A new starting point for Hengrui

May 28, 2025

Source: drugdu

214

214

Hengrui Medicine was founded in 1970. Its predecessor was a small pharmaceutical factory in Lianyungang, Jiangsu (Lianyungang Pharmaceutical Factory). In 1982, Sun Piaoyang joined Lianyungang Pharmaceutical Factory and took office as the new factory director in 1990. Under his leadership, Hengrui Medicine gradually grew from generic drugs to innovative drugs, and became a leader in China's pharmaceutical field.

In 2020, Hengrui Medicine's market value exceeded 600 billion yuan, driven by innovative products such as carrelizumab.

However, with the advancement of national centralized procurement and medical insurance negotiations, Hengrui Medicine's performance faces severe challenges, and its revenue and net profit have not yet returned to the highs of Q4 2020.

The revenue of the generic drug business has shrunk sharply in the past few years, bringing Hengrui Medicine's performance into its darkest moment, with revenue falling from 27.73 billion yuan in 2020 to 22.82 billion yuan in 2023. In 2024, although Hengrui Medicine's performance has rebounded, it is still dragged down by generic drugs, and the revenue of the generic drug business has fallen by 39.83% year-on-year.

In the innovative drug business, under the cost control environment of the national medical insurance negotiations, although Hengrui Medicine has more than a dozen innovative drugs on the market, the revenue from innovative drugs in 2024 will only be 13.892 billion yuan, and the proportion of revenue will increase from 38.1% in 2022 to 49.64% in 2024, which is still less than half.

Compared with BeiGene, which has integrated into the global market, the revenue of its innovative drug Zebutinib alone reached US$2.644 billion (approximately RMB 19 billion) in 2024, which shows the importance of overseas markets.

What is even more worrying is that the "involution" of domestic innovative drugs has intensified, and going overseas has become the most important growth logic for innovative drugs.

2. A new starting point for internationalization

Many years ago, Hengrui proposed a dual-drive strategy of "innovation + internationalization". However, in the wave of domestic innovative drug BD going overseas, Hengrui Medicine has been slow to appear in large-scale transaction projects.

It was not until 2023 that Hengrui Medicine reorganized its BD team, followed by a series of major transactions.

According to Hengrui Medicine's prospectus, since 2018, Hengrui has conducted 14 outlicensing transactions with global partners, involving 17 molecular entities with a total transaction value of approximately US$14 billion.

Among these transactions, there are 9 transactions after 2023, with a total amount of approximately US$13 billion, including 5 transactions worth more than US$1 billion, including a transaction with Kailera Therapeutics with a total amount of approximately US$6 billion, and large outlicenses with Merck, Merck Group, IDEAYA Biosciences and Aiolos Bio (later acquired by GSK).

This year, Hengrui Medicine's internationalization journey has taken another key step forward.

In January, Hengrui submitted a listing application to the Hong Kong Stock Exchange and was officially listed on the Hong Kong Stock Exchange in May.

Hengrui's Hong Kong IPO is intended to solve the dilemma of internationalization, enhance brand influence through financing in the international capital market, and pave the way for overseas expansion. Hengrui Medicine clearly stated in its prospectus that the funds raised will be mainly used for R&D plans, the construction of new production and R&D facilities in China and overseas markets, and other purposes.

3. Future Opportunities

Compared with the A-share market's valuation logic that focuses on domestic business, the Hong Kong market's international investor structure places more emphasis on a company's innovation capabilities and overseas expansion prospects.

In recent years, Hengrui Medicine has continued to increase its R&D investment, with a total R&D investment of 46 billion yuan since 2011. The total R&D investment in 2024 will reach 8.228 billion yuan, setting a new historical record.

With heavy investment, Hengrui Medicine has accumulated an extremely rich pipeline, which holds huge opportunities whether it is BD overseas or independent overseas expansion.

Hengrui Medicine has extensive layout in four major fields: tumors, metabolic and cardiovascular diseases, immune and respiratory diseases, and neuroscience. Currently, 20 Class 1 innovative drugs have been approved for marketing in China, more than 90 independent innovative products are under clinical development, and about 400 clinical trials are being carried out at home and abroad.

Rich ADC pipeline

Oncology is Hengrui Medicine's core advantage area, and ADC is Hengrui Medicine's most important layout in the oncology field.

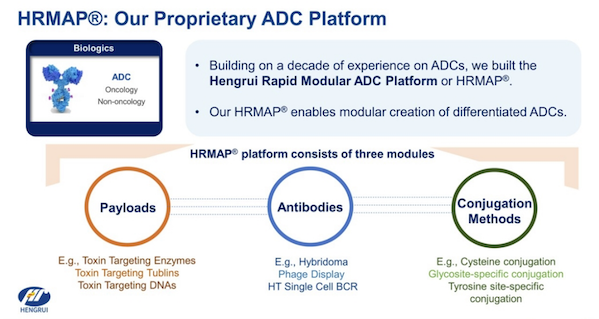

In the ADC field, Hengrui Medicine has built a complete ecosystem covering target exploration, technology platform innovation, clinical development and international cooperation. Its core competitiveness lies in the creation of a modular HRMAP technology platform that can quickly develop a variety of differentiated ADC products.

