Healthcare companies may turn to big banks after SVB’s fall

March 17, 2023

Source: drugdu

414

414

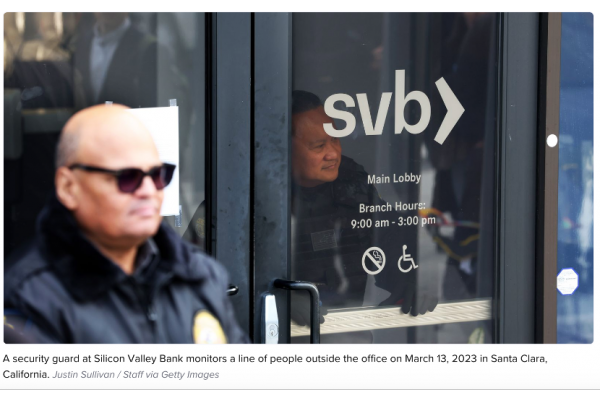

Healthcare startups may turn to traditional large banks and prioritize conserving cash after the collapse of regional lenders Silicon Valley Bank and Signature Bank last week.

The fall of SVB created a hole in the life sciences startup sector, locking out funds temporarily for some companies and cutting off a source of short-term cash for healthcare startups.

A major bank and lender for healthcare companies, SVB last year had clients in nearly half of U.S. venture-backed technology and life sciences companies.

“At this very moment, I think most of the companies are flying to safety, to the big banks,” said Ian Chiang, partner at healthcare investing company Flare Capital, “Perhaps it’s a little bit of a knee-jerk reaction to see what would happen.”

However, companies may still deposit with regional banks, depending on size. Healthcare unicorns, meaning companies with valuations exceeding $1 billion, are likely not going to be able to have multiple bank accounts with enough to keep everything under the $250,000 Federal Deposit Insurance Corp. insured limit, Chiang said.

Earlier stage companies may still tend to work with regional banks, as long as they keep deposits under the FDIC insured limit, he added.

Outlets like the Financial Times reported Monday that large banks, including JPMorgan Chase, Citigroup and Bank of America, were being inundated by fund transfer requests from smaller lenders. To compensate for demand, the banks were shortening their allocated waiting periods, with Citi’s private banking division attempting to open accounts within a day of application, compared to usual turnaround times of one to two weeks.

But migrating to large banks could hamper access to quick, short-term cash for healthcare companies. Regional banks, like SVB, can serve as reliable bridges for short-term cash needs for companies. And those loans are generally much harder to get at big banks, said Bill Evans, founder and CEO of Rock Health.

It’s also unclear if larger lenders, including the so-called Big Four banks, would want to do smaller venture-capital backed deals that would traditionally be done through regional banks, said Brad Haller, partner at consulting company West Monroe’s mergers and acquisitions division.

“I think that’s going to be the longer term effect of this, that fewer deals are going to be getting done, fewer VCs are going to be getting the capital that they need, and ultimately [it’s] going to impact innovation,” Haller said.

The uncertainty around banking comes as funding in the healthcare sector has dropped this year, compared to pandemic-driven heights. Healthcare and biotech initial public offerings have stalled as well. In 2022, funding dropped to $15.3 billion from $29.1 billion the year previous.

For now, healthcare startups are focused on various ways to extend their cash runway amid an uncertain economic environment, Chiang said.

“I think more and more of the founders are going to focus on how to improve the efficiencies of their capital deployment, versus in the past where it’s the growth at all costs,” he said.

https://www.healthcaredive.com/news/fall-of-svb-hits-healthcare-sector-as-federal-regulators-step-in/644822/

By editorRead more on

- a full look at 15 blockbuster drugs. February 28, 2026

- EMA CHMP Recommends EU Approval of Henlius’ Pertuzumab Biosimilar HLX11 February 28, 2026

- Akeso Biopharma’s autoimmune pipeline reaches another milestone! Mandocizumab submits application for market approval, targeting a market worth tens of billions. February 28, 2026

- $2.1 billion! Novo Nordisk reaches new cooperation agreement February 28, 2026

- After Eli Lilly and Novo Nordisk, who most resembles the “Third Brother of Weight Loss”? February 28, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.