Challenging the “Cancer King”

December 11, 2024

Source: drugdu

288

288

Revolution Medicines recently announced that its pan-RAS inhibitor RMC-6236 has shown significant anti-tumor effects and good safety in the treatment of patients with pancreatic ductal adenocarcinoma (PDAC) who have undergone other treatments.

Revolution Medicines recently announced that its pan-RAS inhibitor RMC-6236 has shown significant anti-tumor effects and good safety in the treatment of patients with pancreatic ductal adenocarcinoma (PDAC) who have undergone other treatments.

The study results show that RMC-6236, as a single drug for second-line treatment, can improve the median progression-free survival (PFS) and overall survival (OS) of PDAC patients carrying RAS mutations. Among them, the overall survival of patients at 6 months The rate data are impressive: 100% for patients with KRAS G12X mutations and 97% for patients with any RAS mutation.

Pan-KRAS inhibitors have been making rapid progress, challenging the "king of cancers" pancreatic cancer.

The toughest target?

Pancreatic cancer is a malignant tumor with a high mortality rate, and RAS gene mutations have an important impact on the occurrence and development of pancreatic cancer. Data show that about 85% to 95% of pancreatic cancer patients have RAS mutations, especially KRAS mutations. KRAS mutations are not only common in pancreatic cancer, but are also high-frequency mutations in various gastrointestinal tumors such as colorectal cancer.

Specific to the type of KRAS mutation, about 91% of pancreatic cancer patients have KRAS G12 mutations, of which KRAS G12D accounts for about 40%, KRAS G12V accounts for about one-third, while KRAS G12 and KRAS G12C are relatively rare, accounting for about 1% each. KRAS is a type of GTP-binding protein that regulates its own activity and the opening and closing of downstream signaling pathways by binding to GTP and GDP and transitioning between activation and inactivation states, thereby completing signal transduction. When cancer occurs, mutations in the G12D gene lead to continued activation of downstream signals, promoting cancer cell proliferation and survival.

However, KRAS was once an "undruggable target" because the KRAS protein is small in size, has a smooth surface, and has almost no pockets suitable for small molecule binding. Fortunately, KRAS G12C became the first KRAS mutation to be successfully targeted due to its binding pocket that facilitates targeting. This breakthrough laid the foundation for subsequent research on other KRAS mutations.

The world's first approved KRAS G12C inhibitors are Amgen's Sotorasib and BMS's Adagrasib, both of which are recommended by guidelines as second-line treatment options for patients with stage IV KRAS G12C mutated NSCLC. first-line treatment options, but neither drug has yet been approved in China. Since the beginning of this year, two domestically produced KRAS G12C inhibitors have been approved for marketing, namely Innovent/Jinfang Pharmaceutical’s fluzerecet and Chia Tai Tianqing/Yifang Biotech’s gluzorexide.

Since the four KRAS inhibitors currently approved for marketing in the world are all KRAS G12C inhibitors and have no indication for pancreatic cancer, they are not suitable for patients with other mutations or wild-type, and their coverage is limited. There is still a huge unmet clinical need in KRAS mutated pancreatic cancer. The research on pan-KRAS inhibitors is an important direction in the current RAS inhibitor research and is expected to tear a hole in the "king of cancers". Now, RMC-6236 may take the lead in this track.

The high-profile front-runner

Revolution Medicines, founded in October 2014, is a clinical-stage oncology company in Delaware, USA. Focus on developing targeted therapies to inhibit cutting-edge targets in RAS-addictive cancers. The company's advanced structure-based drug discovery capabilities are based on deep knowledge of chemical biology and cancer pharmacology and innovative proprietary technologies that enable the creation of small molecules that fit into unconventional binding sites.

Revolution's R&D pipeline includes a series of RAS(ON) inhibitors and RAS chaperone inhibitors designed to inhibit multiple oncogenic variants of the RAS protein. The company's RAS(ON) inhibitors RMC-6236, RMC-6291 and RMC-9805 are currently in clinical development. Other development opportunities in the company's pipeline focus on RAS(ON) mutation-selective inhibitors, including RMC-5127(G12V), RMC-0708(Q61H) and RMC-8839(G13C), as well as the RAS chaperone inhibitor RMC- 4630 and RMC-5552.

Revolution is developing a series of RAS inhibitors. The company's stock has doubled in the past 12 months due to the potential of these drugs in treating solid tumors, especially pancreatic cancer.

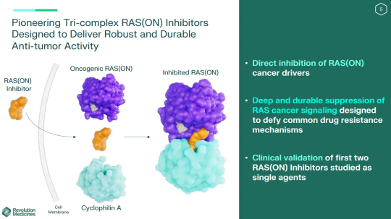

Revolution has attracted attention in the industry for its unique ternary complex inhibitor platform. The molecules designed by this platform can bind to the intracellular chaperone protein cyclophilin A to produce an inhibitory binary complex, which then forms a ternary complex with active GTP-bound RAS and inhibits RAS signaling by disrupting the interaction with the effector, thereby achieving the purpose of tumor suppression.

