Artiva’s IPO Reels In $167M to Bring NK Cell Therapy to Autoimmune Diseases

July 23, 2024

Source: drugdu

588

588

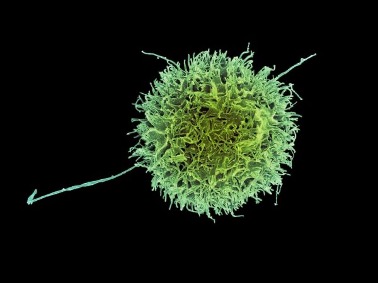

Lupus is the lead autoimmune indication for Artiva Biotherapeutics, which has an early-stage clinical trial underway. Artiva’s allogeneic cell therapies are based on natural killer cells.

By Frank Vinluan Cell therapy first reached patients as treatments for cancer. Artiva Biotherapeutics is part of a growing group of companies working to bring cell therapy to autoimmune disease, and its IPO has raised $167 million for clinical trial plans.

Cell therapy first reached patients as treatments for cancer. Artiva Biotherapeutics is part of a growing group of companies working to bring cell therapy to autoimmune disease, and its IPO has raised $167 million for clinical trial plans.

Artiva priced the IPO at $12 per share, which was below the $14 to $16 per share price range the biotech set in preliminary terms last week. However, it boosted the deal size by increasing the number of shares in the offering. The 8.7 million shares it initially planned to offer would have raised $130.5 million at the proposed pricing midpoint. The company was able to raise more by selling 13.92 million shares.

The shares of San Diego-based Artiva shares debuted on the Nasdaq Friday under the stock symbol “ARTV.” But those shares were flat, closing their first day of trading at the IPO price.

The first cancer cell therapies were autologous, made from a patient’s own T cells in a lengthy and expensive multi-step process. Artiva works with a different type of immune cell called a natural killer cell, or NK cell. The Artiva therapies are allogeneic, made from donor cells in a process that the company says is cost effective and scalable. Rather than sourcing NK cells from healthy donors like some NK cell therapy developers, Artiva’s cells come from cord blood. After manufacturing, these cell therapies are stored frozen, ready to ship to a patient’s treatment location when needed.

Lead Artiva program AlloNK is in Phase 1/1b testing in patients with systemic lupus erythematosus, the most common form of lupus. Some lupus patients also develop lupus nephritis. Artiva’s open-label trial is enrolling lupus patients who have this kidney condition as well as those who do not. Study participants are receiving the study drug in combination with either Rituxan or Gazya. Both are FDA-approved antibody drugs that deplete B cells, a type of immune cell associated with many autoimmune conditions, including lupus.

AlloNK is also being tested for treating a range of additional immunology disorders in an investigator-initiated clinical trial. This research is proceeding as a basket study, clinical research that evaluates how a therapy works against multiple diseases that share a common characteristic. Diseases covered in the basket trial include rheumatoid arthritis, pemphigus vulgaris, and two subtypes of anti-neutrophil cytoplasmic autoantibody-associated vasculitis.

In the IPO filing, Artiva says it believes AlloNK is the first allogeneic NK cell therapy candidate to receive the FDA green light for a clinical trial as well as first to receive the agency’s fast track designation in an autoimmune disease. The company also claims to be first to bring a cell therapy into an autoimmune disease basket trial.

“We believe as we continue to execute on our strategic plan that these critical first mover advantages will solidify our leadership in multiple autoimmune diseases with high unmet need,” the company said in the filing.

Artiva plans to apply $55 million of the IPO proceeds toward the Phase 1/1b test of AlloNK in lupus, according to the prospectus. The IPO cash will also fund the basket study. Artiva said in the filing it expects preliminary data from either study in the first half of 2025.

Other companies are further along in clinical development of cell therapies for autoimmune diseases, albeit with therapies made from different immune cells. Earlier this year, Kyverna Therapeutics’ IPO raised $319 million for early- and mid-stage clinical tests of its CAR T-therapies in systemic sclerosis, multiple sclerosis, and myasthenia gravis, among other autoimmune conditions. Other companies are developing autoimmune disease cell therapies based on a type of immune cell called a regulatory T cell, or Treg.

Artiva was founded in 2019, spun out of GC Lab Cell Corporation (now known as GC Cell), a South Korea-based cell therapy developer. Artiva holds rights, outside of Asia, to GC Cell’s NK cell manufacturing technology and programs, including lead program AlloNK. In 2020, Artiva launched with $78 million in Series A financing. Prior to the IPO, Artiva said it had raised $222.4 million since its inception. GC Cell’s parent company, GC Corp., is Artiva’s largest shareholder with a 13.5% post-IPO stake, according to the filing. 5AM Ventures, venBio, and RA Capital Management each own 8.1% of the company after the IPO. The company reported a cash position of $62.1 million at the end of the first quarter of this year.

The IPO is Artiva’s second try at going public. The company first submitted a registration statement in 2021, when the biotech IPO market was still hot. At that time, the NK cell therapy company was focused on cancer. A cancer research collaboration struck with Merck in 2021 paid the biotech $30 million up front. The pharma giant terminated the deal last fall.

When Artiva withdrew its IPO filing in late 2022, the IPO market had cooled off considerably. But by then, the company had begun another cancer partnership with Affimed in Hodgkin lymphoma. This collaboration is testing AlloNK in combination with Affimed’s acimtamig, an NK cell engager. Affimed is funding this clinical research, which is currently in Phase 2 testing.

Image by Flickr user NIAID via a Creative Commons license

Read more on

- Gan & Lee Pharmaceuticals’ new PROTAC drug GLR2037 tablets have been approved for clinical trials to enter the field of prostate cancer treatment March 3, 2026

- AideaPharmaceuticals plans to raise no more than 1.277 billion yuan through a private placement to focus on the global clinical development of innovative HIV drugs March 3, 2026

- Giant Exits! Its Star Business Acquired March 3, 2026

- Focusing on cardiovascular and cerebrovascular diseases! OpenMediLead Medical Intelligence Dual Engines Launch Internal Testing, Connecting Drug Development and Clinical Diagnosis in a Closed Loop March 3, 2026

- Innovent Biologics Announces Approval of New Indication for BTK Inhibitor “Pitubrutinib” in China March 3, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.