Vivos receives FDA 510(k) clearance for oral devices to treat severe sleep apnea

December 2, 2023

Source: drugdu

404

404

Dive Brief

Vivos Therapeutics has received 510(k) clearance for the use of its oral devices in adults with severe obstructive sleep apnea (OSA).

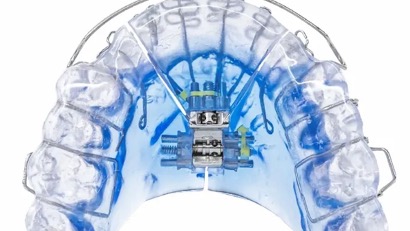

The Food and Drug Administration ruling, which comes 11 months after Vivos received clearance for an oral appliance in mild-to-moderate OSA, gives the green light to an application that was previously only possible off-label. The company’s trio of devices, called Complete Airway Repositioning and/or Expansion (CARE) oral appliances, include the DNA, mRNA and mmRNA products.

Vivos’ share price increased nearly 834% to $41 when the market closed on Wednesday. The medtech company’s market capitalization was approximately $30.8 million even after the latest jump in its stock, according to Nasdaq.

Dive Insight

Vivos sells a set of airway repositioning and expansion devices for treating dentofacial abnormalities and OSA. The company has worked to add clearances to use more of the devices in the treatment of OSA, winning a 510(k) nod for its daytime-nighttime appliance, called DNA, at the end of 2022. The 510(k) decision provided regulatory authorization for an application that Vivos knew dentists may pursue off-label.

The recent clearance in severe OSA positions Vivos to market its airway repositioning and expansion devices, including DNA, as an alternative to continuous positive airway pressure machines and neurostimulation implants. The FDA’s decision also comes amid uncertainty for the sleep apnea market following the Philips recall of over 15 million respiratory devices and ongoing safety problems with some of its CPAP products.

Vivos CEO Kirk Huntsman said in a statement that the company believes the clearance will help its position with third-party distributors, like durable medical equipment providers.

“This approval could also clear the way for greater reimbursement levels from medical insurance payors and Medicare,” Huntsman said. “We believe that all these factors should favorably impact our ability to grow our revenues in 2024 and beyond.”

Vivos’ revenues fell to $3.3 million in the third quarter, down from $4.2 million in the prior year’s quarter. Talking to investors on a recent quarterly results conference call, Huntsman attributed the decline to “cost-cutting measures [that] came with some near-term trade-offs.” The layoffs and other cuts reduced operating expenses by 32% to help Vivos reach its goal of being cash flow positive by the end of next year.

The company’s stock price growth slowed Thursday morning, declining by 36% to $26.20 after the market opened.

Source:

https://www.medtechdive.com/news/vivos-receives-fda-510k-clearance-for-oral-devices-to-treat-severe-sleep/701092/

Read more on

- Anglikang Adenosylcobalamin Capsules Obtain Drug Registration Certificate March 6, 2026

- Two Minoxidil Topical Solution Applications from its Subsidiary Approved March 6, 2026

- Zhejiang Medicine’s ARX305 Initiates Phase II Clinical Trial March 6, 2026

- Indacaterol Mometasone Inhalation Powder Clinical Trial Approved for Asthma Treatment March 6, 2026

- Harsco Pharmaceutical’s innovative drug HSK50042 tablets receive clinical approval for a new indication March 6, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.