Turnaround! Generic drug giant successfully “revived”

February 9, 2026

Source: drugdu

28

28

Recently, Teva Pharmaceuticals, an Israeli multinational pharmaceutical company, released its 2025 financial report. The company achieved total revenue of $17.3 billion, a 4% year-on-year increase in US dollar terms; net profit of $1.42 billion, successfully reversing the losses of the same period in 2024; and free cash flow of $2.4 billion, a 16% year-on-year increase.

Notably, Teva has achieved revenue growth for three consecutive years . Revenue from its innovative drug portfolio exceeded $3.1 billion, representing a year-on-year increase of approximately 35%, becoming the core engine driving the company's transformation.

01

Three new drugs continue to see increased sales volume

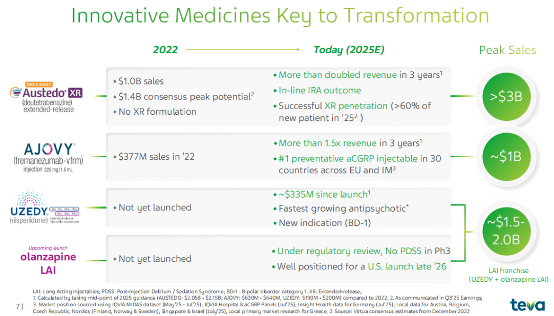

In recent years, Teva's revenue from innovative drugs has continued to increase, from 9% in 2022 to about 18% in 2025.

Image source: Teva official website

Image source: Teva official website

Austedo (deuterated benzidine) is its most important innovative drug to date. Approved for marketing in 2017, it was the world's first approved deuterated drug for the treatment of tardive dyskinesia and Huntington's disease.

Austedo’s sales revenue reached $2.26 billion in 2025, a year-on-year increase of 34% , and it is projected that its sales will reach $2.5 billion in 2026, with a peak sales of $3 billion.

In addition, Teva developed AUSTEDO XR (an extended-release formulation), which offers significant convenience by requiring only once-daily dosing, outperforming competitors in terms of patient compliance and simplified treatment. Currently, the XR formulation is rapidly penetrating the market, accounting for over 60% of new patients, becoming a key driver for the company to maintain and expand its market share in the tardive dyskinesia field.

Ajovy and Uzedy also delivered outstanding performances.

Ajovy (remannetumab) saw revenue grow 30% to $673 million. This drug, a calcitonin gene-related peptide (CGRP) antagonist used for migraine prevention, is ranked number one in new prescriptions at top headache centers in the United States and holds a leading position in 30 countries across Europe and international markets.

In August 2025, AJOVY received FDA approval in the United States to expand its indication to include the preventative treatment of episodic migraine in children and adolescents aged 6-17 years. With the expansion of its pediatric indications and the continued growth in the international market, AJOVY is expected to maintain strong growth, with Teva projecting sales of $750-790 million in 2026.

Uzedy (risperidone long-acting injectable) revenue grew 63% to $191 million. This improved new drug utilizes Medincell's SteadyTeq copolymer technology to achieve stable drug release. Since its approval in the US in April 2023, Uzedy prescriptions have steadily increased, making it the fastest-growing brand among long-acting injectable atypical antipsychotics in the US.

In 2025, the FDA approved its expanded indication to include adults with type I bipolar disorder (BD-I), further broadening its market reach.

With increased market penetration, the product is projected to generate $250-280 million in sales in 2026, and is expected to become another blockbuster product in Teva Neuroscience with annual sales exceeding $1 billion.

Teva has submitted a marketing application in the United States for another long-acting olanzapine injection (TEV-'749), a psychiatric drug developed in collaboration with MedinCell . This injection is expected to become the first long-acting olanzapine injection without post-injection delirium/sedation syndrome. Its Phase 3 SOLARIS study showed no PDSS events during the one-year study, and the overall safety data were consistent with the oral olanzapine formulation.

02

The pipeline under development is worth tens of billions of US dollars.

