AstraZeneca’s big move

May 13, 2025

Source: drugdu

278

278

At AstraZeneca's first quarter 2025 earnings conference, the pharmaceutical giant dropped a bombshell on its strategic adjustment: it will officially withdraw from the field of neuroscience and instead focus resources on core areas such as weight loss and immunology.

1. Cut the pipeline

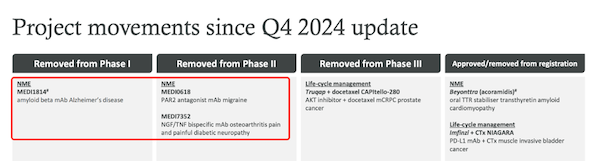

AstraZeneca's first quarter 2025 financial report showed that the company had terminated the development of a number of neuroscience projects, including MEDI1814 for the treatment of Alzheimer's disease developed in cooperation with Eli Lilly, MEDI0618, a migraine monoclonal antibody in Phase 2 clinical trials, and MEDI7352, a dual-antibody for the treatment of diabetic neuropathy. At this point, the company's neuroscience pipeline under development has been reduced to zero.

Image source: AstraZeneca 2025 Q1 financial report

The field of neuroscience is recognized as a challenging "R&D black hole" due to the extreme complexity of the brain and nervous system and the unclear pathogenesis, which leads to low clinical trial success rates and long R&D cycles.

Take AbbVie as an example. Its key candidate drug Emraclidine in the treatment of schizophrenia suffered a major setback in November 2024: both key Phase 3 clinical trials failed to reach the primary efficacy endpoint. This failure directly triggered a violent market reaction, with the company's stock price plummeting by more than 12% in a single day and its market value shrinking by more than US$40 billion overnight. This failure prompted AbbVie to reflect on its R&D strategy in the field of central nervous system diseases, and it made it clear at the 2025 JPM Healthcare Conference that in the future, a more prudent evaluation mechanism will be adopted for large investments in early research stages.

According to data from the American Pharmaceutical Manufacturers and Research Association, Alzheimer's disease is one of the most complex neurological diseases. Over the past 20 years, the global cumulative R&D investment has exceeded $600 billion, and more than 300 drugs have failed, with a R&D failure rate as high as 99.6%. Global pharmaceutical companies such as Johnson & Johnson, Roche, and Merck have all suffered setbacks in this field.

In the field of neurological disease treatment, even if a drug is successfully approved for marketing, its commercialization process still faces the challenge of patients' ability to pay. Taking the Chinese market as an example, imported drugs such as Leqembi (lencanetumab) have not yet entered the national medical insurance catalog. Patients need to pay the full cost of treatment at their own expense. The annual expenditure of hundreds of thousands of dollars is a heavy financial burden for ordinary families. In the United States, the reimbursement restrictions set by the federal medical insurance (Medicare) on some neuroscience drugs have added obstacles to their commercialization.

Judging from AstraZeneca's financial performance in the first quarter of 2025, its total revenue reached US$13.588 billion, and its total product revenue reached US$1.351 billion, of which the oncology business accounted for 42% of the core with US$5.643 billion in revenue. The diabetes drug Farxiga increased by 15% year-on-year to US$2.058 billion, becoming the core engine driving revenue growth.

Compared with the strong performance of the above-mentioned advantageous businesses, the contribution of its neuroscience pipeline is relatively low. Soliris (eculizumab), which is used to treat the rare disease neuromyelitis optica spectrum disorder (one of the approved indications for the drug), saw its revenue drop 40% to US$444 million in the first quarter of 2025, accounting for only 3% of the company's total revenue.

Faced with such a reality, in order to improve the overall return on investment, AstraZeneca has to shift its limited resources to the fields of oncology, immune and metabolic diseases, which have huge market sizes. As CEO Pascal Soriot said: "We cannot provide funding for all projects. The field of central nervous system diseases is more suitable for companies that focus on this field to deepen their research."

In the current competitive landscape, Biogen's Alzheimer's drug Leqembi and Eli Lilly's Donanemab have taken the lead in establishing market advantages in this field, while competition in the field of migraine treatment is concentrated on Amgen and Teva's CGRP inhibitors. Based on considerations for optimal resource allocation, AstraZeneca finally announced its full withdrawal from the neuroscience field and focused on the high-growth treatment track.

2. Betting on high-growth tracks

AstraZeneca's exit from neuroscience is not a simple subtraction, but a repositioning based on the value coordinate system.

Sharon Barr, executive vice president of AstraZeneca's biopharmaceuticals research and development, emphasized that the withdrawal from the neuroscience field is to concentrate resources to support core therapeutic areas and high-value projects. Funds will be reinvested in areas such as weight management, dyslipidemia, respiratory diseases and immunology.

In its first quarter 2025 financial report, AstraZeneca proposed to achieve a revenue target of $80 billion by 2030, a nearly 50% increase from the revenue of $54.1 billion in 2024. Among the multiple pipelines with the potential for peak sales of more than $5 billion disclosed by AstraZeneca that drive its performance growth, there is a GLP-1 pipeline for weight management.

As the number of obese people in the world exceeds 2 billion, the weight loss track has seen explosive growth, and weight loss therapies represented by GLP-1 receptor agonists have shown a market potential of hundreds of billions of dollars. For example, Novo Nordisk's semaglutide will have global sales of approximately US$29.3 billion in 2024, a year-on-year increase of 38%, and Eli Lilly's telotriol will achieve sales of US$16.4 billion in 2024.

