270 million! Chinese medicine giant acquires 100% equity of innovative pharmaceutical company

November 14, 2024

Source: drugdu

428

428

Chinese medicine companies are beginning to acquire innovative pharmaceutical companies.

01

270 million yuan

Kangyuan Pharmaceutical acquires 100% equity of Zhongxin Pharmaceutical

On November 7th, Kangyuan Pharmaceutical released an announcement on the acquisition of 100% equity of Jiangsu Zhongxin Pharmaceutical Co., Ltd. and related party transactions. It plans to acquire 100% equity of Zhongxin Pharmaceutical with its own funds of 270 million yuan.

After the completion of this transaction, Zhongxin Pharmaceutical will become a wholly-owned subsidiary of Kangyuan Pharmaceutical. In this transaction, Kangyuan Pharmaceutical's controlling shareholder Kangyuan Group holds 70% equity of Zhongxin Pharmaceutical, corresponding to a transfer price of 189 million yuan. Kangyuan Pharmaceutical will make the first payment of 60%, or 113.4 million yuan, to Kangyuan Group, and the remaining 40%, or 75.6 million yuan, will be paid in installments after the corresponding pipeline drugs of Zhongxin Pharmaceutical obtain marketing authorization. Nanjing Kangzhu Enterprise Management Partnership (Limited Partnership) holds 30% equity of Zhongxin Pharmaceutical, with a corresponding transfer price of 81 million yuan. Kangyuan Pharmaceutical will make a one-time payment.

In this transaction, Kangyuan Pharmaceutical's controlling shareholder Kangyuan Group holds 70% equity of Zhongxin Pharmaceutical, corresponding to a transfer price of 189 million yuan. Kangyuan Pharmaceutical will make the first payment of 60%, or 113.4 million yuan, to Kangyuan Group, and the remaining 40%, or 75.6 million yuan, will be paid in installments after the corresponding pipeline drugs of Zhongxin Pharmaceutical obtain marketing authorization. Nanjing Kangzhu Enterprise Management Partnership (Limited Partnership) holds 30% equity of Zhongxin Pharmaceutical, with a corresponding transfer price of 81 million yuan. Kangyuan Pharmaceutical will make a one-time payment.

270 million yuan is not a small amount for Kangyuan Pharmaceutical. In the first three quarters of 2024, Kangyuan Pharmaceutical achieved a net profit attributable to its parent company of 357 million yuan, and the acquisition expenses of 270 million yuan accounted for almost 75% of Kangyuan Pharmaceutical's net profit attributable to its parent company in the first three quarters of this year.

Moreover, Kangyuan Pharmaceutical stated that the initial budget for the four core pipelines of New Pharma still requires approximately 400 million yuan in clinical funds. Therefore, from the completion of this transaction to the profitability stage of the core pipelines, it will need to continue investing in New Pharma's research and development expenses, capital expenditures, and debt repayment. In addition, as of September 30th this year, Zhongxin Pharmaceutical still has a total loan principal and interest of approximately 479 million yuan from Kangyuan Group.

If the two potential investments mentioned above and the 270 million yuan required for the acquisition of 100% equity are added, the total funds paid by Kangyuan Pharmaceutical after including Zhongxin Pharmaceutical as a wholly-owned subsidiary have reached at least 1.149 billion yuan.

However, in the view of Kangyuan Pharmaceutical, this acquisition can better promote its development strategy of one body and two wings, achieve complementary advantages and industrial synergy with Zhongxin Pharmaceutical, and help further enhance its competitiveness.

As a biopharmaceutical research and development company, Zhongxin Pharmaceutical's core technology is to design and confirm the function of drug molecules through genetic engineering. At present, Zhongxin Pharmaceutical has obtained 6 clinical approvals for 4 innovative drugs, including (rhNGF) recombinant human nerve growth factor injection, (rhNGF) recombinant human nerve growth factor eye drops, (GGGF1) triple target long-acting weight loss (hypoglycemic) fusion protein, and (GGF7) dual target long-acting weight loss (hypoglycemic) fusion protein, two of which are GLP-1 products and have entered the clinical stage.

At the same time, Zhongxin Pharmaceutical has a molecular design technology platform and a complete set of biological macromolecule cell culture, separation and purification, biologics, quality characterization, and biological evaluation technologies, which can provide guarantees for the continuous development of current and future innovative biopharmaceuticals.

Undoubtedly, this acquisition is an important step for Kangyuan Pharmaceutical to accelerate its layout and development in the field of bio innovative drugs. However, the acquisition is only the first step, and the development of Kangyuan Pharmaceutical still faces a series of uncertainties in the future.

Firstly, Kangyuan Pharmaceutical's main commercial products and revenue sources are currently traditional Chinese medicine products, which have certain differences in drug categories compared to the innovative biopharmaceutical products developed by Zhongxin Pharmaceutical. As a latecomer to GLP-1, how can Kangyuan Pharmaceutical seize the market?

