The Rise of Domestic Production

January 1, 2025

Source: drugdu

893

893

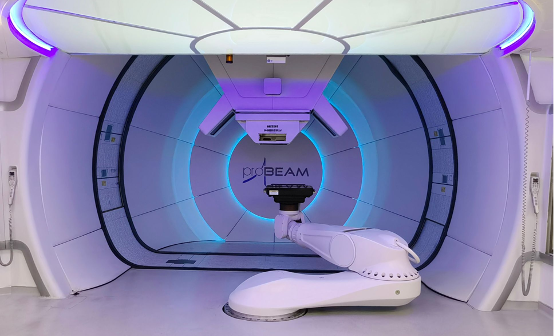

Proton therapy is known as the "crown jewel" of tumor radiotherapy for its excellent performance, representing the highest level of radiotherapy technology. This technology utilizes the high-energy properties of proton beams to accurately strike tumor tissues while minimizing damage to surrounding normal tissues, bringing unprecedented treatment hope to cancer patients. According to the latest statistics, the number of proton heavy ion therapy centers worldwide has exceeded one hundred, which fully demonstrates the widespread recognition and application of proton therapy technology worldwide. According to market predictions, the global proton therapy market is expected to reach nearly 1.6 billion US dollars by 2031, which fully reflects the enormous potential and broad prospects of proton therapy technology.

Proton therapy is known as the "crown jewel" of tumor radiotherapy for its excellent performance, representing the highest level of radiotherapy technology. This technology utilizes the high-energy properties of proton beams to accurately strike tumor tissues while minimizing damage to surrounding normal tissues, bringing unprecedented treatment hope to cancer patients. According to the latest statistics, the number of proton heavy ion therapy centers worldwide has exceeded one hundred, which fully demonstrates the widespread recognition and application of proton therapy technology worldwide. According to market predictions, the global proton therapy market is expected to reach nearly 1.6 billion US dollars by 2031, which fully reflects the enormous potential and broad prospects of proton therapy technology.

As 2024 is coming to an end, Instrumental Home has conducted a statistical analysis of the progress of proton therapy system projects in mainland China (based on public reports), and found that there are already 7 operating proton therapy centers and 17 projects under construction.

01. Seven proton therapy projects in operation

Proton therapy stands out in the field of tumor radiotherapy due to its unique physical and biological characteristics. Compared with traditional radiotherapy techniques, proton therapy can achieve more precise dose distribution, allowing tumor tissues to receive higher doses of radiation while surrounding normal tissues receive significantly reduced radiation. This precise strike ability not only improves treatment effectiveness, but also significantly reduces treatment side effects and improves patients' quality of life.

There are currently 7 proton therapy centers in operation in mainland China, and with the continuous promotion and completion of new projects, this number is expected to continue to rise. Currently, three out of the seven projects in operation are using Varian products, two are using IBA, and one is each from domestic Aipuqiang and Maisheng. This basically reflects the current situation of the proton therapy equipment market. IBA is the largest supplier of proton therapy equipment in the world, with a market share of about half in the proton equipment field, while Varian's market share is second only to IBA. However, Varian China has production bases, so it may have an advantage in the Chinese market. In addition, domestic products are also on the rise, and Aipuqiang and Maisheng also have a place in the Chinese market.

02. There are 17 projects under construction

Entering the 14th Five Year Plan period, the National Health Commission will further increase the allocation of proton radiation therapy systems. On June 29, 2023, the "14th Five Year Plan for Large scale Medical Equipment Configuration Planning" was released, which clearly stated that 41 heavy ion proton radiotherapy systems will be planned and configured nationwide. Subsequently, in a notice on October 7th of the same year, the planned approval quantity was adjusted to 31 units, and ultimately 21 medical institutions were approved, of which 14 units were proton therapy systems.

On February 8, 2024, the National Health Commission issued another notice to adjust the configuration plan of large-scale medical equipment during the 14th Five Year Plan period, adding 8 sets of heavy ion proton radiotherapy systems specifically for social medical institutions. This policy adjustment aims to promote the rapid development of social healthcare and provide high-quality proton therapy services for more patients.

