A battle for survival for BTK inhibitors?

January 9, 2025

Source: drugdu

673

673

Recently, Sanofi's Rilzabrutinib was applied for listing in China for the treatment of immune thrombocytopenia (ITP). This means that the "six-strong competition" pattern in the domestic BTK inhibitor market has begun to emerge. The

Recently, Sanofi's Rilzabrutinib was applied for listing in China for the treatment of immune thrombocytopenia (ITP). This means that the "six-strong competition" pattern in the domestic BTK inhibitor market has begun to emerge. The

autoimmune

BTK inhibitor market is now a place of chaos.

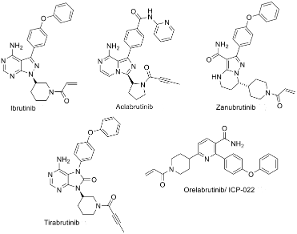

Before Sanofi's Rilzabrutinib was applied for listing, five BTK inhibitors had been approved in China, including AbbVie/Johnson & Johnson's ibrutinib, AstraZeneca's acotinib, BeiGene's zanubrutinib, Innovent's obeticholic steroids, and Eli Lilly's Pirtobrutinib. The indications are mainly concentrated in hematological tumors, and only a few have been approved for autoimmune diseases.

It can be seen that focusing on autoimmune indications has become a differentiated breakthrough path. Sanofi's Rilzabrutinib is the embodiment of this strategy.

The strong players in the autoimmune track are not only AbbVie and Johnson & Johnson, but also Sanofi's strength should not be underestimated. For example, the ace product Dupixent (dupixentumab) is a "super blockbuster" with annual sales of over 10 billion US dollars, and there are also rich autoimmune pipelines, including BTK inhibitor combination products.

Rilzabrutinib, which was listed in China, is an oral, reversible covalent BTK inhibitor. It was acquired by Sanofi through the acquisition of Principia Biopharma for nearly US$3.7 billion. It is currently under regulatory review in the United States and the European Union. The FDA's PDUFA date is August 29, 2025.

If approved, Rilzabrutinib will become the first BTK inhibitor to treat ITP. ITP is a serious acquired autoimmune blood disease characterized by a decrease in platelet count, which leads to easy bleeding and bruising. Severe bleeding may cause internal bleeding or intracranial hemorrhage, which is life-threatening.

In April 2024, Sanofi announced that the Phase III LUNA 3 study of Rilzabrutinib for the treatment of adult patients with persistent or chronic ITP reached the primary endpoint, and announced specific data at the ASH 2024 conference in August of the same year: the proportion of patients in the Rilzabrutinib group who had a sustained platelet response was significantly higher than that in the placebo group, and the safety was consistent with previous studies.

In addition to the ITP indication, Rilzabrutinib is also exploring more immune diseases, including IgG4-related diseases, chronic spontaneous urticaria, asthma, warm antibody-type autoimmune hemolytic anemia, nodular prurigo, etc. Sanofi expects that Rilzabrutinib is expected to become a "blockbuster" covering multiple indications, bringing the company peak sales of up to US$2.2 billion to US$5.5 billion.

It is worth mentioning that Tolebrutinib, another oral BTK inhibitor of Sanofi that can cross the blood-brain barrier, has also made a breakthrough: the HERCULES Phase III study for the treatment of non-relapsing secondary progressive multiple sclerosis (nrSPMS) has reached the primary endpoint, becoming the first and only drug that can delay the accumulation of disability in nrSPMS patients.

At present, Sanofi is completing the final preparations for submitting a new drug application for Tolebrutinib to the FDA, and is evaluating the potential for treating various types of multiple sclerosis in multiple Phase III trials.

Of course, Sanofi is not the only one to take the path of differentiated breakthrough.

Differentiated breakthrough

Since abnormal activation of BTK is not only related to a variety of hematological tumor diseases, but also closely related to a variety of autoimmune diseases, expanding to autoimmune indications has become one of the ways to break through.

In addition to Sanofi, many pharmaceutical companies around the world have conducted clinical studies on autoimmune diseases, including Novartis Remibrutinib, Roche Fenebrutinib, Innovent Biologics's Obeticholic Bacteria, and Hutchison Medicine/Chuangxiang Biopharma IMG-004.

As early as August 2023, Novartis announced that both Phase III REMIX-1 and REMIX-2 studies of Remibrutinib for the treatment of chronic spontaneous urticaria (CSU) achieved positive results, reaching all primary and secondary endpoints.

At present, Remibrutinib is submitting an application for listing. If approved, it will be expected to become the first new drug for the treatment of CSU in a decade. In addition, Novartis is also exploring the therapeutic potential of Remibrutinib for multiple sclerosis (MS), hidradenitis suppurativa (HS), chronic induced urticaria, food allergies and other diseases.

MS is an autoimmune central nervous system disease and the main cause of non-traumatic disability in young people. The onset is usually between 20 and 40 years old, and the number of patients is large (nearly 3 million people worldwide in 2022). Due to the long treatment cycle of patients (lifelong medication is required) and high willingness to treat, some "blockbuster" products have been born, such as Roche's ocrelizumab and Novartis's ofatumumab.

As a result, Roche further laid out the third-generation BTK inhibitor Fenebrutinib, which is currently in the Phase III stage.

In September 2024, Roche announced the latest results of the Phase II FENopta open-label extension (OLE) study: patients with relapsing multiple sclerosis (RMS) who received Fenebrutinib for up to 1 year maintained very low levels of disease activity and did not progress in disability. During the OLE period, 96% of patients had no relapse of the disease within 1 year.

