Baird Medical’ successfully went public in the United States

September 14, 2024

Source: drugdu

334

334

Recently, Baird Medical's business merger with overseas special purpose acquisition company ExcelFin Acquisition Corp. has been approved by the US SEC, and the F-4 application documents have officially come into effect, with a declaration of registration effectiveness issued.

Baird Medicalhas achieved listing on the NASDAQ Stock Exchange in the United States through the merger with ExcelFin Acquisition Corp., a foreign special purpose acquisition company. In addition, Baird Medicalalso announced that ExcelFin has arranged a special shareholders' meeting to be held on September 26, 2024. After the meeting, it is expected to receive approval from ExcelFin shareholders and the merger will be completed soon.

The bumpy road falls on the eve of going public

Before going public in the United States, Baird Medicalhad a bumpy road to going public in Hong Kong.

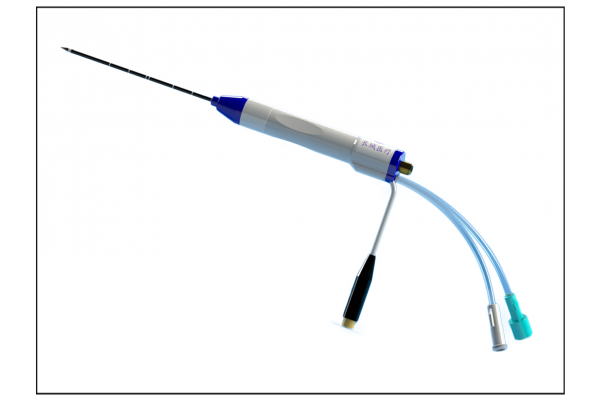

Founded in 2012, Baird Medicalis a leading developer and provider of microwave ablation medical devices for minimally invasive treatment of tumors in China. The product supply and pipeline products of Baird Medicalmainly include microwave ablation therapeutic devices and microwave ablation needles used in conjunction with therapeutic devices. Its proprietary microwave ablation medical devices are used to treat benign and malignant tumors with rising incidence in China, including thyroid nodules, liver cancer, lung cancer, and breast nodules. In the fiscal year 2021 alone, over 300 hospitals in China purchased products from Baide Medical, including 159 tertiary hospitals.

Prior to its IPO, Baird Medicalcompleted three rounds of financing, with the final round of Series C completed in June 2021. The cost per share was RMB 0.55, equivalent to approximately HKD 0.62, representing a 60.3% discount from the median issue price. Prior to the IPO, there was a six-month lock up period for investors.

On September 15, 2022, Baird Medicalsuccessfully passed the hearing of the Hong Kong Stock Exchange. The original plan was to list on the main board of Hong Kong on October 5 of the same year, with an expected total fundraising of HKD 347 million, jointly sponsored by two well-known institutions, Bank of China International and Zhongtai International.

But just before going public, on October 3rd, Baird Medicalmade an emergency announcement, announcing that it needed to respond to regulatory inquiries and, after consulting with the joint global coordinator, decided to postpone the issuance and IPO process. At the same time, the dark market transaction originally scheduled for October 3rd was also considered invalid. The reasons for this are twofold: on the one hand, it is due to regulatory policies, and on the other hand, the delay of Baide Medical's IPO may be related to its cold reception during the IPO stage.

At that time, Baird Medicalhad originally scheduled 10% of its shares for public offering and 90% for international allocation. However, subsequent announcements have shown that the proportion of its publicly issued shares has skyrocketed to 18.18%, while the proportion of its international issued shares is only 81.82%, which means that the international issued shares by Baird Medicalare insufficient.

Subsequently, Baird Medicalchanged course. Starting from June 6, 2023, Baird Medicalhas embarked on its journey to merge and list on SPAC in the United States.