In addition, on September 6, 2024, the National Health Commission launched the second round of application for Class A large-scale medical equipment configuration permits, planning a total of 17 heavy ion proton radiotherapy systems. At present, the round of configuration application and approval work is in full swing, and it is expected that more medical institutions will join the configuration of proton therapy systems.

The following are currently 17 proton therapy projects under construction (some of which may not have public information, so they were not included in the statistics, and some projects cannot find information about product manufacturers in public information, so they were not labeled). At present, there are 8 proton centers under construction that are domestically produced, including Maisheng, Zhongke Ion, and CGN. Maisheng Medical has a significant advantage in small equipment, with a total of 5 companies using it. Of course, IBA still has an absolute advantage, with 5 companies using it. CGN's proton therapy products are in cooperation with IBA company. CGN Technology introduced IBA's globally leading multi chamber proton therapy technology in 2020, and through digestion, absorption, and re innovation of the introduced technology, achieved the localization and localization of world-class proton therapy equipment.

03. Proton therapy equipment provider

With the rapid development of proton therapy technology worldwide, more and more medical equipment providers are entering this field. Here are 15 leading proton therapy equipment providers from around the world.

Varian Medical

Varian Medical Systems was founded in 1948 and is a leading global provider of diagnostic and treatment solutions for cancer and other major diseases. It was also the first high-tech company to settle in Silicon Valley, California, USA. Varian has over 70 branches worldwide and production bases in the United States, Europe, and China. Since the 1990s, Varian has been involved in the development and research of proton therapy technology, and officially entered the proton therapy system market in 2009, quickly establishing a proton therapy business with superconducting cyclotrons and pen beam scanning technology as advanced technology platforms. It was acquired by Siemens Healthineers in 2021.

IBA

IBA (Ion Beam Applications S.A.) was founded in 1986 and is a world leader in particle accelerator technology, as well as the world's largest supplier of proton therapy equipment. IBA's proton therapy device has treated over 110000 patients worldwide, including over 8000 cases of pediatric patients. In August 2020, IBA reached a cooperation agreement with CGN and signed the "Multi Room Proton Therapy System Technology License Agreement" and "Strategic Cooperation Agreement" to jointly promote the localization and autonomy of proton therapy technology.

ProNova Healthcare

The predecessor of Provision Healthcare was CTI, the world's largest PET-CT equipment company, which focused on proton therapy equipment after being acquired by Siemens in 2006. Its ProNova Solutions division has developed the ProNova SC360 proton therapy system, which is the first and only superconducting compact proton therapy system, providing a complete 360 ° treatment angle.

P-Cure

P-Cure was founded in 2007 and has developed a patient-centered comprehensive proton therapy solution. Its P-Cure solution eliminates the need for highly shielded multi-layer centers, enabling the construction of proton therapy rooms within existing radiation oncology departments and halving the cost of proton centers of equal size. P-Cure uses pen shaped beam proton scanning, combined with FDA approved indoor high-quality imaging 4D CT, to achieve better proton beam transmission.

Leo Cancer Care

Leo Cancer Care was founded in Australia by an internationally renowned radiation therapy team, which has developed a streamlined new radiation therapy system with integrated shielding capabilities. Its Marie ™ The system includes a unique upright patient positioning system and CT scanner, allowing simulation and treatment to be performed in one place. Leo Cancer Care's research has shown that treating patients in an upright position has many benefits.

B dot Medical

B dot Medical is a startup company dedicated to developing ultra compact proton therapy systems. The proton therapy system designed by it does not require a rotating frame and uses superconducting magnets to bend the proton beam, greatly reducing the system volume. This system is easy to install in newly built proton hospitals or general X-ray tumor treatment system spaces.

