Lilly’s Jaypirca tipped to capture 60% of BTK leukemia market, leaving AstraZeneca, BeiGene in the dust

January 24, 2024

Source: https://www.pharma.com/marketing/lillys-jaypirca-tipped-capture-60-btk-leukemia-market-leaving-astrazeneca-beigene-dust

475

475

Eli Lilly’s attempt to wrestle a leukemia market from companies including AbbVie, AstraZeneca, BeiGene and Johnson & Johnson has analysts purring, with the GlobalData team tipping the drugmaker to capture 60% of demand and deliver $3 billion in annual sales.

The GlobalData report covers the use of BTK inhibitors in the treatment of chronic lymphocytic leukemia (CLL). Pharmacyclics, now part of AbbVie, and J&J created the market with Imbruvica but now face a sea of threats, with the Inflation Reduction Act, increased competition and the looming prospect of generics pointing to a downward trajectory.

AstraZeneca’s Calquence began challenging Imbruvica for the CLL market in 2019 and BeiGene’s Brukinsa joined the party last year. But the GlobalData analysts expect Lilly to come from behind to become the dominant force in CLL in the coming years.

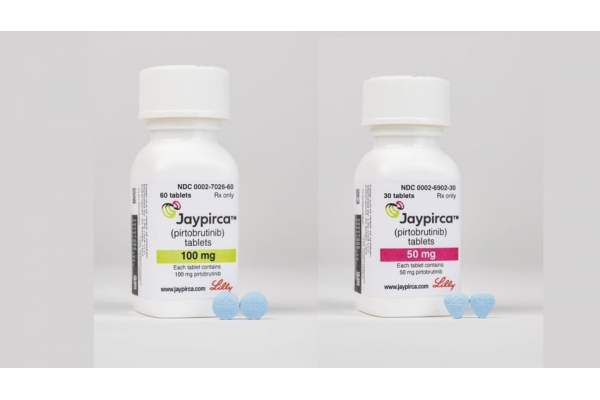

Lilly won accelerated FDA approval for Jaypirca in CLL last month. While the drugmaker, which acquired Jaypirca in its $8 billion takeover of Loxo Oncology, has ceded a headstart to rivals, it has a differentiated asset that the GlobalData analysts believe will translate into leadership of the blockbuster market.

The other molecules bind covalently to BTK and are susceptible to resistance mutations. Jaypirca binds noncovalently and triggers responses in patients who have progressed on other BTK inhibitors, as well as in people without mutations that confer drug resistance.

GlobalData’s team predicts Jaypirca will capture 60% of the CLL market by 2032, leaving Calquence and Brukinsa in the dust. Calquence and Brukinsa are forecast to come in second and third with 21.7% and 15.8% of the market, respectively. By then, the loss of market exclusivity is forecast to have eaten away at Imbruvica sales.

The GlobalData report also mentions Velexbru, an Ono Pharmaceutical product that Gilead struck a deal for in 2014, but makes no reference to Merck & Co.’s noncovalent BTK inhibitor nemtabrutinib. Merck acquired the candidate in its $2.7 billion takeover of ArQule a few years ago and is on course to wrap up a phase 3 trial in CLL in 2027.

By editorRead more on

- Phase III Clinical Trial of Recombinant Staphylococcus Aureus Vaccine Progressing Normality January 21, 2026

- Its drug marketing application for injectable iza-bren has been accepted January 21, 2026

- Kain Technology withdrew a drug registration application, resulting in a profit reduction of 111 million yuan in 2025 January 21, 2026

- Received Notice of Approval for Drug Clinical Trial January 21, 2026

- Breaking news! AstraZeneca to be delisted from Nasdaq. January 21, 2026

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.