In addition, Innovent's Obtunib, Eli Lilly's Pitonib, and Biogen's BIIB091 are all conducting clinical studies on MS. Among them, Obtunib has been approved by the FDA to conduct Phase III clinical studies for the treatment of primary progressive multiple sclerosis (PPMS) and secondary progressive multiple sclerosis (SPMS).

It is worth mentioning that Obtunib has been approved for multiple hematological tumors, including chronic lymphocytic leukemia (CLL)/small lymphocytic lymphoma (SLL), mantle cell lymphoma (MCL), marginal zone lymphoma (MZL), etc. In particular, with the differentiated advantage of being the first and only approved drug for MZL in China, Obtunib achieved a year-on-year revenue growth of 45% to 693 million yuan in the first three quarters of 2024.

In the field of autoimmunity, Obtunib is also advancing Phase III clinical trials for the treatment of ITP, Phase IIb studies for the treatment of systemic lupus erythematosus (SLE), and Phase II studies for neuromyelitis optica spectrum disorders (NMOSD), as well as potential indications such as CSU and HS.

However, in this battle of survival, it is difficult to break through and maintain a long-term balance by simply expanding autoimmune indications.

The battle of survival

is becoming increasingly competitive as many pharmaceutical companies flock to it.

According to public information, at least 20 BTK inhibitors in China have entered the clinical research stage. In terms of generic drugs, the core patent of ibrutinib will expire on December 28, 2026, and at least 10 domestic pharmaceutical companies have laid out generic drugs for ibrutinib.

A phenomenon that cannot be ignored is that due to the crowded track, Shouyao Holdings issued an announcement that it would adjust the subsequent development strategy of SY-1530, actively terminate the clinical development of monotherapy for relapsed/refractory MCL and other B-cell non-Hodgkin's lymphomas, and plan to explore the potential of the drug in other indications.

On the other hand, Eli Lilly chose to hand over the import, sales, promotion and distribution rights of the third-generation BTK inhibitor Pitobrutinib in mainland China to Innovent Biologics. Such a strong combination strategy will undoubtedly help to form stronger competitiveness and jointly resist market risks.

Pitobrutinib was obtained by Eli Lilly with a huge $8 billion acquisition of Loxo Oncology. It is the world's first and only approved non-covalent (reversible) BTK inhibitor. Because it does not bind to the C481 site, it shows the potential to overcome resistance to covalent BTKI.

It is worth mentioning that in order to verify the strength of BIC globally, Pitobrutinib adopted a "one-on-three" strategy and conducted head-to-head clinical trials of ibrutinib, zanubrutinib, and acalabrutinib.

At present, Pitobrutinib has been approved in the United States for the treatment of MCL and CLL/SLL, and in October 2024 it was approved in China for the treatment of adult patients with relapsed or refractory MCL who had previously received at least two systemic treatments (including BTK inhibitors). In the first half of 2024, global sales of Pitobrutinib reached US$142 million. Eli Lilly expects that the drug's annual sales in the chronic lymphocytic leukemia market will reach US$3 billion in 2030.

You know, the reason why BeiGene's zanubrutinib has achieved rapid growth in sales revenue and continued to seize ibrutinib's market share is inseparable from its head-to-head victory over ibrutinib.

In addition, some pharmaceutical companies have also reached out to the BTK inhibitor resistance market, developing BCL-2 inhibitors, BTK PROTAC, etc.

In terms of BCL-2 inhibitors, AbbVie's Venclexta (Venecla) combined with ibrutinib has shown excellent efficacy in clinical studies; BeiGene's Sonrotoclax combined with zanubrutinib to treat R/R CLL/SLL patients showed an overall response rate (ORR) of 97% and a complete response (CR) rate of 57%; Innovent Biologics's obeticholic acid combined with ICP-248 first-line treatment of CLL/SLL is in clinical phase II/III.

Ascent Pharmaceuticals' APG-2575 combined with AstraZeneca's acotinib first-line treatment of CLL/SLL patients is in phase III; Zhengda Tianqing's BCL-2 inhibitor TQB3909 showed an ORR of 83.3% and a CR/CRi of 41.7% in R/R CLL/SLL patients resistant to BTK inhibitors in phase I studies.

In addition, BeiGene's BTK degrader BGB-16673 has also shown preliminary efficacy: the ORR for patients with Waldenstrom's macroglobulinemia (WM) is 90%, and it has shown good anti-tumor activity in patients with R/R WM who have received a large number of BTK inhibitors (including patients with BTK and CXCR4 mutations).

Currently, BGB-16673 is being simultaneously studied in Phase I/II clinical trials in many countries around the world. It has also been granted a fast track designation by the FDA for the treatment of adult patients with R/R CLL/SLL who have previously received at least two lines of treatment (including BTK inhibitors and BCL2 inhibitors).

From the above, it can be seen that the battle for the survival of BTK inhibitors has been fully launched, and major pharmaceutical companies are doing their best to compete for market share. Domestic pharmaceutical companies such as BeiGene and Innovent Biologics are constantly improving the competitiveness of their products through head-to-head trials and combination therapy.

https://news.yaozh.com/archive/44780.html

By editorRead more on

- Gan & Lee Pharmaceuticals’ new PROTAC drug GLR2037 tablets have been approved for clinical trials to enter the field of prostate cancer treatment March 3, 2026

- AideaPharmaceuticals plans to raise no more than 1.277 billion yuan through a private placement to focus on the global clinical development of innovative HIV drugs March 3, 2026

- Giant Exits! Its Star Business Acquired March 3, 2026

- Focusing on cardiovascular and cerebrovascular diseases! OpenMediLead Medical Intelligence Dual Engines Launch Internal Testing, Connecting Drug Development and Clinical Diagnosis in a Closed Loop March 3, 2026

- Innovent Biologics Announces Approval of New Indication for BTK Inhibitor “Pitubrutinib” in China March 3, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.