Currently, GLP-1 weight loss drugs are mainly injections, and no oral small molecule GLP-1 receptor agonists have been approved for marketing in the global market. As early as November 2023, AstraZeneca introduced the small molecule GLP-1 receptor agonist AZD5004 (ECC5004) from the Chinese company Chengyi Bio, choosing to enter the hot GLP-1 weight loss track with a differentiated strategy. Small molecule drugs are an important supplement to the current GLP-1 track. In the Phase 1 trial, AZD5004 achieved a 5.8% weight loss in 4 weeks and improved patients' blood sugar indicators. At the same time, AstraZeneca also plans to combine AZD5004 with the SGLT2 inhibitor Dapagliflozin to treat patients with type 2 diabetes, chronic kidney disease and heart failure. The combination of AZD5004 and the oral PCSK9 inhibitor AZD0780 has the potential to further reduce high-risk cardiovascular diseases.

Although GLP-1-based therapies have shown good results in the treatment of obesity and related comorbidities, the potential side effect of muscle mass loss may limit the long-term application of such therapies. AstraZeneca has collaborated with SixPeaks Bio to develop weight loss drugs with "preserving muscle mass" as its core differentiation advantage. The drug aims to solve the muscle loss problem of existing therapies by targeting the antibody mechanism of activin receptor IIA/B.

In addition, AstraZeneca has also diversified its drug layout in the field of obesity treatment and actively developed products with novel mechanisms of action, including the amylin therapy drug AZD6234, as well as drugs with different targets such as GHSR inverse agonists, MCHR1 antagonists, IGFBP2 analogs, and GPR75 modulators.

The field of oncology has always been AstraZeneca's "cash cow". In the first quarter of 2025, the total sales of oncology-related products exceeded US$5.6 billion, accounting for more than 40% of the company's total revenue. The third-generation EGFR inhibitor osimertinib (Tagrisso) had revenue of US$1.679 billion, a year-on-year increase of 5%. The PD-L1 monoclonal antibody Imfinzi achieved sales of US$1.261 billion, a year-on-year increase of 13%. The HER2 ADC drug Enhertu, developed in cooperation with Daiichi Sankyo, achieved sales of US$596 million, a year-on-year increase of 29%.

AstraZeneca's first quarter 2025 financial report shows that the respiratory and immunology (R&I) business increased by 11% year-on-year to US$2.084 billion, becoming the fastest growing sector. AstraZeneca has established a solid market position in the treatment of asthma and chronic obstructive pulmonary disease (COPD). Saphnelo achieved sales of US$723 million in the first quarter of 2025. Asthma drug Tezspire has been approved in nearly 60 countries and regions around the world, with sales increasing by 81% to US$217 million.

Faced with the huge patient base and unmet needs of immune diseases such as atopic dermatitis and lupus, AstraZeneca and Harbour Biopharma reached a $175 million collaboration to jointly develop multi-specific antibody therapies targeting indications such as systemic lupus erythematosus. At the same time, it acquired Gracell Biopharma's GC012F CAR-T therapy to explore its application in the treatment of autoimmune diseases, attempting to gain a foothold in the autoimmune field.

3. Focus and slimming strategies

AstraZeneca's complete withdrawal from the field of neuroscience is not an isolated case, but a microcosm of the global pharmaceutical companies' "focus and slimming down" trend.

Pfizer spun off its generic drug business in 2019 and merged it with Mylan to form Huizhi, completely divesting non-core assets and focusing fully on the research and development of innovative drugs.

Novartis also spun off its generic drug division Sandoz and listed it independently, also shifting its focus to innovative drug business.

As its core products are facing patent expiration, BMS launched a $1.5 billion downsizing plan in 2024, laying off 2,200 employees, closing the Cancer Immunology Research Center, terminating 12 early projects, and concentrating resources on core products such as Reblozyl and Opdualag.

In 2023, Takeda Pharmaceutical will streamline its pipeline on a large scale, stop developing 18 drugs covering multiple therapeutic areas such as oncology and neuroscience, and focus resources on projects with the greatest potential and in line with the company's long-term strategy. In the first quarter of fiscal 2024, it achieved global revenue of 120.8 billion yen, a year-on-year increase of 2.1%.

At a time when market competition is becoming increasingly fierce, the underlying logic of these "focus strategies" and "slimming actions" is basically the same: divest low-return assets and concentrate resources on high-growth, high-certainty areas such as immunity, weight loss, and oncology to cope with the pressure of patent expiration and R&D efficiency challenges.

However, the other side of the coin is that the focus strategy may also bring potential problems. When the industry collectively escapes from "tough nuts to crack" such as neuroscience and rare diseases, an innovation vacuum may appear in areas where clinical needs are not met. Therefore, while pursuing high returns, pharmaceutical companies need to find a balance between efficiency and innovation.

4. Conclusion

AstraZeneca's strategic shift is essentially an active response to the pharmaceutical industry's rule of "high risk in R&D and high returns in the market."

In the balance between commercial goals and scientific exploration, every strategic choice is a re-evaluation of the value of life and health research and development. Exiting the field of neuroscience reflects AstraZeneca's prediction of market trends. When pharmaceutical companies focus their resources on high-growth tracks, how to ensure long-term investment in complex disease areas while pursuing commercial returns has become a topic that the entire industry needs to think about.

https://news.yaozh.com/archive/45436.html

By editorRead more on

- Rovaxitinib approved for marketing, filling the demand for myelofibrosis treatment March 2, 2026

- Warrant Pharmaceuticals’ active pharmaceutical ingredient receives Brazil’s first official GMP certification March 2, 2026

- Merck’s New Story March 2, 2026

- Rongchang Biotechnology has turned a profit! March 2, 2026

- Jiuyuan Gene’s “Simeglucopyranoside” for weight loss (Jikeqin®) has been submitted for market approval March 2, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.