The 10 billion-dollar ankylosing spondylitis market is undergoing a transformation

May 8, 2025

Source: drugdu

232

232

In January, Zhixiang Jintai's Celicizumab Injection was approved for a new indication, becoming the first domestically produced IL-17A inhibitor approved for the AS indication in China; in March, Hengrui Medicine's JAK1 inhibitor Amacitinib Tablets were approved for marketing, with ankylosing spondylitis as the first indication; then in April, another product of Hengrui Medicine - Fulanixzumab Injection became the second domestically produced IL-17A inhibitor approved for AS.

In January, Zhixiang Jintai's Celicizumab Injection was approved for a new indication, becoming the first domestically produced IL-17A inhibitor approved for the AS indication in China; in March, Hengrui Medicine's JAK1 inhibitor Amacitinib Tablets were approved for marketing, with ankylosing spondylitis as the first indication; then in April, another product of Hengrui Medicine - Fulanixzumab Injection became the second domestically produced IL-17A inhibitor approved for AS.

The strong breakthrough of domestic innovative drugs represented by Hengrui Medicine has not only broken the long-term monopoly of similar imported drugs and provided Chinese AS patients with new treatment options, but also marked the transformation of domestic innovative drugs from "followers" to "game changers", injecting new vitality into the tens of billions of AS drug treatment market.

Billion-dollar drug treatment market

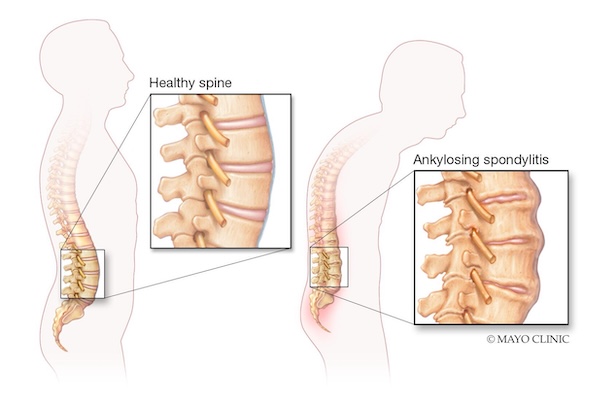

Ankylosing spondylitis is a disease caused by autoimmune disorders that causes chronic inflammation of the joints of the body, mainly damaging the sacroiliac joints and spine, and causing stiffness and pain in other parts of the body. If not treated in time, it can also lead to joint fusion and spinal rigidity, affecting organs such as the eyes, heart, lungs, and stomach.

The treatment of ankylosing spondylitis is divided into surgical treatment and drug treatment. Drug treatment is the main treatment for early AS. Thanks to the continuous advancement of medical technology, the overall market size of AS drugs in my country has grown steadily. Data shows that from 2014 to 2022, the market size will increase from 7.064 billion yuan to 11.655 billion yuan, with an annual compound growth rate of 6.2%.

However, due to the complex pathological mechanism of ankylosing spondylitis, it is difficult to treat AS with a single method. Before the advent of biological drugs, the treatment of AS remained at the "symptom relief" stage for a long time, mainly relying on three types of drugs:

Nonsteroidal anti-inflammatory drugs (NSAIDs) are first-line drugs. They inhibit cyclooxygenase (COX) activity and reduce prostaglandin synthesis, thereby quickly relieving pain and morning stiffness. Representative drugs include diclofenac and celecoxib, and early symptoms of about 70% of patients can be controlled. However, this type of drug can only relieve symptoms, but cannot prevent bone destruction and disease progression. Long-term use may also cause side effects such as gastrointestinal bleeding and cardiovascular events.

Sulfasalazine (DMARD) is a traditional anti-rheumatic drug. It can be decomposed into 5-aminosalicylic acid in the intestine to play an anti-inflammatory and immunosuppressive role. It is widely used in clinical practice, especially for patients with peripheral synovitis symptoms. Sulfasalazine is generally used for medication. However, the drug has a slow effect and the efficacy is not satisfactory.

Glucocorticoids (such as prednisone) can quickly relieve symptoms during acute inflammation, but their systemic side effects (such as osteoporosis and metabolic disorders) limit their long-term use. Guidelines clearly recommend avoiding systemic use and only using them for short periods of time when injected into local joints.

Overall, traditional therapeutic drugs are inexpensive and constitute the "cornerstone" of early treatment, but they have obvious shortcomings in the depth of disease control and long-term prognosis, which also leaves ample room for the research and development of innovative drugs and market expansion.

Targeted drugs reshape the treatment paradigm

In recent years, the treatment of ankylosing spondylitis has seen revolutionary breakthroughs. Targeted innovative therapies represented by biologics and targeted small molecule drugs have gradually replaced the "symptomatic treatment" model of traditional drugs. This change not only significantly improved the quality of life of patients, but also promoted the reconstruction of the tens of billions of market structure.

As the first generation of biological agents, TNF-α inhibitors can quickly relieve pain and inhibit bone erosion by neutralizing TNF-α activity, with a clinical remission rate of 60%-70%. AbbVie's adalimumab (Humira), as a benchmark in this field, has accumulated global sales of more than US$200 billion since its approval in 2002. It has been the "king of medicine" for 11 consecutive years. Even in 2024, when biosimilars are appearing in large numbers, it still achieved sales of US$8.99 billion.