The "star of tomorrow" RMC-6236 was produced on this platform. Compared with other traditional KRAS inhibitors, its main advantages include: it can inhibit multiple different RAS mutation types at the same time, including RAS G12X, G13X and Q61X mutations, not just Only limited to a specific mutation; targets the active state of RAS instead of the traditional inactive state, thereby avoiding mutant resistance to inhibitors; prevents RAS from binding to effectors and enhances its GTPase Activity; with mutation specificity, appropriate molecules can be selected for treatment according to different mutants.

In addition, RMC-9805, another high-profile KRAS G12D inhibitor in Revolution’s pipeline, has also received good news recently. Among 40 patients with previously treated pancreatic cancer who received a daily dose of 1,200 mg of the KRAS G12D inhibitor RMC-9805, 12 experienced tumor shrinkage of at least 30%, implying an objective response rate of 30%.

The track has quietly emerged.

The treatment of KRAS mutated cancers has broad prospects, and the related drug market is expected to grow significantly in the next few years. According to DelveInsight's analysis, the market size of KRAS inhibitors will reach US$240 million by 2022 and reach US$240 million by 2032. An astonishing US$10 billion, with a compound annual appreciation rate of 36%.

KRAS inhibitors currently approved or in clinical trials, such as Sotorasib and Adagrasib, work by binding to the "OFF" state of the KRAS G12C mutant protein. They can form covalent bonds with the GDP-binding switch II pocket and lock KRAS in an inactive state. However, this strategy also has some limitations, such as it can only target specific mutation types, cannot completely inhibit downstream signaling pathways, and is prone to drug resistance. This may be the main reason why the sales of existing KRAS G12C drugs on the market are lower than expected.

The audience for inhibitors targeting single-mutated KRAS has always been limited, which has led to the unremitting pursuit of pharmaceutical companies to develop pan-KRAS inhibitors. According to incomplete statistics, there are currently nearly 35 pan-KRAS inhibitors under development worldwide, of which 8 have entered the clinical stage. In addition to RMC-6236, there are also JAB-23E73 (Jaxos, clinical phase I/II), LY4066434 (Eli Lilly, clinical phase I), PF-07934040 (clinical phase I), BGB-53038 (BeiGene, clinical Phase I), QTX3034 (Quanta, clinical phase I), YL-17231 (Yingli Pharmaceuticals, clinical phase I) and BI 3706674 (Boehringer Ingelheim, clinical phase I).

For KRAS targeted therapies, domestic clinical pipelines under development were almost all focused on KRAS G12C/G12D. Pan-KRAS inhibitors have broad prospects, attracting domestic pharmaceutical companies to catch up. Yingli Pharmaceutical's YL-17231 is the first pan-KRAS inhibitor to enter the clinical stage in China, and is currently undergoing Phase I clinical trials in China and the United States. Jabsco's pan-KRAS inhibitor JAB-23E73 recently completed the administration of the first patient in a Phase I/IIa clinical trial in China. JAB-23E73 can inhibit KRAS in active and inactive states at the same time, has no obvious inhibition on HRAS and NRAS, and can inhibit KRAS in ON/OFF states at the same time. BeiGene’s pan-KRAS inhibitor BGB-53038 was also approved for IND in September this year.

In addition to small molecule inhibitors, different forms of drugs in this field have also seen many new developments recently. For example, a team of scientists from the University of Dundee and BI published breakthrough results in Science magazine and developed a small drug called ACBI3. Molecule PROTAC. ACBI3 has been shown to efficiently and selectively degrade 13 of the 17 most common KRAS mutants. These findings elucidate a new concept of pan-KRAS degradation.

In addition, AMPLIFY-7P, an anti-cancer vaccine under development targeting seven common KRAS mutations (G12D, G12R, G12V, G12A, G12C, G12S, and G13D), has been administered to the first patient in the Phase 2 clinical trial of ELI-002 7P for treatment. Adjuvant therapy for pancreatic ductal adenocarcinoma (PDAC) harboring KRAS mutations.

Phase I clinical trial data in Nature Medicine highlight the potential of ELI-002 7P: KRAS mutant-specific T cell responses were observed in 84% of 25 patients with solid tumors, with T cell responses above the median patients' risk of disease progression or death was reduced by 86%. Tumor biomarker responses were observed in 84% of patients, and biomarker clearance was achieved in 24% of patients. After a median follow-up of 8.5 months, the median recurrence-free survival (RFS) of these 25 patients was 16.33 months.

https://news.yaozh.com/archive/44650.html

By editorRead more on

- Gan & Lee Pharmaceuticals’ new PROTAC drug GLR2037 tablets have been approved for clinical trials to enter the field of prostate cancer treatment March 3, 2026

- AideaPharmaceuticals plans to raise no more than 1.277 billion yuan through a private placement to focus on the global clinical development of innovative HIV drugs March 3, 2026

- Giant Exits! Its Star Business Acquired March 3, 2026

- Focusing on cardiovascular and cerebrovascular diseases! OpenMediLead Medical Intelligence Dual Engines Launch Internal Testing, Connecting Drug Development and Clinical Diagnosis in a Closed Loop March 3, 2026

- Innovent Biologics Announces Approval of New Indication for BTK Inhibitor “Pitubrutinib” in China March 3, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.