Baide Medical’s stock surged 624%

January 7, 2025

Source: drugdu

317

317

On December 31, 2024 Eastern Time, Baird Medical Investment Holdings Ltd surged 623.81%. Baird Medical Investment Holdings Limited (hereinafter referred to as "Baird Medical") is the substantive holding company of Baird (Suzhou) Medical Co., Ltd. Baide Medical officially went public on NASDAQ in the United States on October 2, 2024, through the backdoor acquisition of SPAC (Special Purpose Acquisition Company) ExcelFin Acquisition (XFIN).

Baide Medical is a leading microwave ablation medical enterprise in China. According to the data, based on the sales revenue and sales of microwave ablation needles in 2022, Baide Medical ranks first among the suppliers of microwave ablation medical equipment for treating thyroid nodules and breast lumps in China. In addition, based on sales revenue in 2022, the company is the third largest supplier of microwave ablation medical devices in China.

01. After being listed for 3 months, the stock is like riding a roller coaster

On October 2, 2024, Baird Medical was listed on the US market under the name Baird Medical Investment Holdings Limited. On October 2nd, Baide Medical closed at $6 per share with a total market value of $38.5039 million.

In the turbulent market environment, BDMD stock has fallen to its lowest point last week, trading at $1.03, a decrease of over 80% compared to its highest point of nearly $10. This price level reflects the enormous pressure faced by the company's valuation and investors' concerns about the industry and the overall economic environment.

But in the past two weeks, Baide Medical has performed well in the stock market. The stock price of Baide Medical rose 623.81% on the last trading day (December 31, 2024), from $1.05 to $7.60. The stock fluctuated 560.78% from the daily low of $1.42 to the daily high of $9.35. During this period, prices have been fluctuating, with a 377.99% increase in the past two weeks. The total trading volume on the last day increased by 89 million shares compared to the previous day. A total of 89 million shares were traded at a price of approximately 677.18 million US dollars.

This positive stock market performance may be related to the rapid development of Baide Medical's own business in recent times. According to recent news reports, Baide Medical achieved significant financial growth in the first half of 2024, with total revenue increasing by 13.8% to reach 13.1 million US dollars. The company's net profit also surged by 85.8% to $4.4 million, while gross profit increased by 20.9%. These positive financial performance are attributed to Baide Medical's robust core business in China and initial success in the US market.

02. The development path of microwave ablation leader

Founded in 2012, Baide Medical started as a distributor of medical devices. Later, in 2017 and 2019, it acquired the entire equity of Nanjing Changcheng, a manufacturer of microwave ablation medical devices, making it its wholly-owned subsidiary.

Nanjing Great Wall Medical is a leading microwave ablation treatment enterprise in China, which developed a medical microwave therapy device as early as the 1980s. As a result, Baide Medical has transformed from a sales enterprise to a high-tech medical device research and development and production enterprise, officially entering the microwave ablation track.

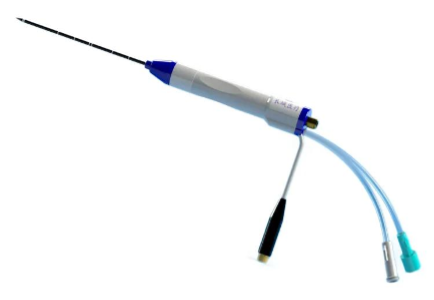

Microwave ablation is a technique that uses microwave heat to destroy cells and tissues in order to achieve therapeutic goals. Under the guidance of medical imaging equipment such as B-ultrasound and CT, the tumor is exposed through a laparoscopic hole or open incision, and a microwave ablation needle is inserted into the tumor. The microwave heating released by the microwave ablation therapy device can ablate (destroy) tumor tissue through the microwave ablation needle within 10 minutes.

Due to the advantages of simple operation, no need for surgery, and short operation time of microwave ablation surgery, with the continuous maturity of technology and the increasing penetration rate of minimally invasive surgery, the market for tumor microwave ablation is also constantly growing.

Baide Medical products mainly target the treatment of thyroid nodules, breast nodules, liver cancer, lung cancer and other fields. According to the prospectus, Baide Medical's products include microwave ablation therapy devices and needles for treating liver cancer and thyroid nodules, long microwave ablation needles, and fine microwave ablation needles.

