HPV vaccine changes overnight

January 13, 2025

Source: drugdu

271

271

Once upon a time, Wantai Bio successfully won the bid for the vaccine procurement project of Jiangsu Government Procurement Network with a price of 86 yuan per dose, which "beat" the price of 2-valent HPV vaccine to less than 100 yuan in one fell swoop, and seized the market with a "discount price".

Once upon a time, Wantai Bio successfully won the bid for the vaccine procurement project of Jiangsu Government Procurement Network with a price of 86 yuan per dose, which "beat" the price of 2-valent HPV vaccine to less than 100 yuan in one fell swoop, and seized the market with a "discount price".

The 9-valent HPV vaccine is also "not to be outdone". Merck first expanded the 9-valent HPV vaccine to women aged 9-45 years old, and then signed an exclusive agency agreement with Zhifei Bio with a total amount of over 100 billion yuan, intending to win the Chinese female HPV vaccine market in one fell swoop.

On January 8, a new story has begun.

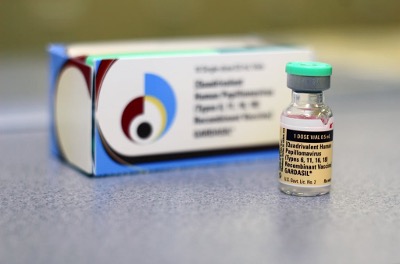

Merck announced that several new indications of its quadrivalent human papillomavirus vaccine (brewer's yeast) have been approved for listing by the National Medical Products Administration and are suitable for vaccination of males aged 9 to 26.

China's HPV vaccine changed overnight and officially "rolled" into the male market.

The first human papillomavirus (HPV) infection in China not only poses a threat to women's health, but men are also at risk of infection.

Previously, a paper titled "Global and regional estimates of genital human papillomavirus prevalence among men: a systematic review and meta-analysis" was published in The Lancet Global Health, a subsidiary of The Lancet, indicating that HPV infection in men is quite common.

Regarding this study, Dr. Meg Doherty, Director of the World Health Organization's Global HIV, Hepatitis and Sexually Transmitted Infection Program, said that this study on the global male genital HPV infection rate confirmed the widespread HPV infection, and that infection with high-risk HPV subtypes may cause genital warts, oropharyngeal cancer, as well as penile cancer and anal cancer in men.

According to statistics, there are about 7.4 million cases of HPV-related cancers worldwide each year, of which male patients account for about 30%. Previously, HPV vaccines were mainly targeted at women, but with the deepening of awareness of the hazards of HPV infection in men, the male HPV vaccine market has gradually attracted attention, and Merck's male HPV vaccine has finally ushered in a "breakthrough".

On January 8, Merck announced that its quadrivalent human papillomavirus vaccine (trade name: Gardasil) has been approved for multiple new indications, suitable for males aged 9 to 26. The new indications approved this time include the prevention of anal cancer caused by HPV16 and 18, genital warts (condyloma acuminatum) caused by HPV6 and 11, and anal intraepithelial neoplasia caused by HPV6, 11, 16, and 18.

This may become another growth engine for Merck's HPV vaccine in China.

In 2023, Merck surpassed AstraZeneca in one fell swoop and became the sales champion of multinational pharmaceutical companies in China with the large-scale sales of HPV vaccines and K drugs in China . In 2024, the situation will be reversed: due to the unsatisfactory sales of HPV vaccines in China , Merck's revenue in China fell by 1% in the first half of the year. Merck's third-quarter report showed that its Gardasil series of products had sales of US$2.306 billion, a year-on-year decrease of 11%.

Against the backdrop of increasingly fierce competition and saturated market for female versions of HPV vaccines, the launch of male HPV vaccines has opened up a new market area for Merck, filling the gap in HPV preventive vaccines for men aged 9 to 26 in China , enabling Merck to cover a wider range of potential vaccine populations and expand its business scope in the Chinese market.

It is worth mentioning that Gardasil has become the first and currently the only HPV vaccine approved for men in China . This first-mover advantage has enabled Merck to take a leading position in the male HPV vaccine market and brought significant growth to Merck's sales in China.

According to Merck's previous forecast, if the vaccine is approved for use by both men and women, its sales in China may eventually reach US$3 billion. With the improvement of awareness of HPV vaccination among men and the increase in vaccination rates, Merck's HPV vaccine sales are expected to achieve new breakthroughs in the Chinese market.

Targeting the male market

Why is the HPV vaccine "rolling" towards the male group? This is related to the gradual cooling of the female HPV vaccine market in the Chinese market.

Currently available HPV vaccines include 2-valent, 4-valent and 9-valent (the valence of the HPV vaccine represents the number of subtypes targeted by the vaccine), most of which cover HPV16 and HPV18.