Hitachi, Ltd

Hitachi has developed Japan's first point scanning proton therapy system and began treating patients at Nagoya Proton Therapy Center in 2013. The pen shaped beam scanning proton therapy device is the first proton therapy device of this type to obtain FDA approval in the United States. In response to the global demand for small proton therapy systems, Hitachi has developed a compact proton therapy system specifically designed for individual treatment rooms.

Sumitomo Heavy Machinery

Sumitomo Heavy Industries, Ltd. is one of the world's first proton system suppliers, and its new generation proton therapy system is a multi chamber type that will accommodate two treatment rooms with rotating frames and one space for future amplification. The system is equipped with a superconducting cyclotron that outputs a powerful proton beam.

OPTIVUS

OPTIVUS is the creator of the world's first hospital based proton beam cancer treatment center, and its Conforma 3000 system has over 30 years of practical treatment experience, representing the sixth generation of conformal proton beam radiation technology. The system is designed to be modular and scalable, and can be expanded according to needs and resources.

THERYQ

THERYQ is located in the south of France and specializes in designing and producing radiation therapy machines that include linear accelerators. Its Flashdeep device is the world's first revolutionary Flash radiation therapy device, which will use ultra-high energy electron radiation to treat drug-resistant cancer.

Advanced Oncotherapy

The LIGHT system developed by Advanced Oncotherapy adopts a modular design, with lighter weight and higher proton transfer efficiency. This system can implement Flash particle therapy technology and maintain full output at any energy level.

ProTom International

ProTom International specializes in developing proton therapy centers with smaller spaces than conventional proton therapy devices using small accelerators. Its Radiance 330 ® The system adopts advanced pencil beam scanning technology, provides proton therapy, and supports single room, multi room, and expandable configurations.

Aipuqiang

Aipuqiang Shanghai Aipuqiang Particle Equipment Co., Ltd. was established in 2011 and is a proton radiotherapy equipment industrialization company targeting the Chinese market. The proton therapy equipment developed by it underwent clinical trials at the Cancer Proton Center of Ruijin Hospital affiliated with Shanghai Jiao Tong University School of Medicine in 2021, and was approved for market by NMPA in September 2022, marking a new step in the localization of high-end medical devices in China.

Maisheng Medical

Maisheng Medical Group is a pioneer in the field of miniaturized proton therapy. Its proton therapy equipment is the world's first integrated, cost-effective single and multi chamber parallel proton therapy system. As of 2022, Maisheng Medical has the highest market share in the single room proton equipment field in the United States.

Zhongke Ion

Hefei Zhongke Ionic Medicine Technology Equipment Co., Ltd. was established in 2016 and is an independent research and development unit of Hefei Ionic Medicine Center. The proton therapy system based on a compact superconducting cyclotron developed by it has obtained a patent and successfully achieved a stable proton beam of 200MeV from the treatment room, marking the successful development of the world's most compact superconducting cyclotron proton therapy system domestically produced.

The above 15 proton therapy equipment manufacturers have been committed to the fight against diseases such as tumors, and in recent years, the Chinese power in this industry has gradually emerged. Of course, this is closely related to the rapid development of proton therapy as an advanced cancer treatment method in China in recent years. According to incomplete public information statistics, the total number of proton projects currently in operation, under construction, and planned in China has reached 49.

Source: http://qixieke.com/Font/index/detailPage.html?id=3312-32

By editorRead more on

- Gan & Lee Pharmaceuticals’ new PROTAC drug GLR2037 tablets have been approved for clinical trials to enter the field of prostate cancer treatment March 3, 2026

- AideaPharmaceuticals plans to raise no more than 1.277 billion yuan through a private placement to focus on the global clinical development of innovative HIV drugs March 3, 2026

- Giant Exits! Its Star Business Acquired March 3, 2026

- Focusing on cardiovascular and cerebrovascular diseases! OpenMediLead Medical Intelligence Dual Engines Launch Internal Testing, Connecting Drug Development and Clinical Diagnosis in a Closed Loop March 3, 2026

- Innovent Biologics Announces Approval of New Indication for BTK Inhibitor “Pitubrutinib” in China March 3, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.