The first major pharmaceutical merger in 2025

January 20, 2025

Source: drugdu

405

405

On January 13, Johnson & Johnson announced that it had reached a final agreement with Intra-Cellular Therapies to acquire all outstanding shares of the latter at a price of US$132 per share, with a total transaction value of approximately US$14.6 billion.

On January 13, Johnson & Johnson announced that it had reached a final agreement with Intra-Cellular Therapies to acquire all outstanding shares of the latter at a price of US$132 per share, with a total transaction value of approximately US$14.6 billion.

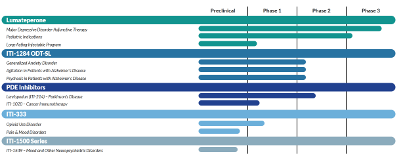

Intra-Cellular Therapies is a biopharmaceutical company focused on the development and commercialization of drugs for the treatment of central nervous system (CNS) diseases. Its core asset is a once-daily oral antipsychotic product Caplyta (lumateperone). The drug is a 5-hydroxytryptamine 2A (5-HT2A) receptor antagonist and dopamine receptor D2 modulator, first developed by Bristol-Myers Squibb (BMS). In 2015, Intra-Cellular Therapie obtained a license from BMS for global development.

In December 2019, Caplyta was approved by the FDA for the treatment of adult patients with schizophrenia, and in December 2021 it was approved for the adjuvant treatment of depressive episodes associated with bipolar disorder type I or type II (bipolar depression). In December 2024, Intra-Cellular also submitted a third new indication application for Caplyta to the FDA for the adjunctive treatment of major depressive disorder (MDD). In addition, Intra-Cellular is also exploring its pediatric indications and long-term solutions.

In addition, Johnson & Johnson has also acquired multiple pipelines under development, including ITI-1284, lenrispodun, ITI-1020, ITI-333, and ITI-1549, further strengthening its pipeline layout in the neurological field.

With the surge in mental health crises and the aging of the global population, more than 1 billion people (or 1 in 8 people) suffer from neuropsychiatric or neurodegenerative diseases worldwide. The huge potential patient market attracts many pharmaceutical companies to layout:

In December 2023, Bristol-Myers Squibb acquired Karuna for $14 billion and obtained Cobenfy (formerly known as KarXT), a potential new drug for schizophrenia, which was approved by the FDA for marketing in 2024.

In December 2023, AbbVie acquired Cerevel for $8.7 billion and obtained several potential candidate drugs for the treatment of schizophrenia, Parkinson's disease, mood disorders and other diseases. However, its "ace project" emraclidine subsequently failed to reach the expected endpoint in two Phase II studies for schizophrenia, reflecting the high risk of new drug development in the neurological field.

In October 2024, AbbVie acquired Aliada for $1.4 billion to obtain its main project Alzheimer's disease (AD) therapy ALIA-1758 to strengthen the neuroscience pipeline.

In October 2024, Lundbeck Pharmaceuticals acquired Longboard Pharmaceuticals for $2.6 billion and obtained the new epilepsy drug Bexicaserin.

Johnson & Johnson's $14.6 billion acquisition of Intra-Cellular will add fuel to the neuroscience field.

Summary: In 2024, there was only one M&A worth more than $10 billion in the pharmaceutical industry, and at the beginning of 2025, Johnson & Johnson fired the first shot of a huge M&A worth more than $10 billion. The JPM conference has just begun, and the pharmaceutical industry is expected to generate more M&A transactions in the next few days.

https://news.yaozh.com/archive/44822.html

By editorRead more on

- Phase III clinical trial of vetcotozumab completes patient enrollment February 9, 2026

- The first long-acting coagulation factor VIII, has officially entered the Chinese mainland market. February 9, 2026

- 17.9 billion yuan! A top-selling topical medication emerges. February 9, 2026

- Turnaround! Generic drug giant successfully “revived” February 9, 2026

- Novartis’s first-ever autoimmune drug has been submitted for marketing approval in China. February 9, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.