This platform is based on the ADC technology platform of Daiichi Sankyo, and is modified and optimized for the toxin Dxd. The technology platform has high certainty and has developed a new generation of site-specific conjugation technology with independent intellectual property rights. It also contains a variety of linkers, a variety of targeted antibodies and toxins with a variety of mechanisms, which significantly improves the plasma stability, uniformity and anti-tumor activity of ADC drugs.

At present, Hengrui Medicine has 13 ADC candidate drugs entering the clinical stage, covering almost all popular targets such as HER2, Nectin-4, Claudin18.2, HER3, TROP2, CD79b, c-MET, DDL3, etc.

At present, Hengrui Medicine has 13 ADC candidate drugs entering the clinical stage, covering almost all popular targets such as HER2, Nectin-4, Claudin18.2, HER3, TROP2, CD79b, c-MET, DDL3, etc.

Among them, several pipelines are at the forefront of clinical progress in the world and have the potential to be first-in-class or best-in-class.

For example, the HER2 ADC drug SHR-A1811 achieved an ORR of 74.5% and a DCR of 98.9% in patients with HER2-mutated non-small cell lung cancer (NSCLC), with a median PFS of 11.5 months, setting a new global record for similar drugs. The drug has been included in the CDE's breakthrough therapy category eight times, including an application for marketing approval for adult patients with locally advanced or metastatic HER2-mutated non-small cell lung cancer who have received at least one systemic treatment, which has been accepted by the CDE and is expected to be approved soon.

For example, the DLL3 ADC drug SHR-4849 uses a topoisomerase I inhibitor as a payload with a DAR value of 8. It not only has strong proliferation inhibition activity against tumor cells with medium and high expression of DLL3, but also has a significant bystander effect. In December 2024, Hengrui Medicine licensed the overseas rights of the drug to IDEAYA Biosciences of the United States for a total of more than US$1 billion.

High Potential GLP-1 Pipeline

The obesity and metabolism field is undoubtedly the fastest growing drug market in the past two years.

Hengrui Medicine has been exploring innovation in the field of metabolic diseases for many years. Currently, there are 4 new Class 1 diabetes drugs on the market, and many products are under development, including GLP-1/GIP dual receptor agonist HRS9531, oral small molecule GLP-1 receptor agonist HRS-7535, and GLP-1/GIP/GCG triple receptor agonist HRS-4729. Three innovative products have been approved for clinical trials and successfully exported through NewCo. The total transaction amount is as high as US$6 billion. Hengrui also acquired 19.9% of Kailera's equity.

HRS-7535 is an oral small molecule GLP-1 receptor agonist. Hengrui has launched a Phase III clinical study of the drug for weight loss indications.

HRS-9531 is a GLP-1/GIP dual receptor agonist that shares the same target as Eli Lilly's star product, telpotide. Currently, the drug has entered the Phase III research and development stage for weight loss and glucose-lowering indications, and has also been approved for clinical use for obstructive sleep apnea (OSA) combined with obesity.

HRS-4729 is a GLP-1/GIP/GCG triple receptor agonist. Compared with the dual-target GLP-1/GIP, the triple receptor agonist increases the activation of the GCG target on the basis of regulating sugar and lipid metabolism and suppressing appetite in the body, promoting energy consumption, lowering blood lipids, and better playing a role in weight loss. The drug has now entered Phase I clinical trials.

Of course, in addition to the two highly-watched areas of ADC and GLP-1, Hengrui Medicine also has many potential pipelines, such as the Lp(a) inhibitor HRS-5346 authorized from Merck this year.

4. Conclusion

Hengrui Medicine is one of the earliest pharmaceutical companies in China to transform from generic drugs to innovative drugs. It has now accumulated rich research results and achieved good commercialization results in the domestic market. However, the overseas market is still a "pain point" for Hengrui. Whether it can leverage the Hong Kong stock market to solve the internationalization dilemma and achieve the leap from "China's King of Medicine" to "Global Pharmaceutical Company" through this listing on the Hong Kong stock market remains to be seen.

https://news.yaozh.com/archive/45525.html

By editorRead more on

- Rovaxitinib approved for marketing, filling the demand for myelofibrosis treatment March 2, 2026

- Warrant Pharmaceuticals’ active pharmaceutical ingredient receives Brazil’s first official GMP certification March 2, 2026

- Merck’s New Story March 2, 2026

- Rongchang Biotechnology has turned a profit! March 2, 2026

- Jiuyuan Gene’s “Simeglucopyranoside” for weight loss (Jikeqin®) has been submitted for market approval March 2, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.