Previously, due to the shortage of 9-valent HPV vaccines and the age restriction for vaccination in China , 2-valent HPV vaccines became the main force. The 2-valent HPV vaccines approved in China include Wantai Biological's Xinkening (approved in December 2019), Watson Biological's Wozehui (approved in March 2022) and GSK's Cervarix (approved in July 2016). Due to the sales of 2-valent HPV vaccines, the net profit of each company's financial report increased and the sales growth rate was "gratifying".

However, with the implementation of the 9-valent vaccine's accelerated market capture strategy, especially the expansion of supply and vaccination population, 2-valent and 4-valent HPV vaccines have been affected to varying degrees, and their market share has continued to decline.

Later, as China's HPV vaccine promotion efforts intensified and the vaccination rate continued to increase, the overall HPV vaccine market in China gradually became saturated, the number of vaccinated people was decreasing, the growth space was sharply compressed, and the market growth rate "cooled down" significantly.

The female HPV vaccine market is saturated, and pharmaceutical companies have set their sights on the male group.

Compared with women, men have innate physiological characteristics, such as thin mucous membranes in the male genital area, relatively weak resistance to HPV, and are vulnerable to virus invasion. What is more serious is that there are no conventional HPV screening and detection methods for men, and many men have no obvious symptoms after being infected with HPV, resulting in the long-term underestimation of the risk of infection.

Behind the severe infection risk is a huge stock market that has not yet been tapped. According to Guojin Securities' forecast, if the age range is 9 to 45 years old, the number of potential male vaccination targets in China exceeds 300 million, and the male HPV vaccine market cannot be underestimated.

The accelerated domestic progress

of the male HPV vaccine, a huge market, has attracted the attention and layout of many pharmaceutical companies. In addition to Merck, Chinese companies such as Wantai Biological and Kanglewei are also actively promoting clinical trials of nine-valent HPV vaccines for male indications.

Wantai Biological

In November 2024, Wantai Biological announced that its wholly-owned subsidiary Wantai Canghai Biological received the "Drug Clinical Trial Notice" issued by the National Medical Products Administration, agreeing to conduct clinical trials for its nine-valent human papillomavirus vaccine (Escherichia coli) for indications in the male population.

According to the announcement, the nine-valent HPV vaccine developed by Wantai Biological covers seven high-risk types of HPV16/18/31/33/45/52/58 and two low-risk types of HPV6/11, and is suitable for the prevention of genital warts caused by HPV6/11/16/18/31/33/45/52/58, penile/perineal/perianal cancer and its precancerous lesions (grade 1, grade 2, grade 3 penile/perineal/perianal intraepithelial neoplasia, PIN1/2/3), anal cancer and its precancerous lesions (grade 1, grade 2, grade 3 anal intraepithelial neoplasia, AIN1/2/3) and other indications.

Kangleweishi

Kangleweishi's nine-valent HPV vaccine has made important progress in the Phase III clinical trial for male indications in

China . The trial was launched in 2022, and the 12th month visit after the first dose has been completed for most subjects, and the 18th month visit after the first dose has been started. Kangleweishi expects to submit a biologics marketing application for the nine-valent HPV vaccine in China and Indonesia simultaneously in 2025, and is expected to become one of the first domestically produced nine-valent HPV vaccines approved for use.

As early as September 2022, Bowei Bio had launched a Phase 1 clinical trial of the nine-valent HPV vaccine for the male population, targeting healthy Chinese men aged 9-45. In June 2024,

Bowei Bio

launched a new Phase III clinical trial to evaluate the preventive effect and safety of the vaccine in the male population. The study is a randomized, double-blind, multicenter, placebo-controlled clinical trial that plans to include 9,000 Chinese male subjects aged 18-45. At present, the Phase III clinical trial has been carried out at 17 trial sites in five provinces, including Hunan, Shanxi, Sichuan, Yunnan and Guangxi. If the clinical progress goes smoothly, Bowei Biopharma expects to submit a biologics license application for the nine-valent HPV vaccine (male indication) in 2027.

Conclusion

With the continuous development of the male HPV vaccine market, more pharmaceutical companies are expected to enter this field in the future. The development and marketing process of domestic HPV vaccines is also accelerating, which is expected to further improve the accessibility and price competitiveness of vaccines. At the same time, as the public's awareness and acceptance of HPV vaccines will continue to increase, the vaccination rate of male HPV vaccines is expected to gradually increase.

https://news.yaozh.com/archive/44795.html

By editorRead more on

- Phase III clinical trial of vetcotozumab completes patient enrollment February 9, 2026

- The first long-acting coagulation factor VIII, has officially entered the Chinese mainland market. February 9, 2026

- 17.9 billion yuan! A top-selling topical medication emerges. February 9, 2026

- Turnaround! Generic drug giant successfully “revived” February 9, 2026

- Novartis’s first-ever autoimmune drug has been submitted for marketing approval in China. February 9, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.