GSK delivers further progress in Q2 and sets out new priorities for the Group

August 4, 2017

Source: www.gsk.com/

706

706

GSK delivers further progress in Q2 and sets out new priorities for the Group

Issued: London UK

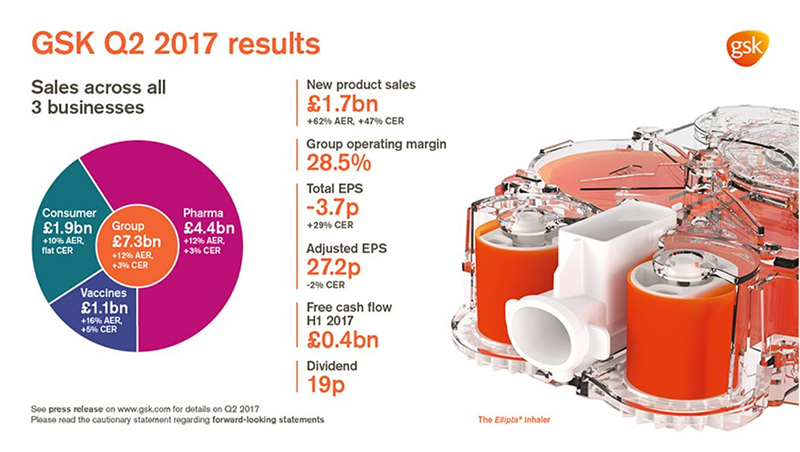

Q2 sales of £7.3 billion, +12% AER, +3% CER

Total loss per share of 3.7p, +59% AER, +29% CER; Adjusted EPS of 27.2p, +12% AER, -2% CER

Financial highlights

- Pharmaceutical sales, £4.4 billion, +12% AER, +3% CER, Vaccines sales, £1.1 billion, +16% AER, +5% CER, Consumer Healthcare sales, £1.9 billion,+10% AER, flat at CER

• Group operating margin 28.5%; Pharmaceuticals 33.6%; Vaccines 33.7%; Consumer 17.7%

• Total Q2 loss per share of 3.7p reflecting charges resulting from increases in the valuation of Consumer and HIV businesses and new portfolio choices

• Updated 2017 guidance: Adjusted EPS growth now expected to be 3% to 5% CER reflecting impact of Priority Review Voucher

• H1 Free Cash Flow £0.4 billion (H1 2016: £0.1 billion)

• 19p dividend declared for Q2; continue to expect 80p for FY 2017

Product and pipeline highlights

- New product sales of £1.7 billion, +62% AER, +47% CER

• HIV two drug regimen (dolutegravir and rilpivirine) filed for approval in US and EU

• Shingrix filed for approval in Japan

• FDA approval received for subcutaneous Benlysta for treatment of SLE

New business priorities to 2020

- New priorities to strengthen innovation, improve performance and build trust

• Pharmaceutical R&D pipeline reviewed with target over time to allocate 80% of capital to priority assets in two current (Respiratory and HIV/infectious diseases) and two potential (Oncology and Immuno-inflammation) therapy areas; more than 30 pre-clinical and clinical programmes to be stopped

• Extended cost reduction programme expected to deliver additional £1 billion annual cost savings by 2020 driven by new business priorities, improved supply chain efficiency and reduced administrative costs

• Enhanced focus on improved cash generation and strengthening credit profile

• Dividend of 80p expected for 2018 in conjunction with new dividend policy

• Group outlook for 2020: Expected 5 year percentage CAGR to 2020 on a CER basis for sales of low-to-mid-single digits and Adjusted EPS of mid-to-high single digits

Emma Walmsley, Chief Executive Officer, GSK said:

“Q2 was another quarter of progress for GSK with Group sales up 3% to £7.3 billion and Adjusted EPS of 27.2p. Our priority for the second half of the year is to maintain this momentum and prepare for the successful execution of several important near-term launches in Respiratory, Vaccines and HIV.

“Today we are updating our full year earnings guidance to reflect the investments we have made to accelerate the review of our new two drug regimen in HIV. We are also providing an update to investors on the longer-term outlook for the Group and our priorities to improve innovation, performance and trust in GSK.”

By editor

Read more on

- Drugdu.com’s 4 most Popular Veterinary APIs and Veterinary medicine Suppliers September 6, 2018

- 4 Pharmaceutical Machinery Packaging and Materials Suppliers September 6, 2018

- 3 ENT Equipment and Medical Anaesthesia Equipment Suppliers September 6, 2018

- Need Natural Plant Extracts? Here are 4 Suppliers! September 6, 2018

- Healthcare Products & Food Additives Suppliers for International Companies September 6, 2018

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.