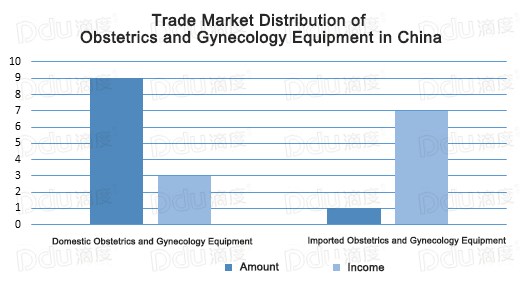

At present, obstetrics and gynecology equipment in China is both domestically-made and imported.

Domestic infrastructures have thus far been able to meet the needs of the local market in terms of technical quality and material and prices are comparatively lower than that of foreign brands, resulting in a greater demand for locally manufactured products than for imported ones. Even though the demand for foreign brands is relatively small, they took up a large amount of market shares due to their high quality.

According to a survey by the China Association for Medical Devices Industry, the number of domestic brands versus that of foreign brands used in the Chinese market is conservatively estimated to be 9 to 1. The sales revenue of domestic brands versus foreign brands is estimated to be 3 to 7 with the total sales revenue of domestic products being 3.24 billion USD while foreign products stand at 7.56 billion USD, clearly demonstrating how high-end equipment took a prominent position in the market.

Ⅱ. Foreign brands in the domestic market

The excellent quality, design stability and technology of foreign brands justify their high price and allows for a footholds in the international market. .

The top foreign brands to enter the Chinese obstetrics and gynecology market are as follows:

General Electric(GE): Owned by General Electric, GE Healthcare is one of the biggest medical devices company in the world, taking a prominent position with its leading technology in the patient care and monitoring, imaging, information providing and other medical fields. (ge.com)

Draeger Medical Equipment Co., Ltd(Draeger): Dräger is an international leader in the fields of medical and safety technology and one of the world’s leading medical device manufacturers. (draeger.com)

Japan Astro Group Medical Co., Ltd(Atom): Atom produced Japan's first modern baby incubator.

Ⅲ. A prosperous market with increasing annual export sales.

There are over 100 Chinese obstetrics and gynecology companies including Benran Tiandi Medical Technology (Beijing) Co. Ltd and Jiangsu Sanwe Medical Science and Technology Co. Ltd, who have had early access to the international markets and received recognition from global partners and Shanghai Hutong Electronics Co. Ltd, one of the most famous and best-selling brands in China.

These enterprises have gained international market shares and achieved scalable development of the products with slight competitive advantage over other companies who are still expanding their market with low prices and cost advantages.

At present, China mainly exports obstetrics and gynecology equipment to Europe, Asia and the Americas with the main export products being labor analgesias, gynecology leep knives and uterine cavity operation monitoring systems.

With the development of China’s obstetrics and gynecology equipment which occurred between 2010 and 2015, it’s clear to see that the rise of enterprises in this field resulted in a significant increase of exports and China’s market prospects look brighter than ever.

IV. Standard of market access of export countries

According to the statistics from the Chinese Ministry of Health, the number of gynecological inpatients of China in 2015 totaled 20 million. China's gynecological equipment market demand is also on the rise with an increasing admission rate of gynecology and obstetrics.

Due to the fact that they are key products related to the life and health of newborns, the Chinese government should not only strictly review the enterprises engaged in this industry and establish a unified management and market-access system, but should also follow up on the development of technology and revision of standards, to enhance the credibility of new research and to regulate the market.

In addition to this, Ddu also suggests that enterprises research and learn all they can about the relevant laws, regulation and correct management methods of medical devices in importing countries before they attempt to launch their products in the international market. This is due to the rigid regulations and management on market access for medical devices in every country which includes CE certification of the EU, FDA registration of the USA and JIS certification of Japan. Knowledge is power and gaining access to these markets equates a giant leap into international markets.

This article is from DduNews, only for non-commercial use and reproduction. Please indicate the source when distributed.

By DduRead more on

- China’s Import and Export Market Report of Vitamins August 26, 2021

- China’s Import and Export Market Report of Rheumatoid Arthritis Drugs August 26, 2021

- What’s Driving the Global Surgical Robotics Market February 26, 2018

- Ddu College–China’s Import and Export Market Report of Antiallergic Drugs December 1, 2017

- Brief Report on Exports of Chinese Vaccines in the First Three Quarters of 2017 November 27, 2017

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.