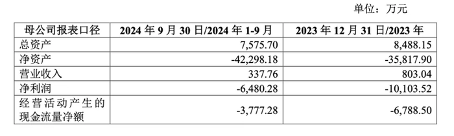

Secondly, Zhongxin Pharmaceutical currently has no commercial product sales, so it is in a continuous loss making state, and will still need to invest a large amount of funds in the research and development of core pipelines in the future. According to the data, as of September 30, 2024, the total assets of Zhongxin Pharmaceutical were approximately 75.757 million yuan, and the net assets were approximately -423 billion yuan. In the future, Kangyuan Pharmaceutical faces risks such as new drug development failure or slower than expected progress, which will have a certain impact on its net profit and cash flow at the merger level.

New pharmaceutical financial data in the picture; Screenshot self announcement

02

Set up a betting agreement

Optimistic about the development of GLP-1 market In this acquisition, Kangyuan Pharmaceutical has set up betting clauses for the 70% equity transfer of Zhongxin Pharmaceutical by Kangyuan Group and the 30% equity transfer of Zhongxin Pharmaceutical by Nanjing Kangzhu.

In this acquisition, Kangyuan Pharmaceutical has set up betting clauses for the 70% equity transfer of Zhongxin Pharmaceutical by Kangyuan Group and the 30% equity transfer of Zhongxin Pharmaceutical by Nanjing Kangzhu.

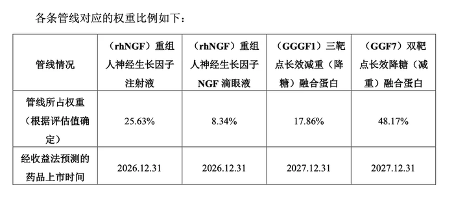

Among them, regarding the 70% equity transfer of Zhongxin Pharmaceutical by Kangyuan Group, the weight ratios corresponding to each pipeline of the betting terms are set as follows:The (GGGF1) triple target long-acting weight loss (hypoglycemic) fusion protein and the (GGF7) dual target long-acting weight loss (hypoglycemic) fusion protein are both GLP-1 class drugs, accounting for approximately 66% of the total assets evaluated. Kangyuan Pharmaceutical believes that GLP-1 drugs have received significant market attention, and overseas pharmaceutical giants have given relatively high valuations to GLP-1 assets; This evaluation did not take into account the overseas commercialization rights of Zhongxin Pharmaceutical's related products, and the evaluation value is much lower than the market valuation of similar product pipelines.

Kangyuan Pharmaceutical believes that GLP-1 drugs have received significant market attention, and overseas pharmaceutical giants have given relatively high valuations to GLP-1 assets; This evaluation did not take into account the overseas commercialization rights of Zhongxin Pharmaceutical's related products, and the evaluation value is much lower than the market valuation of similar product pipelines.

The GLP-1 drug market is booming, and according to research firm Frost&Sullivan, the market size of GLP-1 drugs in China will exceed 50 billion yuan by 2030.

Although the timing for Kangyuan Pharmaceutical to generate revenue through product commercialization is still early, it cannot be ruled out that it may have the opportunity to obtain higher returns through GLP-1 class drug BD in the future.

The research and development of innovative biopharmaceuticals has always had high technical and talent barriers. As a strong traditional Chinese medicine enterprise, Kangyuan Pharmaceutical hopes to enrich its pipeline in the biopharmaceutical field and develop new disease treatment areas to meet unmet major clinical needs through this acquisition.

For the layout and development of the biopharmaceutical field, Kangyuan Pharmaceutical has long mentioned in its development strategy that "taking the development of traditional Chinese medicine as the main body and actively layout in the fields of chemical medicine and biopharmaceuticals". In the first three quarters of 2024, Kangyuan Pharmaceutical invested nearly 467 million yuan in research and development, ranking fifth in the industry.

However, Kangyuan Pharmaceutical's accelerated layout in chemical and biological drugs may be related to the growth rate of its performance.

In 2024, Kangyuan Pharmaceutical achieved a revenue of 3.11 billion yuan in the first three quarters, a year-on-year decrease of 11.06%; Net profit attributable to the parent company was 357 million yuan, a year-on-year increase of 2.18%; Deducting non net profit of 285 million yuan, a year-on-year decrease of 10.16%. Yang Yongchun, the general manager of Kangyuan Pharmaceutical, has publicly stated that it will continue to strengthen the base drug market, accelerate the launch of new drugs such as formula granules, and strive to achieve a revenue scale of billions.

As of now, Kangyuan Pharmaceutical still has a gap between its revenue and the scale of billions.

Under the intensified competition in the pharmaceutical industry, Kangyuan Pharmaceutical has begun to strive for longer-term development through "mergers and acquisitions".

Read more on

- Gan & Lee Pharmaceuticals’ new PROTAC drug GLR2037 tablets have been approved for clinical trials to enter the field of prostate cancer treatment March 3, 2026

- AideaPharmaceuticals plans to raise no more than 1.277 billion yuan through a private placement to focus on the global clinical development of innovative HIV drugs March 3, 2026

- Giant Exits! Its Star Business Acquired March 3, 2026

- Focusing on cardiovascular and cerebrovascular diseases! OpenMediLead Medical Intelligence Dual Engines Launch Internal Testing, Connecting Drug Development and Clinical Diagnosis in a Closed Loop March 3, 2026

- Innovent Biologics Announces Approval of New Indication for BTK Inhibitor “Pitubrutinib” in China March 3, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.