China’s Import and Export of Diagnostic Equipment Report

August 31, 2017

Source: Ddu

1,384

1,384

With economic development and the ongoing medical reform, people are becoming more and more concerned about their health care and the diagnostic equipment market in China is growing at a compound annual rate of about 10%.

Domestic diagnostic equipment has the advantage in the low-end market field and a relative foothold in the middle market, but there is a great gap between China and foreign countries in the high-end market of diagnostic equipment.

Today, Ddu, leading global pharmaceutical & medical device B2B online platform, brings you the import and export report of diagnostic equipment in China.

Ultrasonic diagnostic equipment holds an absolute advantage with high exports.

Compared with CTs and MRIs, the cost of ultrasonic diagnostic equipment is lower, with characteristics of no trauma and real-time access to the images of human tissue which is widely applied in clinical experiments.

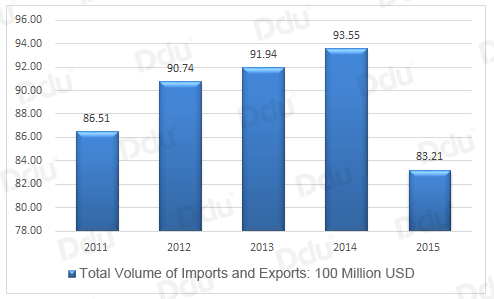

According to these statistics, the total trade volume of global imports and exports of ultrasonic diagnostic equipment totaled 8.323 billion USD with a year-on-year decrease of 11.05%, of which import volumes totaled 4.186 billion USD with a year-on-year decrease of 12.40% and export volumes totaling at 4.135 billion USD a year-on-year decrease of 9.65%.

China's imports topped the list of simple source imports

In 2011, the global import and export trade volume of ultrasonic diagnostic equipment sky rocketed to 2.2742 billion USD. China topped the list with an import volume amounting to 4.762 billion USD whereas import and export trade volumes of ultrasonic diagnostic equipment in Germany and Russia are 2.179 billion USD and 1.598 billion USD respectively.

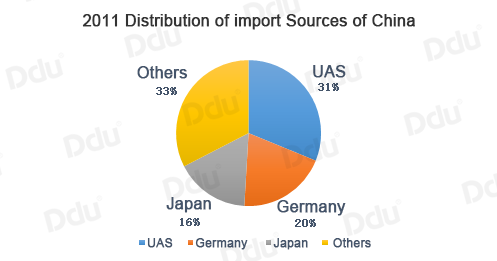

In 2011, China imported diagnostic equipment from 88 countries and regions. The top three countries with the highest import volumes were the USA, Germany and Japan, whose combined volume accounted for 67.43% of the all imports.

Regarding the import of diagnostic equipment of Chinese provinces, Shanghai topped the list with import volumes exceeding 2.162 billion USD and accounting for 33.15% of the overall market; Import volumes of Beijing and Guangdong were 1.719 billion USD and 00.639 billion USD, accounting for 26.36% and 9.8 % of the market, respectively.

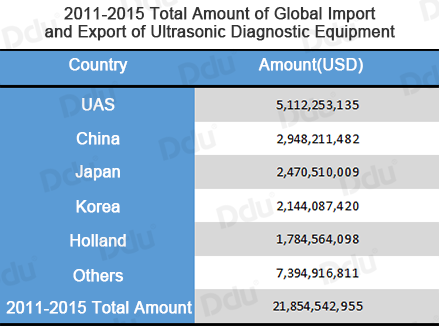

Exports to Asia, Africa and Latin America as a springboard to enter the European market

Since 2011, global import and export trade volumes of ultrasonic diagnostic equipment exceeded 21.855 billion USD. Between 2011 and 2015, the United States topped the list, totaling 5.112 billion USD followed by China with a total volume exceeding 2.948 billion USD.

Chinese ultrasonic diagnostic equipment companies are gaining domestic market share and are gradually expanding into the international market. Asia, Africa and Latin America, being China’s main export markets, have relatively low requirements for market qualifications and registrations. In order to avoid technical and trade barriers in America and European countries, many companies have begun to use underdeveloped regions such as Asia, Africa and Latin America as a springboard to enter the high-end markets of Europe and America.

As the biggest market of ultrasonic diagnostic equipment, Europe and America mainly demand product improvement with a steady increase in the market while developing countries are in need of equipment popularization and product improvement with greater potential.

Besides Asia, Africa and Latin America, the USA and Japan are also important exporting areas of China. According to statistics from 2010, China’s export volumes to Japan and the USA were 24.17 million USD and 12.23 million USD respectively.

According to the statistics of Chinese customs, China’s total trade volume of medical devices totaled 22.38 billion USD with a slight year-on year increase of 1.2% while its export volumes exceeded 9.03 billion USD. The export of medical devices such as cardiac pacemakers, medical vehicles, kidney dialyses and so forth, have seen a year-on-year increase of over 36%. Here is the list of main export companies:

Prospect: preferred development of ultrasonic devices to enter the high-end market

With the increasing investment in the medical industry, China has made obvious progress in the variety of products, technology levels and product quality, expanding its export scale and decreasing the medical equipment trade.

Given the great disparity between the Chinese market share of ultrasonic diagnostic equipment and that of foreign products, Ddu suggests that China should vigorously develop imaging performance, image resolution and other basic ultrasound imaging technology, especially new beam synthesis technology, ultrasound imaging technology and flexible imaging technology.

In this way, we can further enhance the technical strength of China's ultrasound equipment to meet the needs of developing countries like Asia, Africa and Latin America while gradually expanding the high-end market of the developed countries.

This article is from Ddu News, only for non-commercial use and reproduction. Please indicate the source when distributed.

By Ddu

Read more on

- China’s Import and Export Market Report of Vitamins August 26, 2021

- China’s Import and Export Market Report of Rheumatoid Arthritis Drugs August 26, 2021

- What’s Driving the Global Surgical Robotics Market February 26, 2018

- Ddu College–China’s Import and Export Market Report of Antiallergic Drugs December 1, 2017

- Brief Report on Exports of Chinese Vaccines in the First Three Quarters of 2017 November 27, 2017

your submission has already been received.

OK

Subscribe

Please enter a valid Email address!

Submit

The most relevant industry news & insight will be sent to you every two weeks.