As a key cytokine mediating bone destruction in AS, IL-17A has become an important breakthrough in the new generation of targeted therapy. Several clinical studies have shown that IL-17 inhibitors can effectively reduce inflammatory damage and fat deposition at the edges of patients' vertebrae, inhibit the formation of new osteophytes and delay imaging progression. Compared with TNF-α, IL-17A is highly involved in the occurrence and development of AS inflammation. Inhibiting IL-17A can provide patients with more direct and extensive therapeutic benefits. Secukinumab is the world's first IL-17A inhibitor to be marketed. It was approved for AS indications in China in 2020. Its global sales will reach US$6.141 billion in 2024, a year-on-year increase of 25%.

At the same time, small molecule drugs represented by JAK inhibitors have become an important supplement to biological agents with their core advantage of oral administration. Studies have shown that JAK inhibitors can directly block multiple cytokine pathway signals related to the onset of spondyloarthritis, and are very promising in the treatment of AS. Pfizer's tofacitinib and AbbVie's upadacitinib have been approved for AS indications in China, with upadacitinib's global sales reaching US$5.971 billion in 2024, a year-on-year increase of 50.4%.

In addition to the approved therapies, innovative exploration in the field of AS treatment continues to be active. New mechanism drugs such as IL-23 inhibitors and PDE4 inhibitors have entered the clinical research stage, and cutting-edge directions such as bispecific antibodies, stem cell transplantation, and gene editing technology also provide new paths to overcome refractory AS. These therapies, together with biological agents and small molecule targeted drugs, have built a diversified treatment system, and the accelerated launch of domestically produced innovative drugs has injected new momentum into the reconstruction of the tens of billions of market.

The rise of domestic innovative drugs

China's ankylosing spondylitis drug market is undergoing a localization transformation. In the past decade, domestic pharmaceutical companies have gradually broken the import monopoly by taking biosimilars as the entry point, and the intensive approval of domestic innovative drugs in 2025 marks that this field has officially entered the era of "independent innovation".

Since Biote's Gleoli was approved for marketing in November 2019, the number of domestic adalimumab biosimilars has increased to 7, all of which cover AS indications. The launch of domestic biosimilars has significantly lowered the threshold for AS treatment: after medical insurance reimbursement for the original drug Humira, the first-year and maintenance treatment costs are still more than 30,000 yuan, while domestic adalimumab such as Gleoli, Handayuan, and Sulixin, through assistance programs and other means, the first-year cost and annual maintenance costs are only about 15,000 yuan. As biosimilars/generic drugs of blockbuster products such as secukinumab and upadacitinib enter Phase III clinical trials, coupled with the advancement of the centralized procurement policy for biosimilars, domestic pharmaceutical companies are accelerating their penetration into the AS drug market at an alarming rate.

What truly rewrites the market landscape is the technological breakthrough of domestically produced innovative drugs. Zhixiang Jintai's Celici monoclonal antibody uses dual-carrier phage platform technology to stabilize drug molecules, prolong the duration of efficacy and reduce the frequency of dosing, providing patients with a more convenient treatment option. Hengrui Medicine's Fulanixzumab adopts a humanized antibody structure. Compared with the approved secukinumab and ixekizumab, it has a higher affinity for IL-17A, can more efficiently block the IL-17A/IL-17R signaling pathway, and enhance the bone destruction inhibition effect. Its JAK1 inhibitor, emacitinib, introduces a unique pharmacophore structure combination to act more precisely on JAK1, with significantly lower inhibitory effects on JAK2 and JAK3, significantly reducing adverse reactions of the hematopoietic system such as anemia and thrombocytopenia, and providing protection for the safety of long-term medication.

The "next-generation therapies" in the pipeline under development demonstrate the forward-looking layout of Chinese pharmaceutical companies. XKH004, jointly developed by Livzon Pharmaceutical and Xinkanghe Bio, is the fastest-progressing domestically produced IL-17A/F dual antibody that blocks two pro-inflammatory factors at the same time. Phase III clinical results show the best therapeutic potential in its class; Innovent Biologics' TYK2 inhibitor ICP-332 can reduce the side effects caused by inhibiting other JAK family members and is expected to become an oral small molecule drug to replace JAK1 inhibitors.

From biosimilars breaking down price barriers to innovative drugs achieving target breakthroughs, Chinese pharmaceutical companies are reshaping the ankylosing spondylitis treatment ecosystem at the "China speed". According to Frost & Sullivan's forecast, the scale of China's autoimmune drug market will reach US$24.7 billion in 2030, of which the share of domestic innovative drugs will exceed 50%, and the AS field may completely reverse the historical pattern of "imported drugs dominating".

https://news.yaozh.com/archive/45415.html

By editorRead more on

- Rovaxitinib approved for marketing, filling the demand for myelofibrosis treatment March 2, 2026

- Warrant Pharmaceuticals’ active pharmaceutical ingredient receives Brazil’s first official GMP certification March 2, 2026

- Merck’s New Story March 2, 2026

- Rongchang Biotechnology has turned a profit! March 2, 2026

- Jiuyuan Gene’s “Simeglucopyranoside” for weight loss (Jikeqin®) has been submitted for market approval March 2, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.