Endovascular stent approved through priority green channel

November 21, 2024

Source: drugdu

372

372

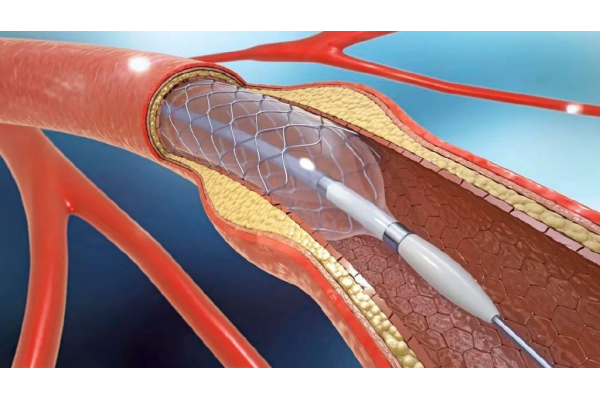

Recently, the Equipment Review Center of the National Medical Products Administration released the results of the priority approval application for medical devices (No. 14 of 2024), and Shanghai Qigong Medical Technology Co., Ltd. (hereinafter referred to as Qigong Medical)'s product - endovascular stent - passed the priority approval green channel. It is worth mentioning that this product is urgently needed in clinical practice and there are no registered medical devices of the same variety in China.

Qigong Medical focuses on innovative vascular intervention products

Against the backdrop of an aging population, the incidence of cardiovascular diseases in China continues to rise, with high mortality rates, difficult treatment, and high risks associated with aortic disease. At present, the clinical treatment options for aortic diseases in China mainly include surgical open treatment and endovascular intervention treatment. Endovascular intervention therapy is a rapidly developing clinical treatment technique in recent years, which combines a series of interventional instruments and materials with modern digital diagnostic and therapeutic equipment for diagnosis and treatment.

In recent years, endovascular intervention therapy for the aorta has been highly recognized by clinical doctors and patients for its advantages of minimal trauma, fewer complications, high safety, and less patient pain. According to Frost&Sullivan's analysis, the global market size of endovascular aortic stents is expected to grow to 3.23 billion US dollars by 2030. It is estimated that by 2030, the overall market size of endovascular aortic stents in China will increase to 4.31 billion yuan based on product factory prices. Moreover, with the continuous development of screening technology for aortic diseases in China, the continuous improvement of clinical experience, and the increasing health awareness of residents, the market size of aortic interventional medical devices in China will continue to increase in the future.

In this context, a group of medical equipment companies specializing in vascular intervention have emerged, and Qigong Medical, which has passed the priority approval green channel, is one of them.

Qigong Medical was established in September 2015, focusing on the technical development, manufacturing, and sales of independently patented, domestically original, and world innovative vascular intervention products, including aortic intervention, peripheral intervention, etc. Its star products are the world's leading series and accessories of aortic mesh stents.

On July 5, 2021, Qigong Medical obtained Series B financing from Guotou Chuanghe and Zhongjin Chuanhua Investment. This round of funding will be used for the development of multi indication clinical trials in the aortic field and the research and development of subsequent accessory groups, in order to achieve the vision of efficient and convenient one-stop treatment of "full aorta+full lumen" as soon as possible.

It is understood that traditional aortic stent graft is designed for the indication of aortic aneurysm abroad, not for the indication of aortic dissection, and is currently only used for local treatment of aortic dissection. Therefore, there is an urgent need for a universal product that meets the characteristics of countrymen aortic dissection.

Qigong Medical is the world's first to propose the principle of active dilation treatment with a mesh stent: by dilating the true lumen of aortic dissection while compressing the false lumen, the true lumen of the aorta can be reshaped. For acute aortic dissection, it is expected to immediately clear most of the false lumen; For chronic aortic dissection, it is expected to reduce some false lumens.

Due to its outstanding characteristics of not affecting branch blood flow and excellent compliance, the mesh stent can be widely used in A-type dissection, B-type dissection, and existing residual dissection.

In the field of vascular intervention, the domestic substitution process is accelerating

With the continuous increase in the number of patients with coronary heart disease, heart failure, valve disease, congenital heart disease, and cardiomyopathy, it is expected that by 2030, the size of China's cardiovascular intervention device market will reach 140.1 billion yuan. China's cardiovascular intervention device market is also gradually transitioning from the monopoly of overseas equipment companies to the rise of domestic new forces.

According to different treatment sites, vascular intervention instruments can be divided into four categories: coronary intervention instruments, aortic intervention instruments, peripheral vascular intervention instruments, and cerebrovascular intervention instruments. It is worth celebrating the influx of domestic innovation forces in all four major fields.

Coronary intervention therapy started early in China and has therefore developed relatively maturely. Especially with the mature development of coronary stents, domestic substitution has been achieved. Data shows that the three major domestic brands, Lepu Medical, Minimally Invasive Medical, and Jiwei Medical, collectively occupy over 60% of the domestic market share for coronary stents. However, in terms of coronary artery access devices, imported products are still the main choice, and domestic alternatives have long and obstructed coronary arteries.

As mentioned earlier, aortic intervention therapy is rapidly developing. In addition to Qigong Medical mentioned in this article, there are also domestic forces such as Xinmai Medical. As a leading player in aortic intervention in China, Xinmai Medical has multiple innovative products, such as Castor branch aortic stent graft and delivery system, Minos abdominal aortic stent graft and delivery system, etc. These products have a high market share and influence in the domestic market.

Due to the relatively late start of the domestic and international peripheral vascular intervention device industry, and the fact that most of them are small and medium-sized enterprises, peripheral vascular intervention in China has become the slowest progressing Chinese made substitute in the four major fields of vascular intervention. In China, whether it is arterial or venous, the main market share is still occupied by foreign companies including Medtronic, Gore, Cook Medical, etc. They can systematically provide related consumables and are the mainstream of the domestic market, with a market share of up to 95%.

Cerebrovascular intervention, also known as neurointervention, is mainly a minimally invasive surgical procedure that uses medical equipment and technology to prevent and treat stroke. In recent years, a large number of local enterprises have entered the neural intervention track that is still in the blue ocean market, and domestic brand technology is continuously accumulating. Equipment companies such as Peijia Medical, Xinwei Medical, Xianruida Medical, and Sainuo Medical have successfully gone public and brought a series of innovative equipment companies.

Source: https://news.yaozh.com/archive/44553.html

By editor

Read more on

- 20-Valent Pneumococcal Vaccine Approved for Clinical Trials January 20, 2026

- ADC205 Tablets Received Approval for Drug Clinical Trial January 20, 2026

- Sifang Optoelectronics makes strategic investment in Changhe Biotechnology January 20, 2026

- Mingde Bio plans to acquire a 51% stake in Hunan Lanyi through capital increase and acquisition January 20, 2026

- accelerating the transition of CLL treatment into a “chemotherapy-free era”. January 20, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.