According to the sales data in 2020, the company, along with Nanjing Yigao, Viking Kyushu, and Nanjing Kangyou, are among the top four microwave ablation manufacturers in China.

At the end of November 2023, Baide Medical's subsidiary Baide (Suzhou) Medical Co., Ltd.'s microwave ablation system and disposable product combination microwave ablation needle officially entered the US market as regulated Class II equipment for sale.

03. The tortuous listing process

The listing process of Baide Medical has been full of ups and downs. On June 30, 2021, Baide Medical completed a Series C financing of 94.4 million yuan. The company's Series C investors include Bank of China International Investment CVC、 International Precision Group and others have a valuation of 838 million yuan after completing their Series C financing. During the Series C financing, Baide Medical also signed a performance betting agreement with one of the investors, Bank of China International, guaranteeing and guaranteeing that the company's audited comprehensive net profit (excluding non recurring gains, profits, and losses) for the fiscal years 2021 and 2022 will not be less than RMB 91.7 million and RMB 126 million, respectively. If the actual audited comprehensive net profit of the company for the relevant fiscal year is lower than the guaranteed profit, Baide Medical needs to compensate Bank of China International Investment. Baide Medical has not completed its 2021 performance bet and is facing investment compensation from Bank of China International. The prospectus mentions that if Baide Medical completes its listing before December 31, 2022, the bet agreement will be terminated, which to some extent explains the reasons why Baide Medical is eager to go public.

Shortly after signing the betting agreement, the company submitted its first application to the Hong Kong Stock Exchange on September 28, 2021, which subsequently expired. Submit the prospectus to the Hong Kong Stock Exchange for the second time on April 7, 2022. In October 2022, Baide Medical was originally scheduled to be listed on the Hong Kong Stock Exchange (HKEX) on the 5th of that month. However, just before going public on October 3rd, the company suddenly announced the postponement of its initial public offering (IPO) plan for the Hong Kong stock market.

After nearly a year of preparation and adjustment, on June 26, 2023, Baide Medical once again embarked on the journey of IPO. However, this time it chose a different market - the United States. The company has reached a final merger agreement with ExcelFin Acquisition Corp. (referred to as "ExcelFin"), a special purpose acquisition company (SPAC).

This SPAC is the third time that Baide Medical has launched a challenge to go public. According to foreign media reports, Grand Fortune Capital, a sponsored affiliate of ExcelFin, a special purpose acquisition company that merges with Baide Medical, will purchase approximately $8.8 million (approximately RMB 57.58 million) worth of Baide Medical's debt from Baide Medical's shareholder, Bank of China International Investment. It is speculated that this debt is Baide Medical's gambling compensation. According to the merger agreement, the pre merger equity value is $300 million, and the implied estimated enterprise value of the merged company is approximately $370 million. Betters shareholders will convert 100% of their existing Betters equity into Baird Medical's common stock.

On October 2, 2024, Baird Medical was listed on the US market under the name Baird Medical Investment Holdings Limited.

As a major country in the global application of microwave ablation therapy technology, China leads the world in microwave ablation clinical medicine and microwave ablation equipment manufacturing.

According to the "2018-2024 China Medical Device Industry Operation Situation and Investment Prospect Forecast Report" released by Zhiyan Consulting, the global market size of thermal ablation medical services (including tumor ablation and non tumor ablation) in 2022 exceeded 12 billion US dollars, with microwave ablation accounting for one-third of it, and the market size reaching 4 billion US dollars.

Source: http://qixieke.com/Font/index/detailPage.html?id=3316-19

By editorRead more on

- Gan & Lee Pharmaceuticals’ new PROTAC drug GLR2037 tablets have been approved for clinical trials to enter the field of prostate cancer treatment March 3, 2026

- AideaPharmaceuticals plans to raise no more than 1.277 billion yuan through a private placement to focus on the global clinical development of innovative HIV drugs March 3, 2026

- Giant Exits! Its Star Business Acquired March 3, 2026

- Focusing on cardiovascular and cerebrovascular diseases! OpenMediLead Medical Intelligence Dual Engines Launch Internal Testing, Connecting Drug Development and Clinical Diagnosis in a Closed Loop March 3, 2026

- Innovent Biologics Announces Approval of New Indication for BTK Inhibitor “Pitubrutinib” in China March 3, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.