On June 6, 2023, submit 425 to the US Securities and Exchange Commission (SEC); On August 21, 2023, submit F-4 to the US Securities and Exchange Commission (SEC); On September 8, 2023, submit a filing application to the China Securities Regulatory Commission (CSRC); On September 22, 2023, received feedback from the China Securities Regulatory Commission (CSRC); At the end of November 2023, Baird Medicalannounced that its subsidiary Baide (Suzhou) Medical Co., Ltd. had obtained FDA 510k approval to begin selling its microwave ablation system and disposable product combination microwave ablation needle as a regulatory Class II device in the United States; On January 2, 2024, obtained the notice of filing for overseas issuance and listing from the China Securities Regulatory Commission (CSRC); On September 6, 2024, we received formal notice of the merger and listing documents from the US Securities and Exchange Commission (SEC); On September 6, 2024, the official notice of SPAC listing and merger was issued.

From then on, after 438 days, Baird Medicalfinally walked through the bumpy road of going public and successfully completed its listing in the United States. Ms. Wu Haimei, founder and CEO of Baide Medical, stated that obtaining FDA approval is an important milestone for the company's regional expansion, and the team is ready to further expand its market scope to provide the most advanced microwave ablation technology for American patients.

Focusing on microwave ablation

According to the previous prospectus, Baird Medicalhas a total of 8 products, of which 3 have been approved for listing, namely microwave ablation therapy device and microwave ablation needle for treating liver cancer and thyroid nodules, long microwave ablation needle, and fine microwave ablation needle.

From the perspective of revenue, Baide Medical's performance has significantly improved since 2020. In 2019, the revenue was 85.029 million yuan, and the total comprehensive income for the year was -49.661 million yuan, with microwave ablation needle revenue accounting for 85.8%; In 2020, the revenue was 118 million yuan, and the total comprehensive income for the year was 46.692 million yuan, with microwave ablation needle revenue accounting for 74.4%; In 2021, the revenue was 189 million yuan, and the total comprehensive revenue for the year was 74.857 million yuan, with microwave ablation needle revenue accounting for 77.4%; In addition, in the first five months of 2022, Baide Medical's revenue in the field of microwave ablation needles was 545.2 billion yuan, accounting for 85.5% of the total revenue.

According to Frost&Sullivan's data, based on sales revenue in 2022, Baird Medicalis the largest supplier of microwave ablation medical devices for treating thyroid nodules and breast masses in China, and also the third largest supplier of microwave ablation medical devices in China. In the field of thyroid nodules and breast nodules, Baird Medicalhas a market share of 35% and is a leading supplier in this field in China.

However, it is worth noting that the microwave ablation medical device market is still in its early stages of development, and Baide Medical's current product technology is based on Weibo ablation. Looking at the international market, the revenue share of radiofrequency ablation technology is much higher than that of Weibo ablation. How to expand the track in the future will be one of the issues that Baird Medicalneeds to think deeply about.

In addition to radiofrequency ablation technology, cryoablation and pulse ablation technologies are also in the process of development. Currently, cryoablation products in the domestic market are mainly imported, accounting for about 10% of the market share. However, after the launch of the Kangbo knife, it has grown rapidly and its new market share has surpassed that of imported manufacturers; Pulse ablation is currently mainly imported, but three models have been approved domestically, and the domestic original research force is rising comprehensively.

Source: https://news.yaozh.com/archive/44215.html

By editorRead more on

- The first subject has been dosed in the Phase I clinical trial of Yuandong Bio’s EP-0210 monoclonal antibody injection. February 10, 2026

- Clinical trial of recombinant herpes zoster ZFA01 adjuvant vaccine (CHO cells) approved February 10, 2026

- Heyu Pharmaceuticals’ FGFR4 inhibitor ipagoglottinib has received Fast Track designation from the FDA for the treatment of advanced HCC patients with FGF19 overexpression who have been treated with ICIs and mTKIs. February 10, 2026

- Sanofi’s “Rilzabrutinib” has been recognized as a Breakthrough Therapy in the United States and an Orphan Drug in Japan, and has applied for marketing approval in China. February 10, 2026

- Domestically developed blockbuster ADC approved for new indication February 10, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.