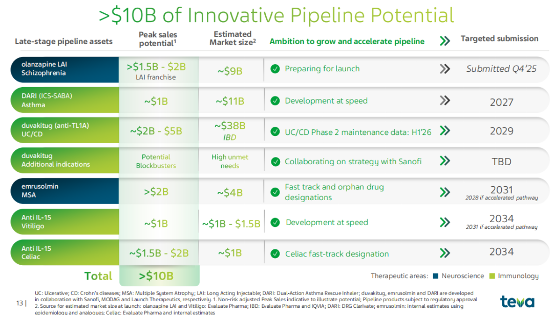

In addition to the strong performance of its existing innovative drugs, Teva estimates that its pipeline of drugs in development will reach peak sales of over $10 billion, covering multiple major disease areas such as inflammatory bowel disease and asthma.

Image source: Teva official website

Image source: Teva official website

Currently, Teva's most attention-grabbing pipeline is the Duvakitug, developed in collaboration with Sanofi .

This is an antibody drug targeting TL1A, used to treat inflammatory bowel disease (IBD). Merck and Roche have already paid $10.8 billion and $7.1 billion respectively to acquire pipelines in this field, reflecting the intense competition and enormous commercial potential of this sector.

In 2023, Teva reached a collaborative development agreement with Sanofi for Duvakitug, receiving an upfront payment of $500 million and milestone payments of up to $1 billion.

Currently, Phase 3 studies of the drug for ulcerative colitis (UC) and Crohn's disease (CD) have been initiated and enrollment has begun, which has triggered a $500 million development milestone payment from Sanofi.

Phase 2 studies showed that after 14 weeks of treatment with duvakitug, the clinical response rate was 27.4% in the high-dose group of UC patients and 34.8% in the high-dose group of CD patients after placebo adjustment. Teva will release 58-week maintenance treatment data in the first half of 2026, which is key to evaluating long-term efficacy.

In the autoimmune field, Teva also has an anti -IL-15 antibody (TEV-'408) , and has previously entered into a $500 million collaboration agreement with Royalty Pharma. Phase 1b data for vitiligo is expected to be released in the first half of 2026, and Phase 2a data for celiac disease is expected in the second half of 2026. Potential indications also include alopecia areata, atopic dermatitis, and eosinophilic esophagitis.

Teva is also developing DARI, an ICS/SABA (inhaled corticosteroid/short-acting β2 receptor agonist) combination for asthma , covering children, adolescents, and adults, and is expected to become a differentiated product. The product is expected to meet its enrollment target for the Phase 3 FLAIR study by the end of 2025, and recruitment will continue to accelerate the achievement of the primary endpoint. A DPI vs MDI device differentiation study is planned for 2026.

03

Stabilize the basics of generic drugs

Despite increasing its investment in innovative drug development, Teva has not abandoned its foundation in generic and biosimilar drugs.

In 2025, Teva's global generic drug business (excluding Japan) remained flat compared to 2024, representing a two-year CAGR of 6%. The stability of the generic drug business reflects Teva's leading position in the global generic drug market. The company covers 60-80% of small molecule drugs with LoE patents and boasts a diversified global footprint.

Biosimilars are the most promising segment of Teva's generic drug business. According to Teva's financial reports, it boasts the industry's second-largest biosimilar portfolio and has launched the most products since 2020. The company expects its biosimilar revenue to double from approximately $400 million in 2024 to $800 million in 2027.

It is worth noting that since 2025, the FDA and EMA have gradually relaxed the Phase 3 clinical trial requirements for biosimilars. If Phase 3 clinical trials become a non-essential condition for biosimilar approval, their development cycle and costs will be significantly reduced. As a global generic drug giant, Teva is expected to further consolidate its competitive advantage by leveraging its mature R&D system, large-scale production capacity, and extensive market channels.

https://news.yaozh.com/archive/47126.html

By editorRead more on

- Phase III clinical trial of vetcotozumab completes patient enrollment February 9, 2026

- The first long-acting coagulation factor VIII, has officially entered the Chinese mainland market. February 9, 2026

- 17.9 billion yuan! A top-selling topical medication emerges. February 9, 2026

- Novartis’s first-ever autoimmune drug has been submitted for marketing approval in China. February 9, 2026

- A world first! A serum-free rabies vaccine is about to be launched, marking a major breakthrough in safety. February 9, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.