Point Bio Prostate Cancer Therapy Meets Phase 3 Goal, But Results Still Disappoint

December 20, 2023

Source: drugdu

381

381

Despite achieving its Phase 3 study's main goal, the results for Point Biopharma's therapy are short of what Novartis radiopharmaceutical Pluvicto achieved in a similarly designed clinical trial. Nevertheless, the data readout should clear the way for Eli Lilly to complete its $1.4 billion acquisition of Point.

By FRANK VINLUAN

A Point Biopharma Global cancer therapy key to a $1.4 billion Eli Lilly M&A deal has met the main goal of its pivotal clinical trial in prostate cancer. But the results raise questions about how well the drug will match up against a radiopharmaceutical marketed by Novartis.

A Point Biopharma Global cancer therapy key to a $1.4 billion Eli Lilly M&A deal has met the main goal of its pivotal clinical trial in prostate cancer. But the results raise questions about how well the drug will match up against a radiopharmaceutical marketed by Novartis.

The Point drug, PNT2002, is also a radiopharmaceutical. It offers targeted delivery of a radioactive particle by linking it to a ligand that targets PSMA, a protein abundant on the surface of prostate cancer cells.

The open-label Phase 3 study evaluated the Point radiopharmaceutical in patients with cases of prostate cancer that has progressed following treatment with an androgen receptor pathway inhibitor (ARPI), a type of prostate cancer therapy. A total of 412 patients were randomly assigned to receive the Point therapy or the ARPI drugs abiraterone or enzalutamide. The main goal is to assess radiographic progression-free survival (rPFS), which is a measure of the worsening of the cancer as shown by medical imaging. Those in the control arm whose disease progressed had the option to cross over to the other arm and receive the Point radiopharmaceutical.

According to Indianapolis-based Point, treatment with its therapy led to a median rPFS of 9.5 months compared to 6.0 months in the control arm. These preliminary results show the Point therapy led to a 29% reduction in the risk of radiographic progression or death, which is enough to be statistically significant. Point said at the time of the analysis, interim overall survival results were immature. The challenge for Point, and partner Lantheus, which has licensed global rights to the therapy, is how these data match up against Novartis’s Pluvicto.

The expectation was that the Point’s drug would provide efficacy comparable to Novartis’s therapy, but with potentially better safety and convenience, Leerink Partners analyst Faisal Khurshid wrote in a note sent to investors Monday. Cross-trial comparisons are tricky, but on the key efficacy measure of rPFS, the Point drug’s preliminary results are short of the 12 months achieved by Pluvicto in a similarly designed trial. On measures of safety, the preliminary data are limited, but Khurshid said PNT2002’s results do not appear to show meaningful improvement over Pluvicto. Khurshid described the results as “close to a worst-case scenario for PNT2002.” He added that the most likely explanation is that the radiation dose matters and the lower dose in the Point therapy compromised the efficacy results.

“We believe this data calls into question the commercial viability of PNT2002 given the availability of a superior product in Pluvicto,” he said.

Point and Lantheus said they expect to report additional follow-up data next year prior to the potential submission of a new drug application with the FDA. They added that the full Phase 3 results will be presented at a future scientific meeting .

In October, Lilly announced an deal to acquire Point in a deal that expands the pharmaceutical giant’s scope to radiopharmaceuticals. The company agreed to pay $12.50 for each Point share, which is a nearly 88% premium to the stock’s price prior to the acquisition announcement. Even though PNT2002’s rights belong to Lantheus, Lilly stands to gain other assets in the Point pipeline as well as its radiopharmaceutical R&D and manufacturing capabilities.

Completion of the acquisition requires the majority of Point’s shareholders to tender their shares in agreement with the deal. Here’s where the PNT2002 data are key. Some Point shareholders were banking on Phase 3 results showing the radiopharmaceutical beating Pluvicto, or at least showing it was comparable. Those expectations had some shareholders reportedly holding out in hopes that the Phase 3 data readout would justify a higher acquisition price. Khurshid said the results reported on Monday make those hopes likely to wash away. The next step is likely a Lilly deal close.

With less than 25% of Point shareholders having tendered their shares, Lilly earlier this month extended the expiration date of its offer to Dec. 15. On Monday, Lilly extended the offer again, giving shareholders until the close of business Friday to tender their shares.

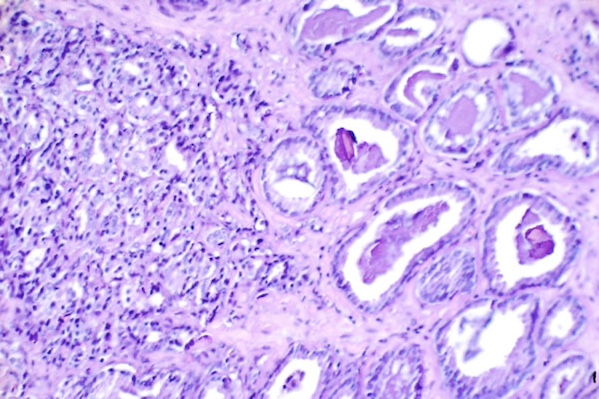

Public domain image by the National Cancer Institute

Read more on

- Gusekirumab Injection Accepted by CDE, Multiple Pipelines Advancing Simultaneously March 4, 2026

- Yifan Pharmaceutical’s teriparatide injection has been accepted by the CDE (Center for Drug Evaluation), adding a new domestic player to the osteoporosis treatment field March 4, 2026

- //news.yaozh.com/archive/47318.html PD-1 sales surge March 4, 2026

- A major breakthrough! Roche’s oral BTK inhibitor achieves its third Phase III clinical trial victory, a game-changer in the multi-billion dollar MS (manufactured pharmaceuticals) market. March 4, 2026

- GB19 Injection Approved for Clinical Trials of Cutaneous Lupus Erythematosus March 4, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.