A “dark horse” has emerged in breast cancer treatment

November 19, 2024

Source: drugdu

324

324

The birth of blockbuster drugs in the field of breast cancer is not new. After all, there is fertile soil for the birth of big drugs here. The most core factor is the extremely large patient population. Breast cancer is one of the most common cancers and one of the leading causes of cancer-related deaths worldwide. In 2020, more than 2 million patients were diagnosed with breast cancer. In the United States, more than 290,000 patients are expected to be diagnosed in 2023.

The birth of blockbuster drugs in the field of breast cancer is not new. After all, there is fertile soil for the birth of big drugs here. The most core factor is the extremely large patient population. Breast cancer is one of the most common cancers and one of the leading causes of cancer-related deaths worldwide. In 2020, more than 2 million patients were diagnosed with breast cancer. In the United States, more than 290,000 patients are expected to be diagnosed in 2023.

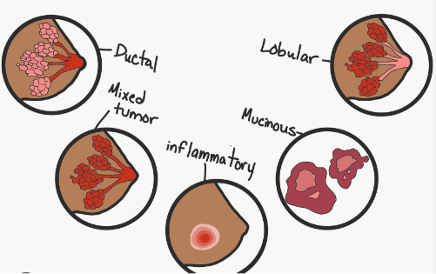

And the proportion of important subtypes is not low. For example, HR+ breast cancer is the most common breast cancer subtype, and more than 65% of breast cancer tumors are considered to be HR+/HER2 low expression or negative. Therefore, a strong demand for drugs has been created. The growth of HR+ breast cancer cells is usually driven by estrogen receptors (ER). Endocrine therapy for ER-driven diseases is widely used as a first-line treatment for advanced breast cancer, and is currently usually used in combination with cyclin-dependent kinase (CDK) 4/6 inhibitors.

In 2023, the overall sales of CDK4/6 inhibitors exceeded US$10 billion, becoming the largest variety in breast cancer treatment. Of course, this is not the end, and the CDK4/6 inhibitor patient group will still develop drug resistance. Therefore, therapeutic drugs are destined to continue to iterate. In response to the drug resistance problem of CDK4/6 inhibitors, pharmaceutical companies mainly start from two ideas. The first is to upgrade CDK4/6 inhibitors; the second is to design specifically for drug resistance. Both directions are in full swing. For example, in terms of drug resistance, changes in PIK3CA/AKT1/PTEN often occur in breast cancer, affecting up to 50% of HR-positive advanced breast cancer patients, which naturally becomes the main focus of pharmaceutical companies. AKT inhibitor Truqap is a dark horse born under this logic.

The logic behind the rapid increase in the volume of AKT inhibitor Truqap is that it is a key role in important signaling pathways. There are three key roles in the signaling pathway where AKT is located: PI3K, AKT, and mTOR. PI3K is an upstream protein of AKT, phosphorylating phosphatidylinositol-4,5-bisphosphate (PIP2) to produce phosphatidylinositol-3,4,5-triphosphate (PIP3), which ultimately leads to the activation of AKT. The activation process of AKT can be inhibited by PTEN: PTEN negatively regulates the PI3K signaling pathway, mainly by converting PIP3 to PIP2. However, the loss of PTEN function will lead to excessive activation of AKT and cause tumorigenesis.

In addition, AKT can activate downstream effector molecules (mainly mTOR protein), thereby stimulating many cellular processes, including metabolic growth and proliferation of tumor cells, immune escape and angiogenesis. In 2012 and 2019, the mTOR protein and PI3K targets were successively conquered, and the AKT target was successfully developed into a drug in 2023. This key signaling pathway was cleared and the treatment plan for breast cancer patients was continuously iterated. However, compared with its predecessors in the same signaling pathway, the AKT target seems to have more advantages. The pain point of mTOR inhibitors is insufficient effectiveness. According to its Phase 3 clinical data, the ORR of the whole population is only 9.5%, which is an extremely low response rate. However, Truqap targets a specific population of the AKT signaling pathway, with an ORR of 28.8% and an mPFS of 7.3 months.

PI3K inhibitors are not challenging in terms of efficacy. The first drug of PI3K inhibitors, Novartis' Alpelisib, targets the PIK3CA mutation population, with an ORR of 26.6% and an mPFS of 11 months. However, the pain point of PI3K inhibitors is the challenge of safety. The rate of adverse events above grade 3 of Alpelisib reached 76%, which was 1 times higher than that of the placebo group, and the problem of hyperglycemia was more prominent. In contrast, AKT inhibitors are safer. The rate of adverse events above grade 3 in Truqap's registered clinical trials was 41.7%, mainly diarrhea and rash. It is precisely with its comprehensive advantages that Truqap has achieved rapid volume growth.

At the beginning of Ruqap's launch, the market had high expectations for it. Some overseas analysts believe that Truqap's peak sales may reach US$3.8 billion. Whether this optimistic expectation can be achieved remains to be verified. Changes in the PI3K/AKT/mTOR pathway were found in 38% of cancer patients, so this expectation is based on a wider coverage of indications. However, how many indications AKT inhibitors can unlock still requires more exploration by pharmaceutical companies, and this process is not smooth sailing. Since last year, Ruqap has encountered setbacks in indications such as triple-negative breast cancer.

But the emergence of Ruqap still proves the fact that the change of treatment methods in the field of breast cancer will give birth to more blockbuster drugs. After Ruqap, there are bound to be more dark horse drugs. In the field of breast cancer, whether it is HER2-positive or HR+, or even triple-negative breast cancer, clinical needs are still not well met. Therefore, the iteration of treatment will not stop. In the field of HER2-positive breast cancer, ADC drugs represented by DS8201 are causing a major change. In HR+ breast cancer, we have seen the iteration of CDK4/6 inhibitors, the development of new targeted drugs for second-line treatment, the combination of CDK4/6 inhibitors in the first line, and the trend of later-line ADC drugs. In triple-negative breast cancer, ADC drugs targeting TROP2 are already on the market, and ADC drugs targeting multiple other targets are under development. In the future, the field of breast cancer treatment will surely be even more exciting.

https://mp.weixin.qq.com/

By editorRead more on

- The first subject has been dosed in the Phase I clinical trial of Yuandong Bio’s EP-0210 monoclonal antibody injection. February 10, 2026

- Clinical trial of recombinant herpes zoster ZFA01 adjuvant vaccine (CHO cells) approved February 10, 2026

- Heyu Pharmaceuticals’ FGFR4 inhibitor ipagoglottinib has received Fast Track designation from the FDA for the treatment of advanced HCC patients with FGF19 overexpression who have been treated with ICIs and mTKIs. February 10, 2026

- Sanofi’s “Rilzabrutinib” has been recognized as a Breakthrough Therapy in the United States and an Orphan Drug in Japan, and has applied for marketing approval in China. February 10, 2026

- Domestically developed blockbuster ADC approved for new indication February 10, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.