Changes in the order of BTK inhibitors

December 13, 2024

Source: drugdu

364

364

Over the past decade, the BTK inhibitor market has continued to explode. Since ibrutinib was approved for the treatment of chronic lymphocytic leukemia in 2013, BTK inhibitors have been advancing rapidly, almost dominating the field of hematological tumors, and the market size has exceeded 10 billion US dollars. Of course, with more and more players entering the market, the BTK inhibitor market has also become undercurrent.

Over the past decade, the BTK inhibitor market has continued to explode. Since ibrutinib was approved for the treatment of chronic lymphocytic leukemia in 2013, BTK inhibitors have been advancing rapidly, almost dominating the field of hematological tumors, and the market size has exceeded 10 billion US dollars. Of course, with more and more players entering the market, the BTK inhibitor market has also become undercurrent.

Ibrutinib is on the decline, and new generation forces such as Calquence, Zebutinib and Pirtobrutinib are on the rise, and more players will enter the market in the future. The emergence of more BTK inhibitors will provide patients with new options for controlling disease progression, but will also bring a new problem: how to combine and how to sort? This still needs pharmaceutical companies to find the answer through exploration. At this year's ASH Annual Meeting, some pharmaceutical companies brought some new answers to the market.

In the competition of innovative drugs, defining the diagnosis and treatment order is an eternal topic. As the first approved BTK inhibitor, the root of ibrutinib's great success lies in that it defines a new order of diagnosis and treatment for many diseases such as mantle cell lymphoma, chronic lymphocytic leukemia, small cell lymphoma, Waldenstrom's macroglobulinemia, and has secured its position.

In this context, if latecomers want to take the lead, they will inevitably need to think about the issue of "definition". BeiGene's zabutinib's success is that it successfully defeated ibrutinib in a head-to-head clinical trial in patients with relapsed and refractory CLL/SLL, and obtained more positive clinical data. Defining the gap between strengths is the key to the rise of zabutinib. Of course, breaking through the BTK inhibitor world is not only about competing head-on with opponents, but also about finding more new solutions that have no clinical answers. Eli Lilly has given the market a new idea: to clearly become the choice of patients with existing BTK inhibitor resistance.

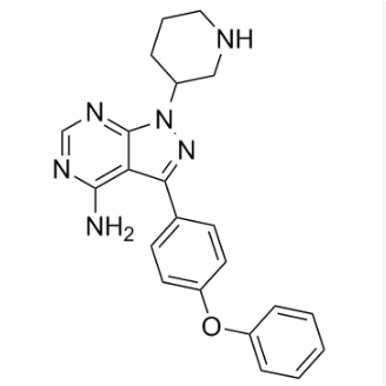

For BTK inhibitors, the problem of drug resistance is inevitable. For example, Woyach et al. estimated that about 19% of CLL patients will experience disease progression after 4 years of ibrutinib treatment. Based on this demand, new solutions including BCL-2 inhibitor Venclexta have also been born. Eli Lilly also sees opportunities in this market. Its new generation of BTK inhibitor Pirtobrutinib is designed not to bind to the action site C481 of the first two generations of BTK inhibitors, and can treat patients who have become resistant to the first two generations of BTK inhibitors.

This has been continuously confirmed in its clinical exploration. In a phase 1/2 clinical trial called BRUIN, Pirtobrutinib was still effective for patients who had already received BTK treatment and developed resistance, so it was approved by accelerated approval for the treatment of third-line and above MCL.

"This is a clinical trial that truly represents the patient population... who have accepted these modern standards of care over the past few years and now need something else," said David Hyman, Eli Lilly's chief medical officer, in an interview. At this year's ASH annual meeting, Eli Lilly's updated BRUIN study data further confirmed this. After adjusting for cross-drug influencing factors, the hazard ratio figures favor Pirtobrutinib, with two different statistical analysis results of 0.87 and 0.78, respectively.

Researchers believe that Pirtobrutinib can delay the next treatment or death of patients by a median of about two years, which highlights its clinical treatment status. According to Jacob Van Naarden, head of Eli Lilly Oncology, these data also suggest a new clinical direction, that is, whether doctors may want to try Pirtobrutinib instead of another drug called Venclexta after patients use the first BTK inhibitor.

Of course, for tumor drugs, while satisfying drug-resistant patients, the biggest hope is to advance to the front line, meet the needs of more patients, and then obtain greater commercial returns. The complexity of the BTK inhibitor world also lies in this. For example, the butterfly effect of Zebutinib's head-to-head clinical victory over ibrutinib in relapsed and refractory CLL/SLL patients is much greater than expected. The core reason is that in another head-to-head ibrutinib clinical trial, AstraZeneca's Calquence only showed non-inferiority results.

This also leads to the fact that although Calquence has been approved for first-line CLL and sales are still growing rapidly, there are still doubts about whether Calquence is the best choice. After all, Zebutinib has also been approved for first-line CLL. In this regard, AstraZeneca also chose to use muscle to resolve market concerns. At this year's ASH annual meeting, AstraZeneca presented the results of the Phase 3 Amplify study of Calquence combined with Venclexta in previously untreated CLL patients.

Data showed that this combination reduced the risk of disease progression or death by 35% compared with standard chemoimmunotherapy. Adding a third different drug, Gazyva, further reduced the risk. This also means that Calquence's combination therapy trial can further extend the survival of CLL patients. The Phase 3 Amplify trial data presented at ASH will undoubtedly consolidate its position.

Of course, the charm of innovative drugs is that competition will never stop. At present, Zebutinib is still opening more gambles, such as its self-developed BCL-2 inhibitor sonrotoclax combined with Zebutinib, and the head-to-head Venclexta combination therapy has accelerated its Phase 3 clinical trial. This also means that the dispute over the first-line treatment of CLL will continue.

In the long run, the competition for BTK inhibitors will inevitably become more and more exciting. The complexity lies in that, on the one hand, the competition for second-generation BTK inhibitors including Zebutinib and Acalabrutinib, although they have established a foothold in the competition with the first-generation BTK inhibitor ibrutinib, the competition between them has just begun, just like AstraZeneca and BeiGene.

On the other hand, the third-generation BTK inhibitors have begun to appear on the stage, adding more complex variables to the situation. As mentioned above, the difference in molecular design has made the efficacy of the third-generation BTK inhibitors in the drug-resistant patient group very clear. In the future, the third-generation BTK inhibitors will inevitably look at the front-line treatment of more indications.

This does not mean that Pirtobrutinib will definitely be the winner. Some studies have shown that the disease progression after Pirtobrutinib treatment is earlier than that of Ibrutinib, suggesting that patients treated with Pirtobrutinib may develop drug resistance earlier. This potential difference may have a certain impact on the development of first-line indications in the future. But in any case, the iteration of BTK inhibitors will not stop, so the re-arrangement of the order of BTK inhibitors will be a continuous topic.

Although most players cannot escape the fate of "cannon fodder", by constantly reviewing the game based on failure, some players will eventually win the final victory and provide patients with better treatment options. This is the world of innovative drugs, cruel but so beautiful.

https://mp.weixin.qq.com/

By editorRead more on

- InnoCare Receives First-in-China Clinical Approval for VAV1 Molecular Glue Degrader February 10, 2026

- End of Overseas Partnership for Compound Danshen Dripping Pills Deals, Another Blow to Tasly’s “American Dream” February 10, 2026

- Phase III clinical trial of vetcotozumab completes patient enrollment February 9, 2026

- The first long-acting coagulation factor VIII, has officially entered the Chinese mainland market. February 9, 2026

- 17.9 billion yuan! A top-selling topical medication emerges. February 9, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.