FDA Approves Sandoz Biosimilars for Two Blockbuster Amgen Bone Drugs

March 7, 2024

Source: drugdu

319

319

Sandoz drugs Jubbonti and Xgeva are approved for use in all indications covered by the Amgen products, Prolia and Xgeva. But no launch date is planned yet, due to ongoing patent litigation between the two companies.

By FRANK VINLUAN

A blockbuster Amgen antibody that treats bone conditions is set to face its first biosimilar competition. The FDA on Tuesday approved two Sandoz drugs as interchangeable with and approved for all uses of the Amgen products.

A blockbuster Amgen antibody that treats bone conditions is set to face its first biosimilar competition. The FDA on Tuesday approved two Sandoz drugs as interchangeable with and approved for all uses of the Amgen products.

The Amgen antibody, denosumab, is marketed as Prolia for the treatment of osteoporosis. A different dose of the antibody is marketed as Xgeva for preventing bone problems in multiple myeloma patients as well as those whose solid tumors have metastasized to the bones. Sandoz’s biosimilar for the osteoporosis indication will be marketed under the name Jubbonti. For cancer, the Sandoz product will be called Wyost.

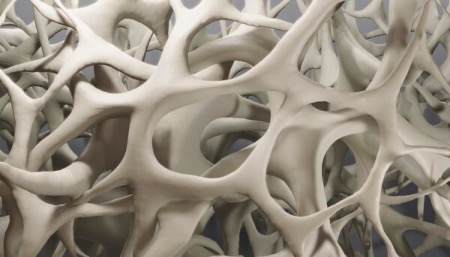

The Amgen and Sandoz drugs work by binding to a protein called receptor activator of nuclear factor kappa beta ligand, or RANKL. Doing so prevents bone cells called osteoclasts from breaking down bone. This approach is intended to result in greater bone mass and strength. The FDA said approval of the Sandoz antibody makes it the first interchangeable biosimilar for a RANKL inhibitor.

The regulatory decision for the Sandoz products is based on comparative clinical data confirming that Jubbonti and Wyost, each administered as a single subcutaneous injection in healthy adults, achieved similar exposure in the body as the Amgen drugs. An additional study in postmenopausal women with osteoporosis showed similar efficacy, safety, and immune response.

On measures of safety, the FDA said the side effect and adverse events observed in clinical trials of the Sandoz drugs are consistent with those of the Amgen products. Prolia’s label sports a new black box warning that flags the risk of hypocalcemia, or low levels of calcium in the blood. The label for Sandoz’s Jubbonti also carries a warning for this risk. In addition, Jubbonti’s approval comes with a Risk Evaluation and Mitigation Strategy (REMS), a program that informs patients and prescribers about the drug’s risks. That’s consistent with Prolia, whose approval also came with a REMS.

Prolia generated $4 billion in revenue last year, a 12% increase over sales in 2022, according to Amgen’s annual report. Xgeva’s 2023 revenue was $2.1 billion, a 5% year-over-year increase. Like most biosimilar and generic drugs, regulatory approval of the Sandoz drugs does not signal their immediate availability. Makers of branded products typically turn to patent litigation to keep their competition off the market for as long as possible. Amgen sued Sandoz last year. In a statement, Sandoz said given the ongoing patent litigation around the products, it will not comment on their launch timing or other launch details.

Sandoz was the longtime generics and biosimilars division of Novartis. Like many of its big pharma peers in recent years, Novartis evaluated whether to spin off its generics and biosimilars business to focus on the R&D of innovative medicines that bring higher profit margins. Last fall, Sandoz emerged from Novartis as a standalone publicly traded company.

Illustration: Getty Images

Read more on

- The first subject has been dosed in the Phase I clinical trial of Yuandong Bio’s EP-0210 monoclonal antibody injection. February 10, 2026

- Clinical trial of recombinant herpes zoster ZFA01 adjuvant vaccine (CHO cells) approved February 10, 2026

- Heyu Pharmaceuticals’ FGFR4 inhibitor ipagoglottinib has received Fast Track designation from the FDA for the treatment of advanced HCC patients with FGF19 overexpression who have been treated with ICIs and mTKIs. February 10, 2026

- Sanofi’s “Rilzabrutinib” has been recognized as a Breakthrough Therapy in the United States and an Orphan Drug in Japan, and has applied for marketing approval in China. February 10, 2026

- Domestically developed blockbuster ADC approved for new indication February 10, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.